The Canadian dollar eased versus the US currency on Wednesday, retracing some of the previous day's gains, as expectations that US interest rate hikes could pick up speed prompted traders to bid up the greenback. Domestic long-dated bonds retreated from their recent gains. The currency was at C$1.2507 to the US dollar, or 79.96 US cents, down from C$1.2476 to the US dollar, or 80.15 US cents, at Tuesday's session close.

"It's a rebound from yesterday, and the US dollar generally is looking a little better bid again today," said Adam Cole, senior currency strategist at RBC Capital Markets.

A Wall Street Journal report quoting Federal Reserve Bank of Atlanta President Jack Guynn as saying the US central bank still has "got a ways to go" on raising interest rates put a spark in the US currency as some took it as a signal the Fed might quicken its pace of rate increases.

"For foreign exchange markets at least it seems to be another excuse to buy some US dollars, and I think the Canadian dollar is just getting washed around by that," said Cole.

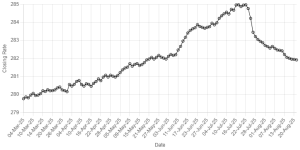

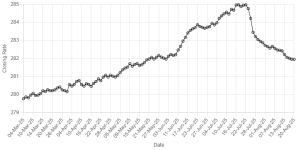

The currency fell decisively below the 80 US cent mark on Monday for the first time in more than 3 months, only to rebound sharply the next session.

Traders are split on whether it will push back above the psychologically important level, or continue the weakness that began in November after hitting 12-1/2 year highs of more than 85 US cents.

Worries about the economic impact of the currency's past rise have sparked the decline, while the US dollar has risen off the lows against the euro that it hit in December.

Canadian bond prices weakened, particularly on the long end, rebounding from their meteoric rise in recent sessions.

BR100

15,115

Increased By

28.1 (0.19%)

BR30

43,048

Increased By

175.6 (0.41%)

KSE100

149,493

Increased By

257.8 (0.17%)

KSE30

45,518

Increased By

11.6 (0.03%)

Comments

Comments are closed.