Equities on Thursday moved both ways on the Lahore Stock Exchange (LSE) and finally closed in negative zone amid marginally increased trading turnover on account of selling pressure in selected shares. The LSE-25 index was marginally improved by 4.76 points to close at 2787.91 points against 2783.15 points of Wednesday, while transaction volume was increased to 2.519 million shares compared with last day volume of 2.151 million shares.

While continuing the day earlier sentiments, market resumed trading on a positive sign and stayed in green zone most of day. However, just ahead of closing, the investors, while preferring profit taking started offloading their positions. As a result, OGDC, Fauji Fertiliser, Fatima Fertiliser, Habib Bank, United Bank, National Bank, Bank of Punjab, Bank Alfalah, Adamjee Insurance, Pervez Ahmed Securities, NetSol Technologies, and D.G. Khan Cement remained under pressure and were closed in minus column

However, PSO, Pakistan Oil Fields, Attock Refinery, Engro Corporation, Fauji Fertiliser Bin Qasim, Lucky Cement, Arif Habib Corporation, Nishat Chunian, Nishat Mills and MCB Bank posted gains and helped index closure on a positive note.

The losers were slightly more than the gainers, as of 104 active companies, 21 registered gains, 26 recorded losses, while 57 companies stayed glued to their previous levels. PSO gained Rs 10.75, Engro Corporation was appreciated by Rs 6.39, Pakistan Oil Fields was improved by Rs 5.67, while Millat Tractors and Nishat Mills were up by Rs 2.93 and Rs 1.44, respectively.

In the minus column, Bata Pakistan lost Rs 9.07, Habib Bank was declined by Rs 5.80, OGDC was depreciated by Rs 4.33, while United Bank was down by Rs 2.10, respectively. NIB Bank topped the volume leaders with trading of 982,362 shares, while Bank of Punjab with trading of 315,719 shares stayed as runner up.

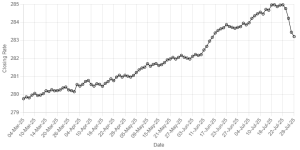

BR100

14,114

Decreased By

-193.8 (-1.35%)

BR30

39,189

Decreased By

-615.2 (-1.55%)

KSE100

138,217

Decreased By

-1463.8 (-1.05%)

KSE30

42,178

Decreased By

-512.6 (-1.2%)

Comments

Comments are closed.