Dadex Eternit Limited (PSX: DADX) was established in 1959 as a public limited company under the repealed Companies Ordinance, 1984 (now, Companies Act, 2017). The company is essentially in the business of manufacturing and selling construction material. Its offered products and services include pipe systems and roofing, and architectural claddings and curtain walls.

Shareholding pattern

With about 63 percent of the shares held under this category, associated companies, undertakings, and related parties is a key shareholder of the company. This category solely includes Sikander (Private) Limited. This is followed by the directors, CEO, their spouses, and minor children that hold 30 percent of the shares, of which Mr. Sikander Dada, one of the directors of the company, is a major shareholder owning 12 percent of the shares. A little over 6 percent is with the general public while the remaining categories hold less than 1 percent shares.

Historical operational performance

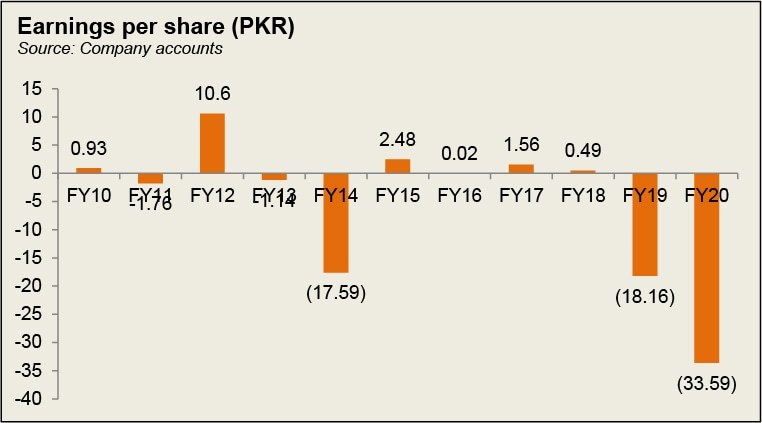

While the topline has been fluctuating over the years, increasing, and decreasing at various rates, profit margins have followed a downward trend, particularly since FY15 for Dadex Eternit Limited.

In FY16, Dadex Eternit saw a marginal fall in its topline. This was due to a year on year decline of 35 percent in sales of FC pipes in Punjab. This, in turn, was impacted as a result of diversion of fund allocation from water supply segment for government projects to Metro Orange Train project. The company’s performance of roofing business was also negatively affected due to cheaper alternatives available such as GI sheets and plastic roofing materials coming from China. During the year, the company was also able to reduce its cost of operations with respect to electricity expense as it redirected supply for its Hyderabad factory to a separate industrial grid that reduced load shedding hours, and hence the need for rental Genset. Despite this, its cost of production as a percentage of revenue rose to a little over 82 percent (FY15: 79%). This brought down gross margin and the effect was also reflected in net margin with bottomline at less than Rs1 million.

During FY17, the construction sector if the economy recorded a 9.05 percent growth. Note that the construction sector is quite pertinent to the company. Moreover, CPEC developments have also given a push. This is also reflected in the topline growth of the company that stood at beyond 10 percent. The company also added equipment and made investments to their factories that allowed for improvement in quality. With this its improved capacity utilization and hence increased their production volumes. While operating margin was driven down by distribution costs due to salaries expense, net margin showed some improvement on the back of better sales.

Construction sector’s growth continued to grow during FY18 at above 9 percent while Dadex Eternit’s topline grew at 22 percent, the highest seen thus far. This was primarily driven by the boost seen in the construction sector. However, the higher topline came at a higher cost of production as well as the latter increased to more than 84 percent as a share in revenue. This was due to increase in raw material prices as well as rise in prices of petroleum products. Therefore, profit margins contracted with net margin reducing to less than one percent.

Topline contracted once again in FY19 by close to 4 percent. This was due to reduced government expenditure on infrastructure development projects that affected the sales of the company as its business is directly linked with the construction sector, particularly the “restrain imposed by Supreme Court of Pakistan on construction activities in the Bahria Town and high rise projects” during the first half of FY19. Moreover, given the inflationary pressure, high interest rates and currency devaluation, cost of production for the company increased to more than 88 percent of the revenue. Other operating expenses also exhibited increase that could not be offset by other income, thereby leading the company to incur a loss of Rs196 million.

Recent result and future outlook

Dadex Eternit was no exception as a number of companies saw their topline falling during FY20 after the outbreak of Covid-19 and the resultant lockdown; the company’s sales fell by more than 15 percent. This also resulted in cost of production making a larger part of the revenue at 90 percent. Apart from this, other expenses and finance cost also increased significantly, due to high interest rates and GIDC expense and allowance for expected credit losses. Thus, the year ended with the highest recorded loss at Rs361 million, and a net margin of negative 15 percent.

While several opportunities exist in the shape of CPEC and government’s housing scheme as the economy gradually recovers, to regain and maintain profitability in the near future the company hopes to explore new sources of raw materials, new markets and develop a wider customer base.

Comments

Comments are closed.