The Rise of Chinese Companies: A Blueprint for Global Dominance

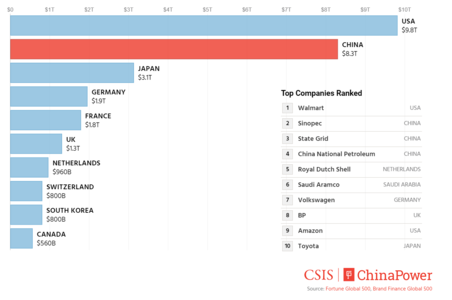

- 124 Chinese companies with combined revenue of $8.3 trillion made it to the Fortune Global 500 companies list.

- China’s changing domestic market dynamics and government support has led to increased interest and growth in its technology sector.

With China’s emergence as an economic superpower, Chinese multinationals have also expanded their global footprint dramatically over the last decade. These influential companies in China have not only grown in terms of size and revenue but have also ascended the ranks to be amongst the largest in the world, offering formidable competition to their western incumbents.

China in the Fortune Global 500

While only 29 Chinese companies made it to the list of Fortune Global 500 companies in 2008, the situation changed dramatically in 2020 when 124 companies with combined revenue of $8.3 trillion were now included in the list, accounting for almost a quarter of the total revenue of $33.3 trillion generated by all 500 companies.

The number of Chinese companies in the Fortune Global 500 list also surpassed that of the United States, which had consistently maintained its position as the country with the highest number of Global 500 companies over the years. Moreover, if Taiwan’s companies are also included, this will lead to an even higher total of 133 companies in the Fortune Global 500 for Greater China.

Although Walmart remained at the top of the list, it was followed by three Chinese companies, namely Sinopec, State Grid, and China National Petroleum. However, it is important to note that the structural and sectorial composition of these Chinese companies is inherently different from other multinationals in the list. More than 73% of the 124 Chinese companies on the Fortune Global 500 list are state-owned enterprises, as is the case for many of the largest companies in China, which operate as state-supported monopolies in the world’s largest market.

China in Tech

Five Chinese tech companies were also included in the 2020 Fortune Global 500 list. Although this is less than the number of US tech companies, which enjoy an edge in revenue, China is gradually solidifying its status in the global technology landscape.

Moreover, China is also home to a rapidly growing young and tech-savvy middle-class consumer base with access to increasing levels of disposable income. This has led to increased demand for personal electronics, specifically mobile phones. According to McKinsey, the share of foreign smartphone brands in China’s domestic smartphone market has reduced to around 10% as emerging Chinese smartphone brands have replaced them. Huawei, being China’s leading technology company with a $124.3 billion revenue, constituted 36% of the domestic smartphone market, while other Chinese companies like Vivo, Oppo, and Xiaomi combined for another 50% share. Whereas, Apple, a top foreign player, accounted for a 6% share only.

Moreover, the Chinese government has also facilitated this growth in the technology sector by introducing its ‘New Generation Artificial Intelligence Plan’ as part of the national strategy, making leadership in Artificial Intelligence a national imperative.

While a growing appetite for technology in the domestic market continued support by the state and supporting macroeconomic factors have spurred the development of new tech-business models in China, the rise of Chinese tech giants has not gone unnoticed by the world. Venture capitalists and foreign companies, which have previously struggled to navigate China’s unique political environment, are becoming eager to participate and find new ways to sell to the Chinese consumer.

Comments

Comments are closed.