Hong Kong shares closed 0.2 percent lower but well off their early lows on Tuesday, as investors bought select stocks including top insurer China Life and rival Ping An, in a late afternoon rally. "We saw some genuine bargain hunting at the lower levels this afternoon, keeping the Hang Seng Index supported at the 21,000 level," said Peter Lai, director at DBS Vickers.

The Hang Seng Index breached the 21,000 level in its biggest single-day jump in five months on Monday after slumping more than 10 percent since the beginning of August. "If Wall Street doesn't let us down tonight, we might see another record rally on Wednesday," he said.

Shares in China Unicom, the smaller of China's two wireless service providers, fell 7.1 percent to become the biggest percentage decliner on the main index as analysts cut their estimates on the stock, citing the company's aggressive capital expenditure plan. China Netcom, which is soon to be merged into Unicom under Beijing's industry restructuring plan, also fell 6 percent. Unicoms' bigger rival China Mobile fell 1.1 percent on Tuesday.

The benchmark Hang Seng Index closed down 48.13 points at 21,056.66 after falling to 20,785.80 earlier. HSBC Holdings fell 1.4 percent on signs of fresh trouble in the US credit market overnight, including a ninth bank failure. Mainboard turnover fell to HK$48 billion ($6.2 billion) from HK$55.6 billion on Monday.

"The market has held up well considering the sharp fall on Wall Street overnight and the big gains we made on Monday," said Andrew To, sales director with Tai Fook Securities. "Now that the earnings season is almost over and the market is grossly oversold, it is quite likely that the HSI may claw its way back up to 22,000 in the short term." The China Enterprises Index of top locally listed mainland Chinese firms rose 0.7 percent.

China Life led gains on both major indices, climbing 2.2 percent, after reporting a smaller-than-expected 32 percent drop in first half earnings, mainly due to steep investment losses in China's battered stock market. Rival Ping An rose 3.3 percent.

J.P. Morgan chief China economist Frank Gong suggested China set up a $100 billion stabilisation fund from forex reserves to help stabilise the stock market. Gong had earlier predicted a possible government economic stimulus of at least 200 billion to 400 billion, sparking a nearly 8 percent rise in the Shanghai Composite Index last week.

Power producers outperformed as China's second power tariff hike in two months, last week, after a two-year price freeze raised hopes for further increases in the short term. Huaneng Power jumped 3.5 percent while Datang Power climbed 2.6 percent. Air China advanced 4.8 percent ahead of its earnings announcement later on Tuesday.

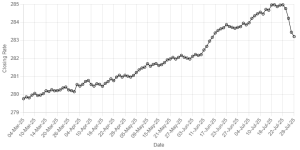

BR100

14,114

Decreased By

-193.8 (-1.35%)

BR30

39,189

Decreased By

-615.2 (-1.55%)

KSE100

138,217

Decreased By

-1463.8 (-1.05%)

KSE30

42,178

Decreased By

-512.6 (-1.2%)

Comments

Comments are closed.