DUBAI: For more than 10 years Dubai property prices have been on a roller coaster, creating and wiping out fortunes, but recently they appear to have run out of steam.

DUBAI: For more than 10 years Dubai property prices have been on a roller coaster, creating and wiping out fortunes, but recently they appear to have run out of steam.

The Gulf emirate shot to prominence as an attractive real estate market after opening up special freehold zones for foreign buyers in 2002.

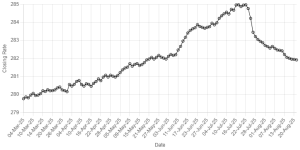

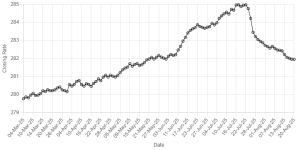

Prices peaked in 2008, driven mainly by speculative investments, but later nosedived as finances dried up because of the global financial crisis, shedding half the sector's value.

Renewed demand boosted values and rents at breakneck speed between 2012 and 2014, stirring fears of yet another bubble until prices headed south again, though more slowly this time.

Last year prices fell by an average of 12 percent, according to Craig Plumb, head of MENA research at property consultancy Jones Lang LaSalle.

"The market is having something of a soft landing at the moment, so the prices have been now falling for over a year... We think the market will continue to drop a little bit more, but not as much as it already has," he said.

"We think that most of the decline we've already seen."

Dana Salbak, head of MENA research at Knight Frank property consultancy, put the 2015 drop in residential prices at 10 percent.

"We saw a slowdown in the residential sector. We saw prices dip about 10 percent over 2015. Not so much in the first quarter of the year," she said.

Dubai's market is driven by overseas demand which has fallen as currencies weakened against the US dollar to which the UAE dirham is pegged, pushing up prices, Plumb said.

"Real estate in Dubai is now more expensive for buyers holding other currencies," Knight Frank said in its 2015 report.

Indians top the list of foreign investors in Dubai property. In 2015, they spent more than 20 billion dirhams ($5.4 billion) out of a total of 135 billion dirhams.

British and Pakistani buyers followed with 10.8 billion dirhams and 8.4 billion dirhams respectively. Iranians spent 4.6 billion dirhams, Canadians 3.7 billion dirhams and Russians 2.7 billion dirhams.

Comments

Comments are closed.