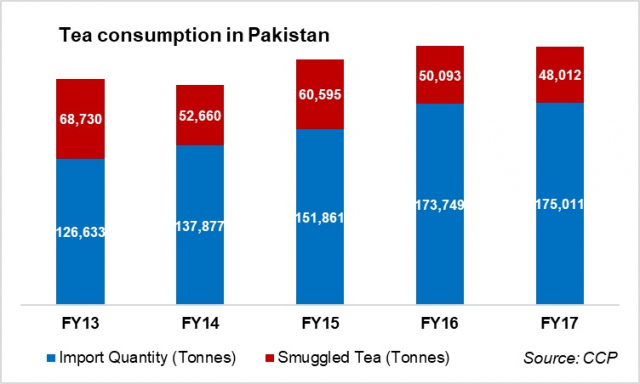

Recently there has been some noise over tea importers and suppliers planning to increase tea prices from next month especially when the international tea prices have been seen falling. However, Pakistan is not a tea producer where its consumption that consists of regulated imports and smuggled tea; increased dependence on imports makes domestic prices highly susceptible a multitude of exogenous factors.

Generally, tea prices are higher in Pakistan compared to its regional peers primarily because these countries are also tea producers. And apart from the changes in international tea prices, inflation and taxes, international supply fluctuations, the domestic tea prices are also affected by the currency value - FY19 has been one heck of downhill ride for PKR.

So price increase by packaged tea companies as well as loose tea suppliers is understandable at times when international tea prices are rising, or when domestic currency is depreciation against dollar. Competition Commission of Pakistan (CCP) has recently published its detailed report on the tea sector of the economy, which shows that how local tea prices respond to changes in the exchange rate. As per the statistical analysis of tea prices in Pakistan conducted by CCP in its study, it appears that the tea prices are more vulnerable to fluctuation in exchange rates than international tea prices: Every one rupee increase in USD leads to an increase of Rs13 in the packaged tea price. In comparison, every one rupee increase in Kenya tea auction price (benchmark tea price) leads to an increase of Rs2.02 in packaged tea price.

Instead, domestic prices can be brought down by addressing the incidence of high taxation and the incidence of smuggling in the tea sector. The competition watchdog has asked for rationalising taxes on tea imports; it has proposed that apart from taking serious steps to curb smuggling, the government can explore the opportunity of introducing absolute taxation on each unit of tea sold, instead of collecting taxes on ad-valorem basis in percentage terms, which would reduce the vulnerability of tax cost of tea to exchange rate or international price fluctuations.

Comments

Comments are closed.