Ittehad Chemicals Limited (PSX: ICL) was established in 1962 by the name of United Chemcials.it later became Ittehad Chemicals when it took over the assets of Ittehad Chemicals and Ittehad pesticides. In 1992. It was privatized in 1995 and listed on the stock exchange in 2003.

Its core business function is to manufacture and sell caustic soda and allied chemicals.

Shareholding pattern

Ittehad Chemicals’ key shareholder are its directors, CEO, their spouses, and minor children that collectively hold a little over 25 percent of the shares. Within this, Mr. Muhammad Siddique Khatri is a major shareholder holding 13.5 percent of the shares. Around 56 percent shares are with the local general public while close to 12 percent held in joint stock companies. The remaining 7 percent shares are distributed with the rest of the categories.

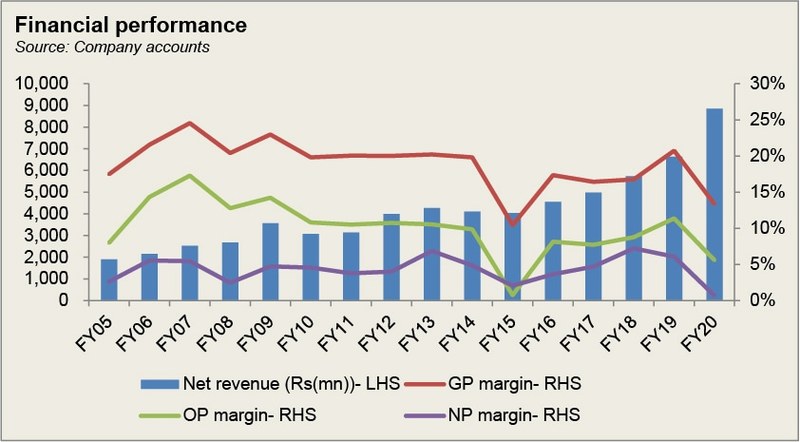

Historical financial performance

Although Ittehad Chemicals has seen topline growing at a negative rate only a few times during the span of fifteen years or so, it has witnessed a notable drop in profit margins twice- once on FY15 and the other time recently in FY20. Reason for margins dropping in FY15 was that Chlor-alkali is a fuel-intensive industry. Since Ittehad Chemicals is the founding company of this industry, with immense energy shortage during the period, the company’s manufacturing cost went up, causing a significant impact on profit margin.

During FY16, the industrial sector posted a growth rate of 6.8 percent, that exceeded the target rate of 6.4 percent. This was driven by CPEC implementations and other infrastructure developments. The company, on the other hand, posted an impressive near 13 percent topline growth. This was in part due to the commencement of a cost-efficient plant IEM Plant-2 (Phase-1). This is reflected in a major drop in cost of production as a percentage of revenue- 82.6 percent compared to last year’s 89.5 percent. This caused net margins to improve to almost 4 percent. This was also supported by “partial reversal of the provision of GIDC made for the period prior to promulgation of GIDC Act, 2015”.

In FY17, the company saw its topline growing by 9.5 percent. However, this came with a slight incline in the cost of production due to “charging of RLNG tariff by Sui Northern Gas Pipelines Limited instead of System Gas tariff”. Moreover, the international prices for Calcium Chloride also fell that had an adverse impact on gross margins. Although other income saw a notable increase, it was off set by the increase in other expenses. Moreover, finance costs also continued to claim roughly 4 percent of revenue. However, net margin improved to over 4 percent due to a combination of gain on investment property and a positive tax figure that supported the bottomline.

With FY18 being an election year, despite the smooth transition between the governments, there was considerable uncertainty with regards to policies, and business environment. Moreover, with currency devaluation and increase in oil prices, in addition to high power tariff and RLNG pries, the chemical industry was deeply impacted due to it being power intensive. Despite this, the company managed to grow its topline by a decent 15 percent and maintain cost of production at the same level as last year- around 83 percent. The higher revenue was attributable to improved prices for Caustic Soda in both, the domestic market as well as the international arena, whereas the stability in production cost was due to transforming its entire production technology to power efficient and environment friendly Ion Exchange Membrane Plants.

With cost of production increasing corresponding to revenue, gross margin remained stable in FY18. On the other hand, bottomline received considerable support from other income that made up more than 2 percent of revenue. This came primarily from sales of scrap. Thus, net margin improved to 7 percent- the highest in a span of fifteen years.

A year after the general elections, there were still political issues impacting economic growth of the country. Amidst inflation, high interest rates, and power tariffs, business environment was adversely impacted. However, Ittehad Chemicals continued on its growth trajectory in revenues in FY19 that grew by almost 16 percent. During the year, the company started commercial production on its new plant IEM Plant-3. The fact that the plant is cost efficient is reflected in the cost of production that went down to 79 percent- a level last seen nearly a decade ago. This allowed a significant improvement in gross margin that increased to almost 21 percent. However, net margin actually declined to 6 percent during the same period due to an escalation in finance cost that went up to make almost 4 percent of revenue. This was due to a high mark-up rate.

Recent results and future outlook

While the outbreak of Coivd-19 wreaked havoc with the growth of economies worldwide, Ittehad Chemicals managed to post an impressive topline growth rate of 33 percent. This rate was last seen a decade ago, in FY09. This was essentially due to inclusion of LABSA Plant in the company’s operations. However, the higher revenue could not raise profit margin for the year; gross margin drastically fell to nearly 13 percent. This was due to a significant climb in cost of production- 87 percent of revenue; this was a result of high RLNG/ LESCO Tariff Rates among other inflationary pressures. Moreover, finance cost further squeezed margins as it made up more than 5 percent of revenue, reducing net margin to less than 1 percent.

The lowering of interest rates will help to curtail the company’s finance expense. In addition, it expects RLNG costs to be lower in the coming year which could help to improve profitability, considering power and fuel expense makes up roughly 50 percent of the total cost of production.

Comments

Comments are closed.