The Japanese government said it would sell more than $100 billion in debt in the next 12 months to finance a record economic stimulus plan, in a move that could put pressure on the Bank of Japan to buy more government bonds. Prime Minister Taro Aso unveiled the stimulus plan on Friday, saying the worlds second-largest economy was in crisis.

The plan, including 15.4 trillion yen ($154 billion) of new spending, would add two percentage points to GDP, he said. "Japans economy is worsening rapidly with exports and production tumbling. Job conditions are also deteriorating sharply," Aso told a media conference. "Japans economy can be described as being in a crisis."

Finance Minister Kaoru Yosano said the government would draw on reserves for about 4 trillion yen of the new spending and pay for the rest by selling bonds. That would require about 11 trillion yen ($110 billion) of new issuance, raising total bond sales for the year to March 31 by at least a third to a record 44 trillion yen.

That exceeds the amount of tax revenue the government estimates it will collect in the middle of the worst recession since World War Two. Japans state debt exceeds 150 percent of GDP, making Tokyo the most indebted government in the industrialised world.

"As bond issuance increases, I think the Bank of Japan will come under enormous pressure from the government to buy more JGBs. Tension between the government and the BoJ could therefore heighten," said Yasuhide Yajima, senior economist, NLI Research Institute.

"The central bank may be forced to increase its JGB purchases as early as the next policy board meeting on April 30." The BoJ has expanded purchases of government bonds twice since December and has repeatedly denied the moves have anything to do with government borrowing plans. But such purchases will depress bond yields and reduce the cost of government borrowing.

Governor Masaaki Shirakawa said last month that any suggestion the BoJ would was simply monetising government debt would eventually devalue the currency and threaten its credibility. Yosano openly welcomed the BoJs plans to expand bond purchases last month, saying they would make government borrowing cheaper. On Friday he was more diplomatic.

"I dont think Japans long-term capital market is in a situation where it could face the problem of crowding out," Yosano said of the impact that new bonds would have on the JGB market. "But we need to have constant dialogue with the markets and when we actually issue bonds, we should carefully handle it."

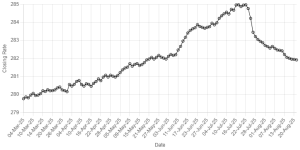

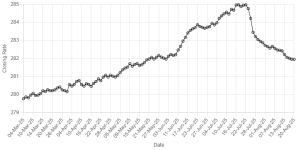

The scale of the new spending had spooked the JGB market, leading to a dramatic steepening of the yield curve this week as details dribbled out. The spread between the two- and 20-year yields reached 170.5 basis points earlier this week, its widest level in three years and has now narrowed to 165 basis points. The benchmark 10-year yield touched a five-month high of 1.490 percent on Friday but closed lower ahead of the announcement, at 1.450 percent.

The government said new stimulus spending was equivalent to 3 percent of GDP and was expected to push up real economic growth by two percentage points in the financial year to next March.

It is the fourth such package in the past year and brings stimulus spending to around 5 percent of GDP as Japan battles a deepening slump with the global financial turmoil shrivelling demand for its cars, technology and other manufactured exports. Japans economy tumbled 3.2 percent in the last quarter of last year and plunging business confidence has raised fears the situation is getting worse.

The United States has announced a $787 billion stimulus package and European Union countries plan fiscal stimulus of 3 to 4 percent of GDP. The governments stimulus efforts may yet face a rocky ride in a divided parliament, where the opposition controls the upper house and can delay legislation.

Prime Minister Taro Aso said on Thursday that the timing of a general election that must be held by October would depend on how opposition parties cooperate in implementing the stimulus plan. Previous plans to respond to Japans dire economic situation have been delayed by the parliamentary deadlock.

Aso has said he might call a snap election if the opposition delays enactment of budget bills needed to fund the stimulus package. A senior official in the main opposition Democratic Party said on Friday his party had no plan to drag things out unnecessarily.

"It seems that Prime Minister Aso wants to link this issue with the election. We dont think it is necessarily desirable to resist and needlessly take time under these economic conditions," Yukio Hatoyama said in a news conference.

BR100

15,115

Increased By

28.1 (0.19%)

BR30

43,048

Increased By

175.6 (0.41%)

KSE100

149,493

Increased By

257.8 (0.17%)

KSE30

45,518

Increased By

11.6 (0.03%)

Comments

Comments are closed.