The Searle Company Limited

The Searle Company Limited (PSX: SEARL) was established in 1965 as a private limited company. It was converted into a public limited company in 1993. International Brands Limited holds 56.6 percent of Searle Company, making former the holding company. The company has three manufacturing plants located in Karachi and Lahore apart from several other warehouses and storage facilities.

It principally operates in the pharmaceutical industry and its product portfolio primarily consists of medicinal products ranging in the following categories, some of which include Antibiotics, Cardiovascular, Gastrointestinal, Nutrition, Oncology, Neurology and Psychiatry, etc.

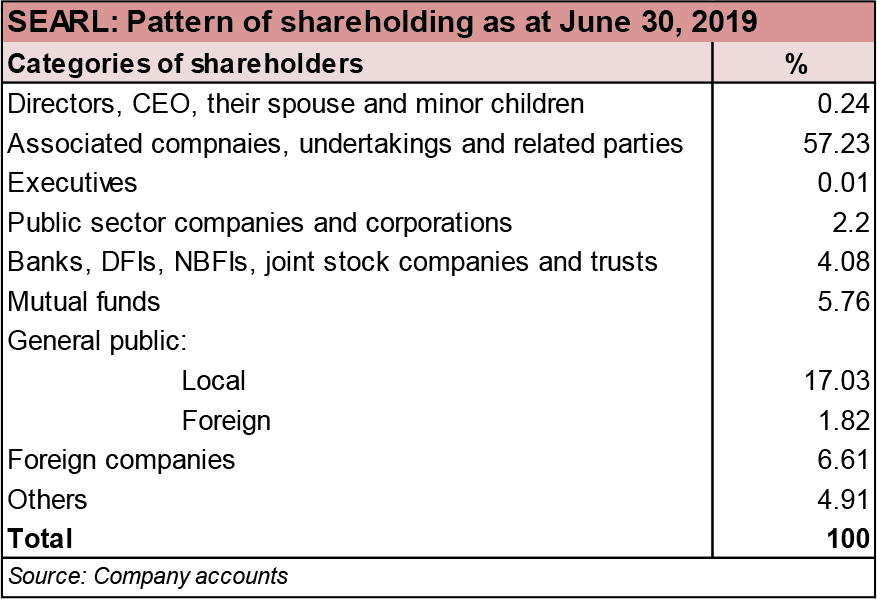

Shareholding pattern

A little over 57 percent of the shares are held under the associated companies, undertakings and related parties, of which 56.6 percent is held by the holding company International Brands Limited. Around 17 percent is with the local general public, while foreign companies hold close to 7 percent.

Industry overview

As of FY19, the pharmaceutical industry stood at an estimated $2.88 billion, with a five-year Compound Annual Growth Rate (CAGR) of nearly 14 percent. Around 64 percent of the market share is with the local companies while multinationals take up the remaining 36 percent. According to the company’s recent annual report, there are around 700 pharmaceutical companies operating in the Pakistani market of which there are only less than 30 companies that are multinationals. The pharmaceutical industry’s contribution to GDP stands at 1 percent annually.

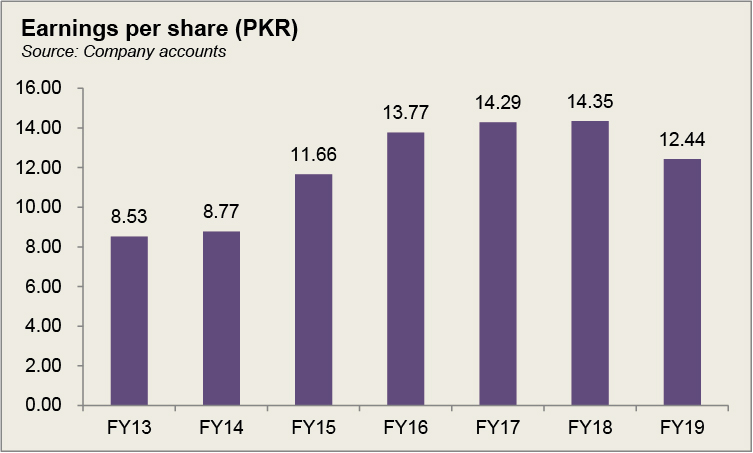

Historical operational performance

The company experienced a considerable growth of nearly 25 percent in its net revenue in FY15, which is attributed to both the factors, price as well as volumes. Higher volumes were a result of expanding doctor coverage while the price increase for the most part occurred during the second half of the year. Apart from the cost controls in all aspects, what also helped profit margins to grow was income generated from other sources. Having a share of 10 percent of the revenue, other income was mainly coming from dividend income from Searle Pharmaceuticals (Private) Limited, a subsidiary company of Searle Pakistan. Thus, with cost curtailment coupled with support from other income, the company significantly improved its profit margins.

During FY16, Searle Pakistan saw a revenue growth of a substantial 26 percent derived from higher volumes, greater demand and notable branding and marketing efforts. The latter is evident from the higher distribution and selling costs, made up mostly by salaries, implying a large sales team, personal training and advertising and promotion. While, gross margins dipped slightly, operating and net margins moved in the opposite direction on the back of other income which increased significantly. Rather, other income made up a sizeable 18 percent of the total revenue.

Although lower than previously seen, Searle Pakistan grew its topline by 12.5 percent in FY17. However, profit margins remained more or less flat as cost of manufacturing continued to consume 60 percent of the revenue. The company also spent heavily on distribution and selling. This fact was also seen in the financials of another pharmaceutical company implying that perhaps, the competition levels are high in the industry. Furthermore, other income provided unrelenting support to the bottomline, standing at Rs2 billion, and making up nearly 22 percent of the topline.

Searle Pakistan is a prominent player in the segments of cardiovascular, cold and cough, diabetes, infant formula, probiotics and antibiotics. During FY18 the company remained on its growth trajectory as it grew its topline by nearly 18 percent. However, it was not translated into a higher gross margin as cost of manufacturing as a percentage of revenue increased to 65 percent, compared to 61 percent in FY17. This was due to the fact that the industry relies on imported raw materials. Since Pakistan experienced a devaluation of the currency against the dollar, it had a direct impact on the cost of manufacturing.

Moreover, the industry is highly regulated in terms of prices therefore, the higher cost of production cannot be passed on to the consumer. With an even higher distribution cost matched by a higher income generated from other sources, operating and net margins were flat.

Profit margins dropped during FY19, as currency fluctuation continued to have an adverse impact on the cost of production which negated the effect of a rise in revenue by nearly 15 percent. In addition, the company also persistently spent on distribution and selling, taking up more than 25 percent of the revenue. Although other income made more than 20 percent of the revenue, it was lower than the previous year, affecting operating profit, whereas the doubling of finance cost due to high policy rate further squeezed margins for the period.

Quarterly results and future outlook

The first half of FY20 saw sales of Searle Pakistan improving by 16 percent year on year. The pharmaceutical industry saw its sales improving overall as a result of better affordability, rising population, and “an increased incidence of chronic diseases”. Moreover, costs in 1HFY20 as a percentage of revenue were significantly lower than 1HFY19 despite the fact that USD to PKR exchange rate was higher during FY20 which remains unexplained. This allowed gross margins to improve considerably, however in the absence of a major ‘other income’ and tax expenses increasing five times, operating and net margins were negatively affected.

The pharmaceutical sector as whole is heavily reliant on imports of Active Pharmaceutical Ingredient (API) and the limited capacity in the chemicals sector along with research restricts local production. According to a host of local news agencies, Pakistan imports more than 50 percent of raw material from India and China. During 2019, Pakistan halted trade with India in retaliation to New Delhi’s decision to revoke Article 370 and 35-A of the Constitution. This severely affected the availability of many medicines and raw material. The decision to halt trade was reversed a month later. The current scenario of reliance on imports for a long time, and the resultant volatility of price of raw material, delays in product approvals and price controls are the major challenges the industry faces.

Comments

Comments are closed.