Rejoice, tobacco industry, for volumes are back! As predicted in this space back in August, cigarette production has indeed shown a stable recovery. But the rebound owes mostly to issues within the tobacco industry and not related with the easing of lockdowns. The pre-lockdown average output in Jan-Mar period was equivalent to the production during the three-month peak lockdown period in Apr-Jun.

Analysis based on data from the Pakistan Bureau of Statistics until the latest available month of August shows that the cigarette production in the first eight months of the calendar year had reached almost 33 billion sticks, which is 9 percent lower than the reported production in 8MCY19. The average monthly production stood at 4 billion sticks in this period in CY20, down from 4.5 billion sticks last year.

However, it is in the latter half of this period where the formal industry has staged real recovery. Between May and August 2020, the reported cigarette production was almost 18 billion sticks, which was about 50 percent higher than same period last year. This output level – averaging 4.4 billion sticks a month – is the highest in recent years for the analysis period. Yearly growth in the months since the early-June budget announcement was 334 percent for whole of June, 76 percent for July and 22 percent for August.

What has changed in recent months, given that in the Jan-Apr period the output was sharply down 37 percent year-on-year? Such periodic jumps in cigarette production (as last happened in 2018), preceded by a period of dim output (as occurred in 2017), aren’t unusual in Pakistan. But the only element of ‘seasonality’ of consequence is what the federal budget presents every year in June. An unfavorable budget, characterized by higher FED or change of duty slabs, often leads to a fall in production. And for ensuing year or so, formal players lament that the last budget helped duty-non-paid (DNP) sector.

Conversely, a budget that passes without a FED hike or maintains status quo is followed by a normalization of output close close to 5 billion sticks a month. Even then, formal players keep protesting about alleged problems created by DNP or illicit sector. The same is happening now, even though the industry had a blockbuster Jul-Sep quarter right after the approval of a comparatively favorable budget.

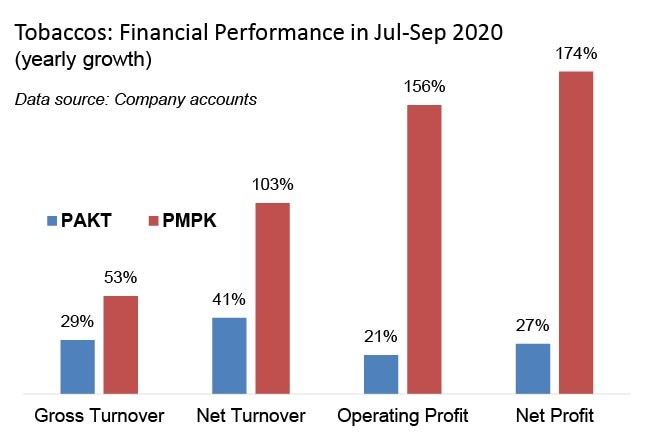

For instance, Philip Morris (Pakistan) Limited (PSX: PMPK) recently reported a 53 percent yearly growth in gross turnover for the post-budget quarter ended September 30, 2020 to Rs8.2 billion. This is presumably due to higher number of cigarette packs sold in the quarter. (Read more: “PMPK: volumes recovering?” published October 27, 2020). Net turnover, however, had a much bigger jump of 103 percent year-on-year to Rs3 billion, as the FED rate (equal to share of excise duty in gross turnover) decreased from 52 percent in Jul-Sep 2019 to 45 percent in Jul-Sep 2020.

But in the recently-released directors’ review for the quarter, PMPK executives didn't explain the quarterly performance per se and instead continued to highlight “challenges from the excessive illicit cigarette sector”. Instead of acknowledging the favorable 2020 budget, the report goes back to faulting the FED increases in the mini-budget of September 2018 and the full-year budget of 2019 that apparently “stretched the price gap between duty-evaded and duty-paid cigarettes”.

In the previous quarterly report, PMPK had noted, per their June 2020 retail audit, that the illicit cigarette sector had a market share of 35.2 percent. But such an estimate is missing in the latest report, nor is there an assertion that illicit sector is growing. This is perhaps wise, considering that further claims of growth in illicit sector would put a question mark on the formal sector’s recent growth, which is presumably coming at the expense of the same illicit sector.

Besides, if illicit sector is claimed by any of the major market players to be “growing” its market share, and if this claim is made at the same time as there is considerable sales growth in the formal sector, it would suggest that Pakistanis are smoking a whole lot more. In turn, this would question government’s tobacco-control measures, and lead to higher duties. And higher FED, well, it is a bête noire for big tobacco.

The market leader Pakistan Tobacco (PSX: PAKT) was also not much forthcoming in its latest directors’ review about the superb growth that this player has also seen in the latest quarter. For context, in the Jul-Sep quarter, PAKT scored a strong gross turnover growth of 27 percent and net turnover growth of 41 percent year-on-year, suggesting a visible drop in FED rate for this firm, too. (Read more: “PAKT: topline is strong,” published October 26, 2020). The report doesn't discuss quarterly sales performance per se. While export revenue growth is explained, a discussion on domestic turnover for Jul-Sep is absent.

In the report, PAKT claims that “the illicit sector share grew by 0.2% by the end of August 2020 (vs June) still representing a sizeable 36.8% of the total market share”. Despite the favorable budget, the company lamented that “price gap between duty paid and non-duty paid products increased to +260% as key brands in the illicit sector reduced their selling prices by 25%”. PAKT has lately also been referring to counterfeit products threatening legitimate industry volumes and government tax revenues.

Bottom line: if the market is still favorable for the illicit sector and if the government crackdown continues to disappoint, perhaps the two main legitimate players need to explain their recent growth better. This growth has to be eating into the market share of illicit smokes. And if that line of reasoning is not put forward by formal industry in coming months, it may strengthen the argument of healthcare advocates that the illicit sector is simply a convenient bogey, whose market share is amplified on paper every now and then to dissuade the government from imposing higher duties to discourage tobacco use.

Comments

Comments are closed.