The General Tyre and Rubber

The General Tyre and Rubber (PSX: GTYR) was established in 1963 as a private limited company and started production a year later in 1964. It was later converted into a public limited company. The company manufactures and trades tyres and tubes for automobiles and motorcycles.

Shareholding pattern

With close to 58 percent shares held in this category, The General Tyre and Rubber is primarily held by its associated companies, related parties and undertakings; this includes Pakistan Kuwait Investment Co. (Pvt) Limited that holds 30 percent, and Bibojee Services (Pvt) Limited that holds almost 28 percent shares in the company. Some 25 percent is collectively held by the local general public, while the directors, CEO, their spouses, and minor children hold a little over 1 percent shares. Around 5 percent are held under mutual funds while the remaining about 10 percent shares are distributed with the rest of the categories.

Historical operational performance

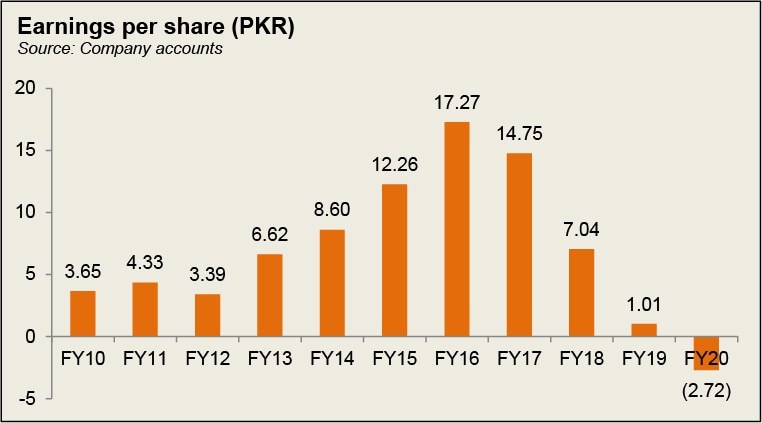

The General Tyre and Rubber has mostly seen positive growth in its topline with the exception of FY16, FY19 and fairly recently in FY20. Profit margins, on the other hand, have been on a decline since the last four years after peaking in FY16.

During FY16, topline reduced very marginally by less than 1 percent. Most of this effect was due to slow growth in the second quarter of FY16 as two large Tractor Tyre OEM (Original Equipment Manufacturers) shut down their plants. Moreover, the replacement market was affected by smuggled goods and under-invoiced tyres. Despite the lower revenue, the company posted the highest net profit seen in a decade; the net profit posted crossed the Rs 1 billion mark. This was as a result of a decline in cost of production from last year’s almost 80 percent to 75 percent of revenue in FY16. The decline in costs was associated with lower raw material costs. Thus, net margin peaked at close to 11 percent for the year.

There was slight growth in topline as it increased by nearly 2 percent during FY17. This marginal growth was due to sales being adversely affected in the last quarter as a result of the switch from old system to the new ERP system which went live in the last quarter of FY17. However, the increase in costs offset the improvement in sales which led to cost of production consuming close to 79 percent of the revenue. This caused gross margins to decrease; the increase in cost of production was attributed to an increase in salaries and raw material costs. Net margin reduced to 9 percent; the decrease in net margin year on year was relatively less as compared to that seen in gross margins, due to a lower tax expense.

The General Tyre and Rubber experienced the highest growth sales at 22 percent, whereas volumetric growth was 18 percent in FY18. This could be attributed to “uplift of tyres by OEMs” that exhibited a 13 percent growth. Moreover, the replacement market posted 31 percent growth as a result of new mixing plant in addition to machinery. However, this increase could not be translated into a better profit margin due to rise in prices of raw material, currency devaluation and stiff competition. The company faces competition from the undocumented sector which hurts the profitability of The General Tyre and Rubber. Thus, net margin decreased to 6 percent.

Topline fell for the second time in a decade in FY19, by 11 percent; this was attributed to a number of factors. The general slowdown in the economy led to dampening demand in the automobile and auto parts industry particularly the farm and truck segment that reduced sales to OEMs. Furthermore, there was a restriction on non-filers to purchase vehicles. Some improvement in replacement market sales was seen but it was offset by the decline in other segments. In addition to this, cost of production also increased to 85 percent of the revenue on account of increase in raw material prices and other utilities as a result of currency devaluation and inflationary pressure; this reduced gross margin, and net margin due to increase in finance expense that was a result of investment in capex apart from increase in discount rate.

Decline in topline was further worsened during FY20 by 16 percent. This was attributed to “lower production days observed by OEMs” during the end of 1HFY20, while the second half of the year was impacted by the outbreak of Coronavirus that severely impacted the auto industry. Demand during the year was also affected due to the requirement of CNIC and higher auto financing rate. Apart from lower revenue, profit margins were also affected by the higher cost of production that increased to 88 percent of revenue. Thus, net margin contracted by 5 times to 1 percent.

Quarterly results and future outlook

Since the same period last year was impacted by various restrictions and high auto financing rate, year on year sales during 1QFY21 increased by 42 percent. This is also the time after a period of reduced demand owing to the Covid-19 pandemic. Although higher cost of production caused gross margins to lower, net margin was supported by changes in discount rates that benefitted the company in terms of lower finance expense.

A stricter controls on the border, more so owing to the pandemic has led to a control on smuggling that has indirectly benefitted the company, while lower discount rate might encourage auto financing that could generate demand in the auto industry. Expecting the economy to recover gradually, the company foresees long-term growth potential in the business.

Comments

Comments are closed.