Dollar hits highs after jump in US retail sales data

NEW YORK: The dollar rose to its highest level against a basket of major currencies in nearly three weeks on Tuesday after US retail sales data showed the largest gain in seven months.

Consumers boosted purchases of motor vehicles as well as discretionary spending, increasing the Commerce Department's reading on sales by 0.6 percent.

The dollar rose by more than 1 percent against the Japanese yen, touching its highest in more than a week and on pace for its largest daily rise against the yen since June. The euro fell to its lowest against the dollar since Aug. 9.

There were two factors that helped push the dollar to its highs, said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington D.C.

"One was that the consumer had been a no-show in recent months, and two was just the tailwind the dollar enjoyed before the data," he said. "The specter of cooler heads prevailing on the geopolitical front is dollar positive, particularly against safe-haven rivals."

July's reading showed the largest gain in the retail sales reading since December 2016 and followed June's upwardly revised 0.3 percent gain.

"The number showed broad-based strength, it beat forecasts both on the headline and the core and what was also encouraging was how the number for June got revised from the red back into positive territory," Manimbo said.

The dollar had earlier been supported by an easing of tensions around North Korea that last week drove capital towards safe-haven currencies.

The yen and the Swiss franc had both surged as Washington and Pyongyang ramped up military threats following the imposition of new sanctions on North Korea through the United Nations.

A North Korean state media report on Tuesday that leader Kim Jong Un had delayed a decision on firing missiles towards the US Pacific territory of Guam was taken by markets as another sign that the threats were rhetorical.

Currency market strategists also pointed to a general recovery by the dollar after its worst four months since 2011 against the euro and the basket of currencies used to measure its strength.

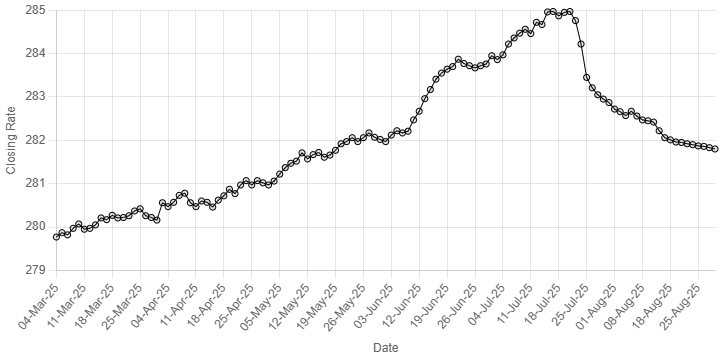

The dollar index was last up 0.7 percent to 94.061. It earlier touched its highest level since July 26.

Sterling also slumped after UK inflation numbers came in marginally below forecast, pushing the pound through key levels against both the euro and dollar.

Comments

Comments are closed.