Blessed Textiles Limited (PSX: BTL) was established as a public limited company. It is part of the larger Umer Group that has companies across various sectors such as textiles, dairy, leather, power generation and construction.

Blessed Textiles Limited is engaged in the business of manufacturing and selling of yarn and woven fabric. The company also generates electricity, however, it is primarily for its own consumption, instead of for sale.

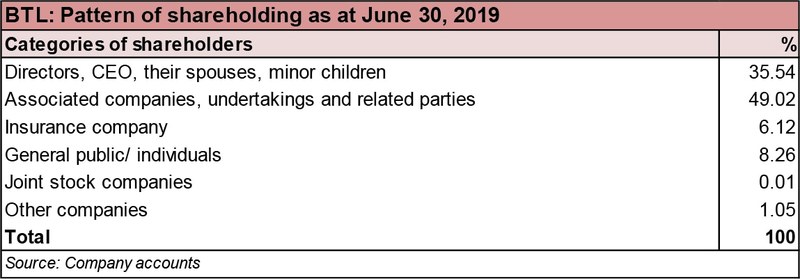

Shareholding pattern

Roughly 50 percent of the shares are held under the category of associated companies, undertakings and related parties. Of this, Faisal Spinning Mills Limited owns about 18 percent of the shares. The next major shareholder are the directors, CEO, their spouses and minor children, that own a little over 35 percent shares. Of this, Mrs. Samia Bilal, a non-executive director of the company, owns a little over 8 percent. About 8 percent of the shares are distributed with the general public/individuals whereas, 6 percent of the shares are with the insurance company, that is, State Life Insurance Corporation of Pakistan.

Historical operational performance

Apart from dipping in FY15 and FY16, Blessed Textiles Limited has largely yielded growth in results, both in terms of revenue and profit margins.

In FY15, the company saw relatively subdued growth in its revenue at 3 percent when compared to last year’s nearly 28 percent. The company operates in the spinning and weaving segment of the textile sector, which was impacted the most during the recession that hit the industry in FY15. Apart from falling prices, the country also lost demand to its regional competitors such as Bangladesh, India, Vietnam. The rising cost of production within the country rendered it impossible to compete with other countries that had energy and labour available at half the cost, the local manufacturers were paying. This is also evidenced by the fact that the rise in production brought with it a more than corresponding rise in costs. Thus, the company saw its lowest net margin at 1 percent.

The full impact of the recession was seen in FY16 for the company as its sales revenue dropped by 10 percent. Majority of the company’s revenue comes from the spinning segment. Given the situation of this segment, the decline in revenue does not come as a surprise. The decline in revenue was accompanied by a rise in cost of production as a percentage of revenue, driving down operating margins. Net margin improved slightly due to a notable fall in finance cost that was a result of a reduction in mar up paid on both, long- and short-term finances.

The company was back on track as its topline grew by nearly 18 percent in FY17. This was attributed to better prices. The weaving segment saw better production than the spinning segment. In addition, most of this higher production of the weaving segment was directed towards the local market, while yarn still dominated the export sales. Cost of production as a percentage of revenue improved slightly as it reduced to 90 percent. This allowed profit margins to pick up. In FY17 and FY16 the company saw a higher than usual other income figure arising from gain on sale of property, plant and equipment which also provided some support to the bottomline.

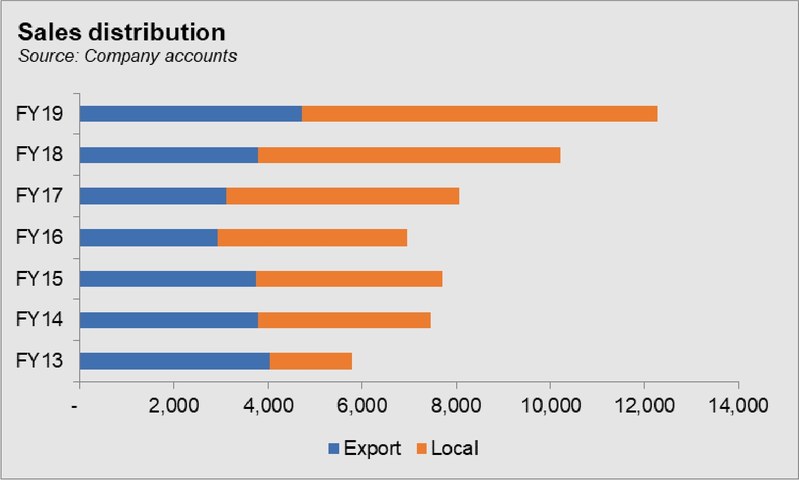

Growth momentum continued during FY18 as revenue saw a 27 percent incline. Both export sales and domestic sales witnessed growth. Increase in export sales was primarily due to the 18 percent currency depreciation which made exports favourable in the international market. Sales breakdown reveals again that yarn sales dominated the export sales. Textile sector overall saw an increase in its exports, which stood at Rs 1,488 billion in FY18. Cost of production, on the other hand, reduced marginally as a percentage of revenue, which allowed profit margins to improve.

Revenue further climbed on to grow by 20 percent during FY19. Both export and local sales saw an increase. It was noticed that from FY12 to FY15, export sales exceeded domestic sales in rupee terms. From FY16, domestic sales took over, until FY19. Along with the rise in revenue, cost of production further fell as a percentage of revenue which allowed the company to post the highest net profit, in absolute terms. The sudden escalation in finance cost was due to the rise in mark up on short term borrowings.

Quarterly results and future outlook

Blessed Textiles Limited maintained its growth trajectory as revenue continued to increase by 6 percent year on year during 9MFY20; however, this was relatively lower when compared to that seen in the last two years. The country had seen lower cotton production during the year. This could serve as a plausible explanation for the rise in costs as the resultant shortfall would have to be met through imports. The slight rise in cost of production as a share of revenue caused a slight decline in profit margins year on year.

The fairly recent development of coronavirus has impacted all the countries alike. While the government has taken several measures to combat the pandemic and support economic activity, the company hopes to find support in terms of timely income tax/sales tax refunds and reduction in gas and electric tariff in response to the decline in global crude oil prices.

Comments

Comments are closed.