As previously analyzed in this space, Pakistan’s telecoms sector had come out largely unharmed from the first coronavirus wave in the summer, throwing up a mixed performance. But how have the telco’s performed in the rather “normal” quarter post-lockdowns. As financial results for individual companies start trickling in for the Jul-Sep quarter, it’s time to evaluate business as usual.

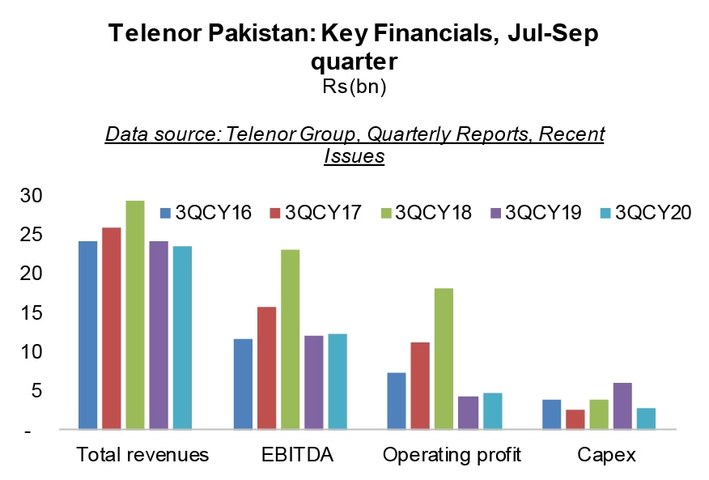

Yesterday, the Telenor Group announced its quarterly results, and the reading for Pakistan shows emerging signs of recovery. Telenor Pakistan’s total revenues declined by 3 percent year-on-year to reach Rs23.4 billion in 3QCY20, mainly due to 2.4 percent fall in core revenues from subscriptions and traffic. This is also lower than the topline score of Rs24 billion in 2QCY20 (down 8% YoY) and Rs25.5 billion in 1QCY20 (down 10% YoY). (Figures are converted from reported Norwegian Krone (NOK) to Pakistani Rupee based on exchange rate of Rs1=NOK 0.0589 that has been used in the quarterly report).

From another lens, the yearly decline is receding as the quarters have moved along – this could be a good omen for the revenue growth in the ongoing quarter. However, some of the yearly improvement post-June-2020 can be attributed to normalization effect that is kicking in after the top court’s annulment of 10 percent “service fee” last summer. That measure had dented the topline across the sector.

Meanwhile, average revenue per user (ARPU) continues to fall for Telenor Pakistan. During 3QCY20, ARPU came in at Rs165 per month, a 5 percent decline from Rs174 per month in 3QCY19. The quarterly ARPU is also 3 percent lower than Rs170 seen in previous quarter. The declining ARPU has come about despite growth in data revenues and gradual addition of subscriptions. The operator’s subscriptions had reached 46.2 million by September 2020, up almost two million since September 2019. (As per the report, “mobile ARPU” was Rs178 per month in 3QCY20, showing an organic decline of 3 percent year-on-year).

Since the revenue decline wasn't calamitous, the operator overcame it apparently through marginally lower operating expenses on account of lower marketing spending and cost optimization during the quarter. This helped deliver a 1 percent growth in EBITDA to Rs12.1 billion in 3QCY20. Relative to same period last year, the EBITDA margin also came in two percentage points higher at 52 percent for the quarter, albeit it is still lower than the peak of 78 percent seen in Jul-Sep 2018.

Accounting for operating profit showed a 10 percent yearly growth to Rs4.5 billion, which, again, is short on this count relative to the high of Rs18 billion seen in 3QCY18. The operator continues to pour money into capital expenditures, but the tally of Rs2.7 billion in the quarter under review is less than half of Rs5.9 billion seen in 3QCY19 and also lower than Rs3.7 billion in the previous quarter. This is understandable, given the demands on cash flows relating to license renewal fees as well as the impact of economic weaknesses on expansion. There has been a lesser activity this year on site up gradations and roll outs.

In total, at the end of nine months ended September 2020, Telenor Pakistan revenues are down 7 percent year-on-year to Rs75 billion and operating profits are down 21 percent year-on-year to Rs15 billion. The operator will need a stellar last quarter to end the year with healthier financials. Meanwhile, the parent group has reported that renewal of Telenor Pakistan’s GSM license remains pending after a court hearing in September and another one this month. This comes after Telenor Pakistan paid in Apr-Jun period about $60 million or Rs10 billion as yearly installment related to license renewal.

Comments

Comments are closed.