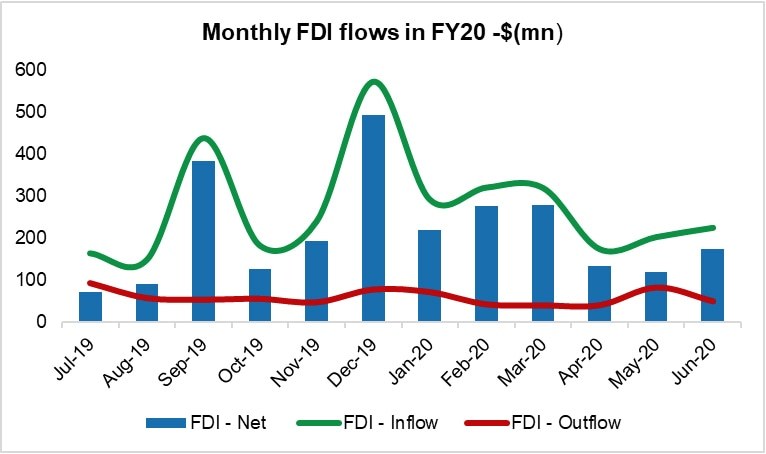

According to the central bank’s latest data, foreign direct investment in country has grown by 88 percent year-on-year to $2.56 billion. Though this number is close to 2015-16 levels, growth in FDI in FY20 has largely been driven by low base of FY19, and a decline in overall outflows than a significant growth in inflows. Total FDI inflows in FY20 increased by 18 percent year-on-year, while the outflows came down by 49 percent.

As expected, much of the growth in inflows and decline in outflows came from China including Hong Kong (over 40 percent) with over a billion dollar net inflows. Much of this was directed towards the power sector projects under CPEC. However, FDI from Norway in the telecom sector of around $400million was another key contributor in FY20.

That’s about it. There are no other pleasant surprises. From the official data, it can be seen that FDI in the country continued to be not only concentrated in the traditional sectors making up 85 percent of the total FDI in FY20, but it declined in all these sectors in FY20 vis-à-vis FY19. And hence government’s claims of focusing on export oriented sectors for FDI growth did not show anywhere in FY20 FDI stats.

With Covid-19’s impact on global FDI significant as captured by UNCTAD, prospects for FDI in FY21 are not very sanguine – unless there is a major remedial policy intervention for diversification and focus on export based FDI. Continuing to only concentrate in domestic sectors has another drawback too: FDI in power sector will start dwindling as most of the CPEC power projects will be completed soon, while other sectors will continue to be a source of dividends and profit repatriation.

Comments

Comments are closed.