Earnings have revived for Honda Atlas (PSX: HCAR) in the first two quarters against the loss that the company faced in the period right before (Oct-Mar-20) even though the company sold about the same volumes during the period (see graph). The company did perform a lot better this time last year but not as well as it did during 2017-18 where volumes soared. With the double-digit growth in volumes month after month, it seems the company will take no time to revisit past glories.

The decline in volumes came long before Covid-19, though it is no longer lingering. During April, the company like the industry recorded zero sales but before that, economic slowdown was the main culprit as higher prices, greater cost of car leasing and overall reduced purchasing powers caused potential buyers to stay away from the automotive market. In fact, the company was observing non-production days and had inventories piling up—covid-19 only worsened demand prosects.

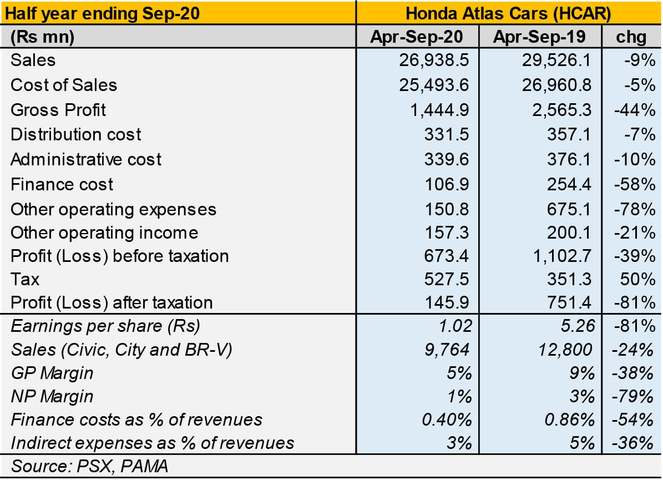

Evidently, times are changing fast. During the half year ending Sep-20, the company recorded only a marginal reduction in revenues against a double digit decrease in volumetric sales while costs of sales also fell. This naturally led to a decline in margins but not by a lot.

This has been made possible due to price hikes across variants over the past two years. On average, the company fetched 20 percent higher revenue per unit sold than the period last year. However, the higher cost per unit sold (24% up) also indicates that the company’s inputs are becoming expensive—mainly due to rupee depreciation. Though automakers boast about high localization, it would appear that high dollar value inputs are being imported while local inputs used also require imported content. As a result, weakening rupee will always cause costs to soar.

The company has managed to keep its indirect expenses in check, by curtailing them as a share of revenue while the company’s insubstantial borrowing kept financing costs below 1 percent and actually falling against last year due to lower interest rates.

Though the threat of the second-wave remains very real—and subsequently, lockdowns may recur too—the automotive industry is moving in a blooming direction. Bank financing is cheaper which would allow a greater number of customers to buy the ever more expensive cars more readily. Though the likes of Kia and Hyundai have emerged in the market as worth contenders, Honda has a loyal customer base, playing with three different vehicle categories—from mid-range City to luxury Civic and a cross-over SUV. Some market share may get chipped away, but given the rising premiums in the market right now elicited by the growing demand; not too much.

Comments

Comments are closed.