TOKYO: Japanese government bond prices rose across the board on Monday after news Japan had unexpectedly slipped into recession, hammering Tokyo stocks.

TOKYO: Japanese government bond prices rose across the board on Monday after news Japan had unexpectedly slipped into recession, hammering Tokyo stocks.

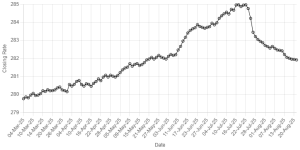

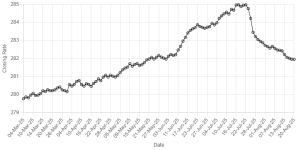

The benchmark 10-year JGB yield fell 1.5 basis points to 0.460 percent and the 20-year yield dropped 3.5 basis points to 1.215 percent as prices rose.

The 10-year yield had risen to as high as 0.535 percent the previous week when market speculation mounted that Japanese Prime Minister Shinzo Abe would delay a sales tax hike, a measure seen as harmful to fiscal discipline, and call a snap election in December - possibly paving the way for a second round of reflationary steps.

Abe's decision was seen hinging on what were widely expected to be soft third quarter GDP figures. But the actual data published on Monday proved far worse than expected, showing the economy had contracted an annualised 1.6 percent in July-September against expectations of a 2.1 percent increase.

The data showed Japan had entered recession and numbed any concerns the bond market may have had over a delayed sales tax hike eroding fiscal discipline.

Tokyo's Nikkei, which had soared to seven-year highs the previous week, sank 2.6 percent on Monday and helped enhance the appeal of safe-haven government debt. "It's basically a 'sell-Japan' scenario unfolding in light of the far-worse-than-expected GDP leading to weaker equities, and as a result firmer JGBs," a dealer at a domestic brokerage said.

December 10-year JGB futures gained 0.17 point to 146.40.

Comments

Comments are closed.