Seeing is believing! As a follow up to our field trip in January this year, BR Research made a short rendezvous with Gwadar last week amid growing fears that developmental work might have slowed down if not stopped in the wake of political wrangling going on in Islamabad. What we saw was entirely different!

Once a sleepy fishing village, it now has the signs of a pre-boom town. Two out of every five people spoken to for the purpose of journalistic Vox Populi were new to Gwadar; some serving in construction, some in the service sector such as roadside food shacks, and others as retailers or traders. This shouldn’t be construed as if the city has become Dubai or Shenzhen, nor can it be expected to become one overnight, as this column had already noted earlier (See Gwadar: Look and feel, January 18, 2017).

Gwadar’s road to Shenzhen depends on a host of developments that need to take place over the course of next few years. The good thing is that development work has not stopped; in some areas it is slower than expected, but in other aspects it is earlier than planned.

Over a quick cup of tea and biscuits in Gwadar Development Authority’s (GDA) conference room, GDA’s chairman Dr Sajjad Baloch told BR Research that the frequency of meetings, visits, and approvals from Islamabad or Quetta has not stopped, nor slowed down. “There is no impact of politics at the implementation level,” he said. Three of the most critical projects have already kicked off.

The work order for the development of Eastbay Expressway, which is absolutely critical to port operations, has been issued to China Communications Construction Company; it was issued in September 2017 and the completion date is September 2019. The project will be completed at a cost of Rs16 billion, which includes expenditure on about 4-kilometer land reclamation from the sea. The design for the project already exists; working drawings are currently being made whereas the civil works are expected to begin before the end of next month.

Another positive development is issuance of Letter of Intent for the 300-MW coal fired power plant; it’s another thing that development on that front has been slower than expected. The new airport is also one of those areas where progress has been noticeably slow. To be fair, however, the delay is on the part of Chinese.

The airport is to be developed under a Chinese grant, as against a loan, which required approvals within the Chinese state machinery. Those approvals have now been given; and civil works is planned to kick off from January 2018. The plan is to first develop the runway which will take about 8-12 months, whereas the total project, including terminal building, will take about three years in total.

One key criterion for success that is missing is water. While progress on the three rain-fed dams is as per schedule, that on water desalination plants has been slow. The 2-MGD desalination plant still has faults, and there are now plans to fix it on BOT basis; notification to that effect is expected in a month’s time.

The 5-MGD is also planned to be built on BOT basis, but the project is a tad big for domestic consumption.

As per initial estimates, the 5-MGD plant will take about Rs2 per gallon to produce water, which translates into Rs10 million per day. The question that looms large is who is going to foot that bill. There are talks that Balochistan government will take up 20 percent of the cost whereas the federal government will pick up the rest. The PM house has reportedly agreed but so far nothing has been confirmed in writing.

At the port, things are pacing as per plans. Five cranes have been installed by the port operator COPHC; two used ones brought from Los Angeles and three new ones brought from Shanghai. The port is operational and two ship liners - COSCO and Sino-Trans - regularly call at the port; a cargo ship carrying developmental goods was seen berthed at the time of our visit. In side news, the PNSC is planning to start ferry service (passenger cum cargo) from Karachi to Gwadar and Chabahar, which will be in addition to its interest in setting up oil storage and workshop in Gwadar.

Compared to 300 Chinese working at the port in January 2017, there are now 1000 Chinese at the port, though it’s another thing that they hardly leave the port area (more on that later). Meanwhile, DG Gwadar Port Authority (GPA) Muneer Jan told BR Research that the COPHC has also started feasibility work on construction of 1500 meter long new terminals with five additional berths.

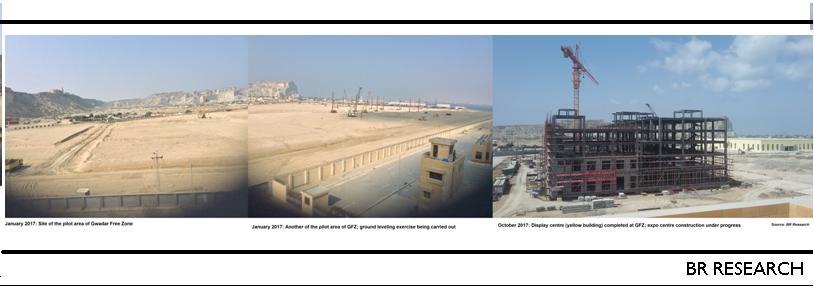

Just outside the terminal area, three building structures have been erected in the free trade zone. One of those is the display centre, whereas other two are the main building for expo centre including a 5-star hotel within the free trade zone. These did not exist in January 2017; back then one could only hear the thumping sounds of ground leveling exercises.

Managed by the COPHC, the free trade zone is planned to be completed and officially inaugurated by December, and the first Gwadar Expo is being planned for December 2017. Previously, it was scheduled to be inaugurated in June 2018. Five companies (of which four are Chinese) have already started spade work for their plants/projects for (a) electronic bikes, (b) fish processing, (c) recycling plant, (d) edible oil processing, and (e) vessel operations.

Together, these five firms are investing about $250 million whereas the COPHC is investing $160 million for the ongoing construction of the free zone pilot area. Meanwhile, the GPA is developing its Business Complex at a cost of Rs2.3 billion where the likes of Askari, Allied and HBL banks have already been allocated space for operations.

Back to the city itself, when BR Research visited last, the city’s master plan was scheduled to be revised to develop Gwadar as a Smart Port City on the orders of the Prime Minister. The task has been given to a Chinese company, FHDI, a subsidiary of China Communications Constructions Company. To date, an inception report has been submitted to the GDA by the FHDI and the revised plan is expected to be finalised by August 2018.

Some of the key areas to be considered under that revision will be: (a) possible inclusion of Kund Malir – along coastal highway – in the Gwadar master plan; (b) land use for the city at large and the industrial zones; (c) use of ICT and safe city concepts; (d) protection of right of the local people; and (e) what kind of laws, regulation – including tax collection regulations - and boundaries should a special economic zone have. How should the revised plan look like in our view; follow this space in the ensuing weeks.

Comments

Comments are closed.