Al Shaheer Foods: Liquidity stunted growth

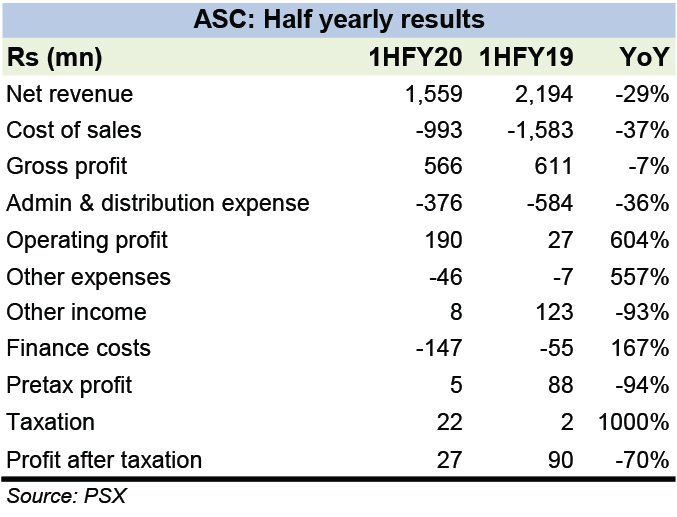

While FY19 was noted by lower sales but better profits for Al ShaheerFoords (ASC), recent results for the half year ended FY20 depict another picture. Liquidity troubles stunted growth in topline primarily, as the companywas unable to fulfill local and export orders, according to Kamran Khalili, CEO of Al Shaheer Foods.

With the lack of capacity to be able to cater to clients, the y tactic was to curtail costs which came about by restructuring within the organization. This included cutting down HR costs, laying off employees and shutting down loss incurring shops of Meat One, their retail outlet for selling meat.

During the first half of FY19, other income drove the company towards profitability which was primarily made up of a net exchange gain brought about by currency devaluation. However, with currency stabilization, this source of income was cut to size, reducing from Rs123 million in 1HFY19 to Rs8 million in 1HFY20.

Another factor which squeezed profits for the period year on year is the hike in finance costs which was more a factor of change in the way of recording expenditure on expansion. Initially it was capitalized, with a change in rule, it is now expensed out causing finance costs to swell.

The liquidity crunch led to rights share, the prime rationale for which is to fulfill working capital requirements. This essentially entails purchase of livestock and other raw materials. The company intends to raise Rs578 million of which 60 to 70 percent will be directed towards the working capital needs, in addition to clearing previous miscellaneous liabilities.

The company hopes to receive finance from rights issue soon and it will be utilised immediately. With the inflow of money and deploying it instantly, Kamran hopes to improve the topline by nearly 50 percent. The new poultry plant plans in Lahore, at the moment have been shelved in order to focus on realigning current business and operations.

Comments

Comments are closed.