MUMBAI: Indian government bonds rose for a second straight day on Wednesday, tracking fall in global crude oil prices and continued short-covering by traders after recent losses.

MUMBAI: Indian government bonds rose for a second straight day on Wednesday, tracking fall in global crude oil prices and continued short-covering by traders after recent losses.

Brent crude oil slipped below $114 a barrel on Wednesday as fears of supply disruption in Iraq receded and after a rise in US inventories pointed to ample stockpiles for the world's biggest oil consumer.

However, investors held off large positions due to persisting uncertainty ahead of the new government's budget on July 10, which will hold details of the 2014/15 borrowing plan.

In addition, market participants cite imminent pressures on inflation due to weak monsoon rains so far. Half of India's farmland still lacks access to irrigation making many farmers particularly dependent on monsoon rains.

"Yields are likely to be range-bound as the momentum is not aggressive because market is worrying about the borrowing numbers in the budget as well as the drought conditions," said Baljinder Singh, a senior dealer with Andhra Bank.

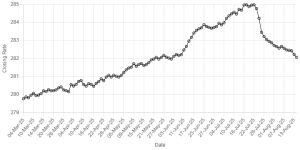

He expects the 10-year yield to trade in a range of 8.60-8.80 percent until the budget.

The benchmark 10-year bond yield ended down 2 basis points on the day at 8.70 percent.

Earlier in the day, yields had edged further lower after the central bank accepted only a third of the 364-day t-bills on sale, which limited the supply into the market.

In the overnight indexed swap market, the benchmark five-year rate closed down 3 bps at 7.94 percent, while the one-year rate ended unchanged at 8.37 percent.

Comments

Comments are closed.