At Pakistan Stock Exchange (PSX) the benchmark index is not at dizzying heights; it is still down about 1.4 percent in the year to date. Trading volume surely is. Just yesterday total trading volume of all listed companies skyrocketed to about 826 million shares, fourth highest in the decade so far according to data tracked by Capitalstake which empowers PSX’s data portal. How exactly should one read this?

The box standard theory is that when penny stocks and pure punting stocks start rising – i.e. stocks that aren’t usually a part of the pitch deck of stockbrokers – then the market is probably close to exhausting its rally. While some such stocks have already been driving market volumes for some time, as noted in this space five weeks ago, yesterday’s voluminous rise in trading volumes was largely led by arguably one of the tiniest of the penny stocks: WorldCall Telecom (WTL), which was valued at one rupee and one paisa on Wednesday’s market close. (See also Reading PSX pulse Jul 10, 2020 & ‘KSE-100: bulls denying virus worries’, 20 Jul 2020)

During market hours yesterday, WTL sent a notice to the exchange stating that a private media house intends to take a stake in the firm; this is an old story but this time the transaction is to be managed by brokerage AKD Securities. The notice sent WTL’s prices 41 percent higher by yesterday’s close with total trading volume of 204 million shares, or about 20 percent of all-share trading volume. Whether or not WTL’s story is going to be real this time around is another story. But it raises questions over the rise and rise of PSX equities, which PTI’s Asad Umar also proudly tweeted about a days ago.

Then again, trading volumes in the market have been rising for some time, WTL regardless. July 2020 closed with total trading volume of 5.5 billion shares, the highest since April 2014. Since April 2014, the KSE-100 had surely risen but trading volumes didn’t. Perhaps such growth in trading volumes is a precursor of good tidings.

However, one also ought to note that while a rise in trading volume of companies outside the benchmark index (KSE-100) generally points to broad-based good market sentiments, yet if the share of KSE-100 volumes as percentage of All-Share volume falls too low, it may also signal a bubble in the making.

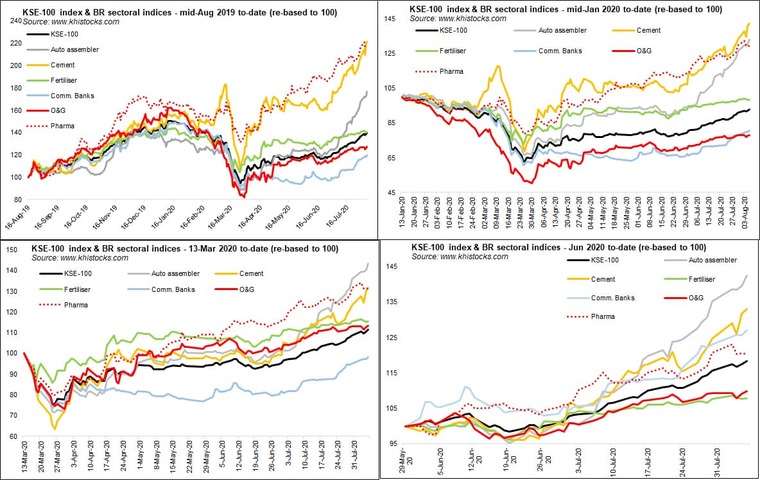

There is no doubt that some stocks in and outside the KSE-100 had fallen to really attractive levels, which lured in buyers all and sundry. Cement, pharma, commercial banks and lately even auto stocks have caught investors’ attention. But it is still too dizzying to see non-KSE-100 firms attract as much trading as they are these days.

Is the next 2-3 years economic outlook today is really as rosy, as it was back in 2013-14? And even if the economy and the stock market is poised to grow as it was back in spring 2014, it’s simply too early for unconventional stocks to gather as much attention as they are these days.

Perhaps the answer lies in the fact that many of the conventional plays at the bourse are, in one way or another, caught up in the mess called circular debt; according to market estimates about 40 percent of market capitalisation is affected by circular debt. Which is why investors are looking for new stories – stories that aren’t yet a part of pitch deck of brokerage houses, such as TRG Pakistan, Systems Limited.

Or perhaps the answer lies in cheap liquidity. With bond yields tapering off, monies parked in fixed income has been moved to equities, whereas institutional cap on national saving scheme has also led to inflow of money to the stock market. To top it all off, the central bank has offered a Utility Stores of sorts for borrowings under its Covid relief strategy, and some of that money is possibly being routed to the stock market for punting purposes. (See also ‘KSE-100: new year, new opportunities, old problems’ Jul 6, 2020)

Whatever the reasons may be, with the index crossing 40,000 points today, the highest since late February 2020, the rally may soon be near its exhaustion around 41000-42000 points. Afterall everyone needs a breather and reassess priorities, unless international oil price soar substantially over next few days driving up energy stocks at local bourses, which in turn can act as an energy drink for bulls at the PSX.

But one data that sorely sticks out is that local individuals and family offices (read: companies in NCCPL data) have been the biggest buyers since the market hit its recent bottom late March 2020, whereas in August to-date, local individuals are the biggest buyers with $33.7 million worth of shares, whereas insurance and mutual funds seem to be booking profits. Ergo, beware the rise of pennies!

Comments

Comments are closed.