JCR-VIS Credit Rating Company Limited (JCR-VIS) has assigned initial medium to long-term rating of A (Single A) and short-term rating of A-1 (A One) to Pakistan Steel Mills Corporation (Pvt) Ltd (PSMC). The outlook on the medium to long-term rating is 'Stable'. PSMC, a state-owned corporation, is the only steel-producing unit in Pakistan with capacity of 1.1 million tons per year (tpy) while the total country demand stands at around 4 million tpy currently.

The ratings take into account the substantial turnaround in PSMC witnessed in the past few years due to the management's endeavour to improve corporate governance, increase human resource efficiency and the significant improvement in the liquidity position arising from exceptional profitability led by the current boom in the steel industry.

Historically, PSMC had been subject to a high-level of mismanagement, overstaffing and general lack of vision with regard to the needs of the organisation, which precluded efficient functioning and development of a long-term viable strategy for the corporation that resulted in huge losses.

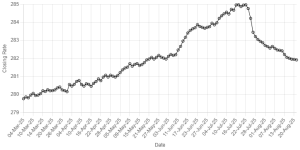

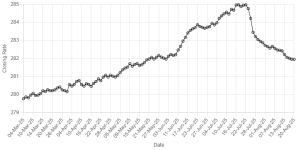

However, the government has taken note of these issues in the past four years or so and the organisation witnessed a remarkable turnaround from a peak accumulated loss of over Rs 9.3 billion at the end of FY2000 to the accumulated profit of nearly Rs 1.25 billion at the end of February 2005. As a result of the management's efforts to streamline operations through reduction of staff, improved productivity and concentration on commercial viability, the organisation found itself well-placed to exploit the opportunities arising from the world-wide boom in steel demand commencing from FY2003, as a result of which profitability and liquidity both touched historic highs.

The significant cash generation enabled the company to pre-pay the restructured initial project loan of Rs 11.35 billion also, while there is no significant upcoming debt servicing pressure on the company due to the level of structuring and amount of debt.

The steel boom is expected to continue for the next 2-3 years at least fuelled by demand in India and China and the current profitability trends are expected to be maintained, after which world-wide new capacities coming online may impact margins.

UPGRADATION OF PLANT: After having succeeded in placing the organisation on a strong financial footing, the management's vision was geared towards the upgrading of plant & machinery, which, due to lack of allocation of sufficient funds for proper upkeep since the inception of the plant, has deteriorated to a significant extent. As a result, a plan was prepared for a major refurbishment of the plant as well as a balancing exercise to increase capacity by a further 0.4 million tpy.

The timing of such a move, at the peak of the industry cycle, would have allowed PSMC to easily meet the required expenditure from its own resources while still maintaining comfortable liquidity levels to guard against any cyclical downturns.

The fact that a large number of engineering staff, who were involved in the original plant set-up and are due to retire over the next 2-3 years, would have been available for ensuring smooth execution of the BMR plan was an added advantage.

However, PSMC has been placed on the privatisation list by the government on a fast track basis resulting in a deferral of the BMR plan. It has been given to understand by the management that this deferral does not extend to critical repairs.

JCR-VIS believes that the capital plan of the PSMC is a major component of its long-term viability and therefore, will continue to monitor the progress in this regard with interest.

Further, JCR-VIS also expects the management to continue to emphasise on the regular upgrading of governance systems of the organisation.

BR100

15,115

Increased By

28.1 (0.19%)

BR30

43,048

Increased By

175.6 (0.41%)

KSE100

149,493

Increased By

257.8 (0.17%)

KSE30

45,518

Increased By

11.6 (0.03%)

Comments

Comments are closed.