A surprise rise in Canada's unemployment rate in July yanked the Canadian dollar sharply lower on Friday, although gains were trimmed by similarly weak US jobs data which firmed expectations that US interest rates will not rise next week.

Bond prices rose on the jobs data, although with further Bank of Canada interest rate hikes largely priced out, the gains were modest.

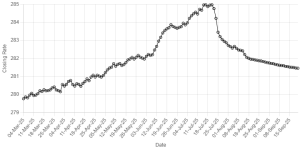

The currency finished at C$1.1283 to the US dollar, or 88.63 US cents, well off its daily lows, but down from C$1.1256 to the US dollar, or 88.84 US cents, on Thursday.

Canada's economy shed 5,500 jobs in July, against expectations of 21,000 added jobs, while the unemployment rate swelled unexpectedly to 6.4 percent from 6.1 percent.

The Canadian dollar plunged on the report, dropping as far as C$1.1348, or 88.12 US cents, although analysts noted the headline result masked modest growth in full-time jobs, while the three-month trend of jobs growth was still fairly solid.

"Maybe it's not quite as bad as it seems, but I suppose when you get a headline unemployment number that's up three-tenths, that's always going to attract some Canada selling, and certainly that's the case today," said Steven Butler, director of foreign exchange at Scotia Capital.

Butler noted that the jobs data came out a few minutes before the usual 7 am Ottawa release time, which surprised traders and forced them to react quickly to the selloff.

"We got a (US dollar) spike and some panic behind it, but we saw decent buying Canada interest again over C$1.1325," he said.

BR100

16,313

Increased By

5.8 (0.04%)

BR30

52,359

Increased By

821.6 (1.59%)

KSE100

158,037

Increased By

83.9 (0.05%)

KSE30

48,251

Increased By

52.4 (0.11%)

Comments

Comments are closed.