Earning rebound for PSO

After a disastrous fourth quarter of FY20, Pakistan State Oil Limited (PSX: PSO) has had a breather in 1QFY21. The oil marketing company returned to profits in the first quarter of FY21 after incurring a loss in the last quarter of 4QFY20.

During 1QFY21, PSO witnessed a rebound in volumetric growth of petroleum products. Overall volumes grew between 9-10 percent while the largest increase was seen in furnace oil sales (27 percent YoY) followed by HSD and MS (14 and10npercent YoY) respectively. However, despite the growth in volumes, PSO’s revenues for 1QFY21 slipped by 1 percent year-on-year due to decline in selling price of petroleum products during the quarter versus similar period of FY20. But the overall revenue growth in 1QFY21 stood higher than that of 4QFY20 (QoQ) due to better pricing and gorwth in volumes.

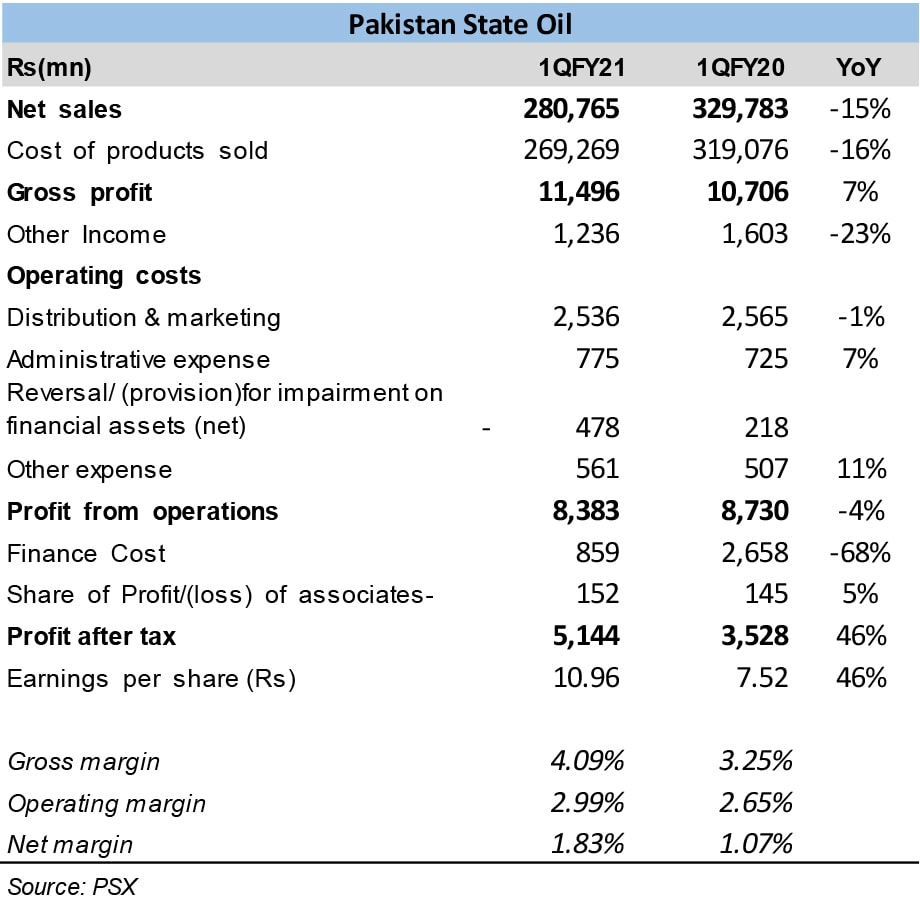

Decline in cost of sales at the same time however lifted gross profits with margins going up from 3.25 percent in 1QFY20 to 4.09 percent in 1QFY21. This was primarily due to inventory gains that the OMC gaint incurred versus similar period last year. This was also a reversal from what the company witnessed in FY20 particularly in 4QFY20 where the OMC incurred staggeringly high inventory losses Also, the company’s overall volumes in FY20 had fallen by around 10 percent, and the decline was led by furnace oil sales that plunged by around 50 percent year-on-year. In addition to the petrol crisis that took place during the year, coronavirus outbreak and the resulting lockdown hit the consumption of petroleum products hard. The decline in volumes for the oil marketing companies that were already facing falling sales due to economic slowdown, mutiplied.

Even though volumes went up for PSO in 1QFY21, the distribution expenses remained flat while administrative expenses posted modest growth . However, the OMC’s other income declined by 23 percent, which was likely due to lower markup on delayed payments. Provision for the impairment of financial assets added to the cost burden and dragged the operating profit of PSO. But the respite from finance cost helped in the bottomline growth. PSO’s earnings for 1QFY21 increased by 46 percent. And it was partly due to 68 percent year-on-year lower finance cost during the period due to lower interest rates and hence lower short-term borrowings.

Demand destruction from COVID-19 has eased as restrictions have ended and volumetric recovery in FY21 offers hope on the sales side. At the same time, all eyes are set on the upcomng OMC policy that is sure to benefitthe largest OMC in retaining and growing its market share.

Comments

Comments are closed.