In 1956, the West Pakistan Industrial Development Corporation (WPIDC) established MapleLeaf Cement (PSX: MLCF) with an initial production capacity of 300,000 tons per annum. Later it was merged by the State Cement Corporation of Pakistan (SCCP) with White Cement Industries Limited (WCIL) which was formed with a clinker capacity of 15,000 tons per annum. The SCCP also established Pak Cement Company Limited (PCCL) with a capacity of 180,000 tons per annum and merged all three during the privatization scheme of the 2000s. The company operates through two production lines for the production of grey cement and white cement and has over 90 percent of the market share in the latter and about 7 percent in the former based on annual capacity of 3.36 million tons of clinker. During FY19, the company added a brownfield line with grey clinker production of about 2.4 million tons annually. The plant is located in Daud Khel, Punjab near the salt range and extraction sites of important minerals like limestone, clay and sand used in the production process.

MapleLeaf primarily supplies to the northern zone markets of the country, MapleLeaf exports to India, Afghanistan, Middle East and other African countries.

Shareholdings and investments MapleLeaf is a subsidiary of Kohinoor Textile Mills Limited (KTML), part of the larger Kohinoor MapleLeaf Group (KMLG) which has businesses in textile, power and investment sectors.

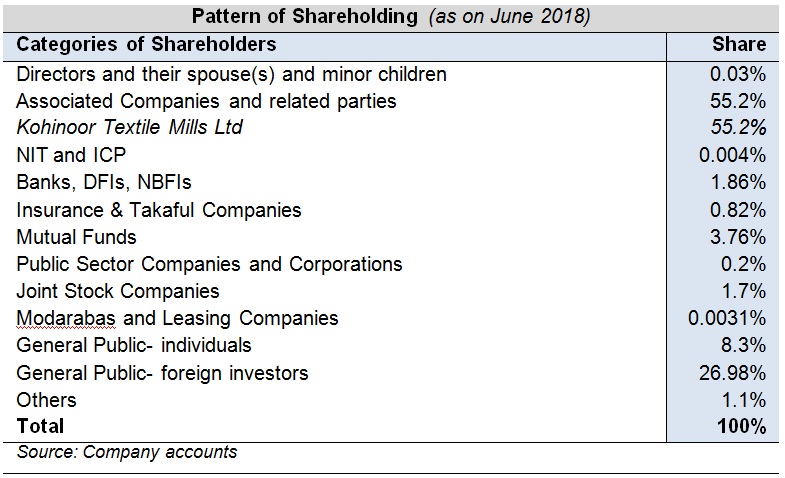

As part of the Kohinoor Group, MapleLeaf's largest shares (55 percent) were held by its holding company KTML as at June 2018. The rest of the shares are spread nominally across banks, NBFIs, insurance companies, mutual funds, joint stock companies and so on. The general public held 27 percent of the company's shares.

The company extends loan facilities to the holding company for working capital needs of KTML and also earn a mark-up equal to one percent above either 3-months KIBOR or the average borrowing cost of the company, whichever is higher.

MapleLeaf also has its own wholly-owned subsidiary called MapleLeaf Power Limited, which generates 40MW of power on imported coal. This captive plant saves the company energy costs which are lower compared to grid prices.

The company's new expansion was worth Rs 26 billion and took the total capacity of the company to 5.4 million tons per annum also undoubtedly raising market share. The project is financed with 59 percent debt and the rest equity. The company offered 12.5 percent right issue at Rs 65 per share (including a premium of Rs 55 per share).

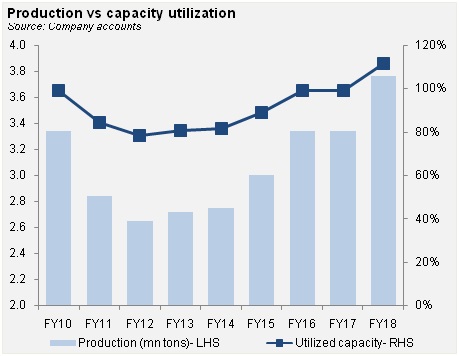

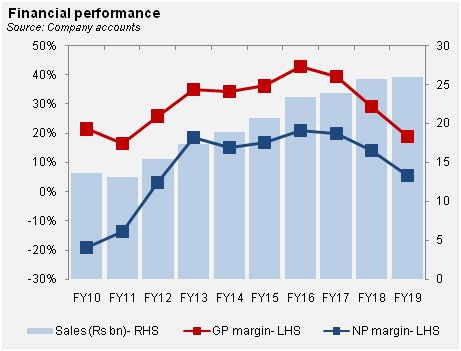

Financial and operational performance If MapleLeaf had a moving target on its back, that target would be moving up, like its revenues. They have grown even during times of weak demand. The company's decision to expand was based on its very high utilisation levels that were at their lowest at 79 percent in FY12 and remained mostly above 80 percent through the years.

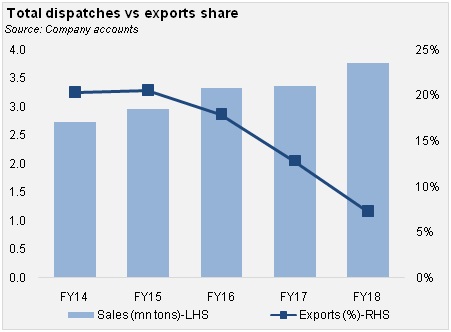

Demand has been a mix of domestic and exports where when domestic demand was rising, the company cut down on its export sales and when domestic demand receded, exports were raised. But traditionally, domestic sales fetch higher prices while in exports, cement companies have to keep prices low to compete.

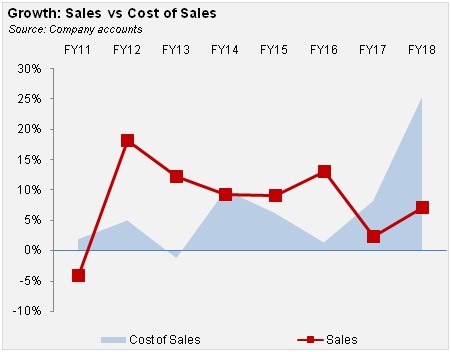

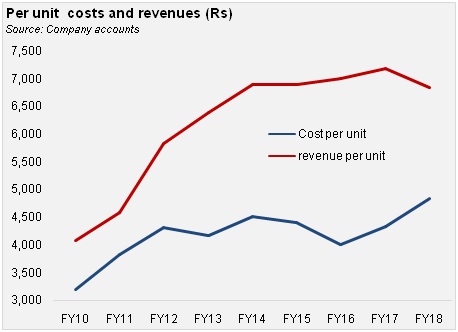

Competition has remained limited though specially during years when demand was a plenty. During the PML-N government term, the economy was in expansion and infrastructure led demand was growing, partly owing to CPEC projects kicking off. The government had raised spending on development while overall economic growth led to higher private sector spending, specially in commercial ventures. The industry embarked on ambitious capacity enhancements and retention prices also improved on the back of high demand and high capacity utilization. Evidently, both kept growing until FY18 for MapleLeaf.

However, higher costs started to manifest as early as FY17 when coal prices globally jumped up. Coal being a major raw material for cement manufacturers brought up costs. As a result, margins receded in FY17 and kept falling up until FY19, only exacerbated in the outgoing year by an unfavorable exchange rate. Since FY16, per unit cost rose 20 percent against a 3 percent drop in revenue per unit till FY18.

In its annual report for FY18, the company argued that because of the coal fired power plant, it was able to reduce per ton cost of power and was able to meet input cost price hikes by better negotiations. Effective inventory management also helped. The company also has a transportation agreement with Pakistan Railways to bring down inland transport overheads which will last till FY21. It also played a maximum portion of the expansion related LC. These cushioned the blow that hit the industry on account of depreciating rupee.

Recent performance and outlook In 9MFY19, clinker production fell by 12 percent while cement production fell by 16 percent. Domestic demand changed during FY19 completely as the new government took over office and slowly administered austerity measures including cuts in development spending and business confidence decreasing. Despite these trends, the company was able to grow revenues by 1 percent.

Also considered the two main markets in the exporting sector- India and Afghanistan- started to become less receptive to Pakistani cement exports, India nearly shutting down imports due to political tensions. In the south, cement companies were able to switch to exporting clinker overseas but north players faced challenges in selling their excess cement to markets. During the first nine months, the company saw exports to India grow which led to revenue growth, though in the last three months, those high duties ensured no volumes could be sent cross border.

According to its nine months report, "the company was able to avoid the likely adverse impact on its profitability due to increase in electricity tariff by NEPRA. [It] relied mainly on its internal power generation sources to meet its electricity requirements which includes coal fired power plant".

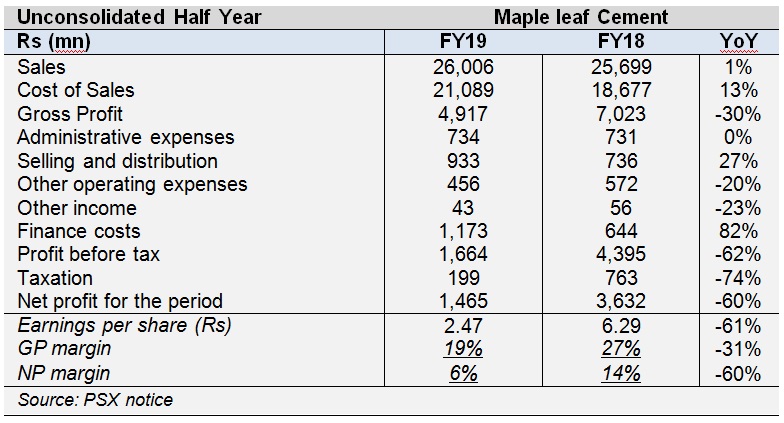

Higher fuel costs, freight and higher average coal prices globally and rupee depreciation led to margin decline that no contingent measures could help, though captive generation while use of pet coke which is more cost effective also helped.

In the full year despite efficiency measures to cut down costs and mitigate risks, the company saw profitability drop by 60 percent year on year. The company also announced it is thinking of floating 85 percent rights shares to improve its debt to equity ratio and inject equity to cover its expansion related long term debt. The cost of borrowing due to monetary policy tightening is putting considerable pressure on the company whose finance costs in FY19 grew to 5 percent from 2 percent last year.

The demand outlook is not changing too swiftly as the company enters FY20 since austerity is in full swing. Though Mapleleaf may grab a great market share due to its expansion. If the Naya Pakistan Housing construction picks up pace, it may lead to domestic demand recovering though nothing can be done about the export segment. On the cost side, falling coal prices in the global market and the company's effective inventory management may help with the margin granted demand does not fall too much.

BR100

11,988

Decreased By

-121.3 (-1%)

BR30

36,198

Decreased By

-400.2 (-1.09%)

KSE100

113,443

Decreased By

-1598.8 (-1.39%)

KSE30

35,635

Decreased By

-564.3 (-1.56%)

Comments

Comments are closed.