Kohat and Pioneer: in losses

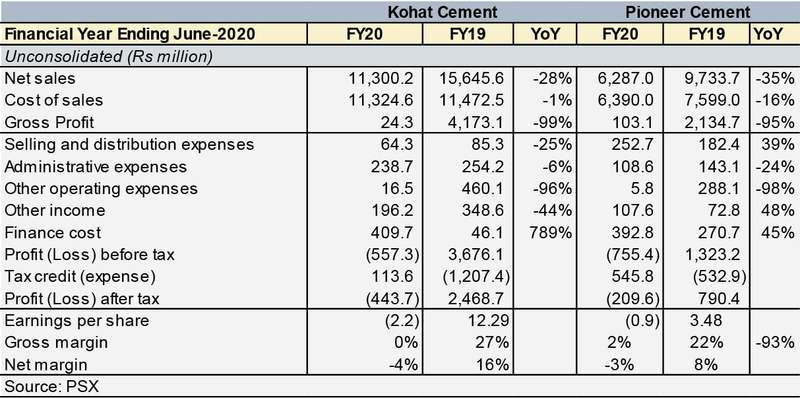

Kohat (KOHC) and Pioneer (PSX: PIOC) are now two more cement companies recording losses in FY20—with Kohat, the larger of the two registering a much bigger drop in the bottom-line after its new capacity came online in January. Though full-year numbers are not available, in 9M, the company saw volumes decline 2 percent against Pioneer’s 8 percent growth. However, the latter’s growth in dispatches did not cushion the ultimately waning profits, though like Kohat, it too started production from its new line.

No doubt, the production in the last quarter was further thwarted due to the outbreak of the coronavirus after factories were closed down due to covid. The price retention in the north during the year also remained weak—both companies have witnessed a substantial decline to their revenues partly due to the demand situation and partly due to poor retention. In fact, revenue per ton sold (estimated for 9M, based on revenue and volume numbers) came down 29 percent and 26 percent for Kohat and Pioneer, respectively.

Economic slowdown did not bode well for the construction industry that had led to reduced demand coming from public development expenditure while consumption was also down in the private sector. Exporting markets have also been less receptive. Though demand from Afghanistan improved from last year, companies fell short of demand from the Indian market in its entirety due to the 200 percent levy on Pakistani imports to that market. For Pioneer, exports fell substantially with the pressure on the domestic market to perform; which it did, despite non-conducive circumstances. Kohat on the other hand, could not leverage its position in the local market quite as much, though exports grew for the company.

Margins for both took a massive toll touching zero for Kohat, and landing at 2 percent for Pioneer against double-digit margins last year which were themselves much lower from the year prior. Price-cost dynamics wreak havoc. Though the companies cite higher fuel costs and input prices, and depreciation of rupee as the cause for higher cost of production; per ton sold, both companies saw cost decline (estimated for 9M- Kohat: 1%, Pioneer: 2%).

The main culprit was certainly poor cement prices in the market. Coal prices have been at their five-year lows which may in fact have shielded cement firms from gross-losses. Expansion based financing also came under fire as interest rates were high due to monetary policy tightening. Finance costs as a share of revenue for Kohat grew to 4 percent (FY20), from negligible share last year and to 6 percent for Pioneer from the comparable 3 percent last year.

These factors really put a dampener on profitability even though Kohat tightened its overheads—bringing them down to 3 percent of revenues during FY20 against 5 percent the preceding year while Pioneer remained on the same level as FY19 at 6 percent.

But FY21 scenarios appear optimistic as the country steps out of the covid-19 crisis into the government’s announced construction package which will potentially bring in substantial investments in private-sector led construction. Meanwhile, several dam constructions have already been approved which will improve demand. Both the companies have higher capacities from last year which make them prepared to capture the new growing market.

Precious domestic demand, better price retention on the back of said demand, lower interest rates and coal prices keeping at their current levels will all contribute towards healthier balance sheets come FY21.

Comments

Comments are closed.