Biafo Industries Limited (PSX: BIFO) was established in 1988 under the Companies Ordinance, 1984 (now Companies Act, 1913) as a public limited company.

It makes commercial explosives and blasting accessories including detonators, etc. due to the nature of the products, the company’s license for manufacturing and sale of the same has to renewed each year.

It operates with a current rated capacity of 6 million kilograms of Tovex water gel and powder, 9 million detonators- plain/electric, and 2.5 million meters of detonating chord.

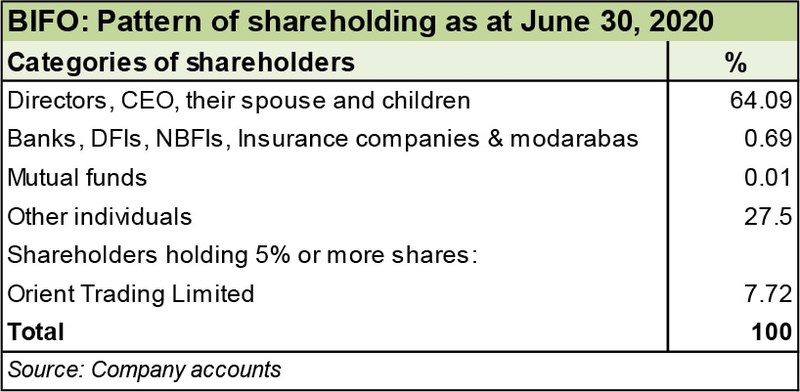

Shareholding pattern

A large majority of the shares, at 64 percent, are held under the category of directors, CEO, their spouses and minor children. Within this, Mrs. Ayesha Humayun Khan holds the majority of the shares at 24 percent. Some 27 percent shares are held under “other individuals” while Orient Trading Limited holds close to 8 percent shares in the company.

Historical financial performance

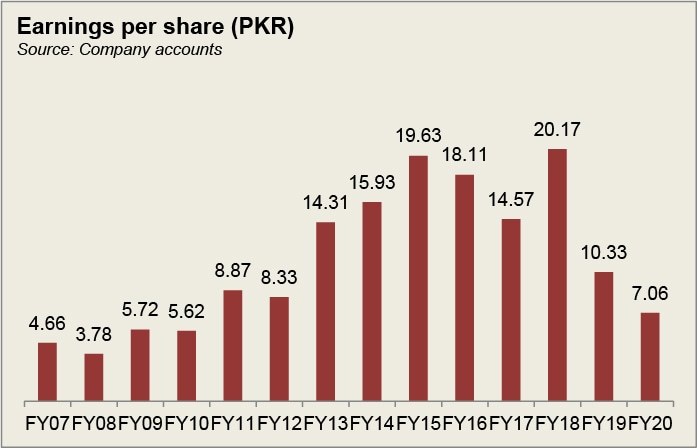

Biafo Industries’ topline has been rather fluctuating over the last decade, with it declining twice year-on-year in the last five years. Profit margins, on the other hand, have remained stable through the first half of the decade, started rising after FY12, peaked in FY18, and have been on a decline since then.

During FY16, the company experienced a marginal growth in topline by a little over 3 percent, as compared to previous year’s growth of nearly 11 percent. Local sales were a major contributor to the net revenue. However, the low rate of growth was due to a reducing demand since a lot of the large projects neared maturity, while no new projects were taken aboard. This was also combined with a decline in cost of production to 53 percent, down form last year’s nearly 56 percent, causing gross margins to increase. However, net margin declined, although only marginally. This was because of a rise in administrative expenses coming from salaries, directors’ traveling and conveyance and legal and professional charges.

In FY17, Biafo Industries saw a 17 percent fall in its revenue. Local sales were primarily responsible since it declined by 27 percent. Although export sales increased, the incline was not sufficient to make up for the decline in local sales. The latter occurred due to “reduced seismic exploration programs” that reduced sales made by the company to the Oil and Gas Exploration sector by a whopping 58 percent. Towards the end of the year, the company took onboard a new project, from which the revenue stream was to be experienced in the coming years. Cost of production for the year increased marginally, that caused gross margins to also reduce only marginally. This was also reflected in the net margin as other elements remained more or less unchanged.

The company saw an exorbitant increase of almost 41 percent in revenue during FY18. This was brought in by both local as well as export sales. During the year there were major road construction projects and large-scale mining projects that allowed for this incline in sales. The company made a commendable effort to reduce costs as cost of production reduced to almost 50 percent of the revenue, raising gross margins to the highest level. The effect of this was also translated into a better net margin that was further supported by a rise in other income. This came from net exchange gain and gain on remeasurement of investment.

In FY19, Biafo Industries saw its revenue contracting by almost 17 percent. Revenue from both avenues, local and export sales registered a decline. This was due to a decline in supplies to large road construction projects as blasting activities were completed at some of the projects whereas activities slowed down at others. This was a result of a general slow down in the business environment owing to economic instability in the wake of rupee depreciation and high inflation and interest rates. Moreover, the government did not announce new infrastructure projects causing a stagnation of demand.

The inflationary pressure resulted in an increase in cost of production that rose to nearly 57 percent of the revenue, causing gross margins to reduce considerably to 43 percent. Although net margin also reduced, but the extent was minimized due to the contribution made by other income that came from dividend income and a net exchange gain. The company also appointed a new CEO, effective in the second half of the year.

Recent results and future outlook

Topline grew by close to 13 percent during FY20, with local sales mostly contributing to this incline. The first quarter contributed the highest revenue of Rs 464 million out of the annual revenue of Rs 1.6 billion, while the last quarter contributed the lowest at Rs 307 million. The latter was largely expected and explicable due to the outbreak of Covid-19 and the resultant lock down that put majority business activities at halt. Cost of production went up to 64.5 percent, bringing gross margin down to 35.5 percent. Increase in raw materials expense mostly dominated the increase in total cost of production. This was reflected in the net margin, which was further squeezed in the absence of contribution by other income to 15.5 percent.

The government had announced several relief measures to revive the economy that had been severely impacted by the pandemic. It approved hydro power projects that could generate opportunities for the company.

Comments

Comments are closed.