SEED partners with KP Government to Reform Sales Tax on Services in KP

- Sustainable Energy and Economic Development (SEED) launched a Policy Note in collaboration with the KP Government to introduce Sales Tax on Services Reform in the province.

The Sustainable Energy and Economic Development (SEED) in collaboration with the Consortium for Development Policy Research (CDPR), the International Growth Centre (IGC) and the Government of Khyber Pakhtunkhwa (GoKP) launched a policy note on ‘Reforming Sales Tax on Services in Khyber Pakhtunkhwa’ in a webinar on Monday.

This note presents a framework for reforming Sales Tax on Services (STS) in the province through the Khyber Pakhtunkhwa Revenue Authority (KPRA).

SEED is a multi-sectoral seven-year program which aims to support the KP Government in achieving economic development and undertaking sustainable energy reforms in KP. This policy note was essentially driven by SEED’s strategic priority to provide technical assistance to the KP Government and was funded by Foreign, Commonwealth and Development Office (FCDO).

Mr. Hasaan Khawar, Team Leader SEED, explained that for the last few years there has been a growing realization that provinces needed to generate own-source revenue and this policy notes paves the way forward to realize this.

As a first ever note of its kind produced for the KPRA, it provides a structure of key reforms for STS in KP and has been drafted in consultation with SEED’s partners, CDPR and IGC Pakistan. The note has been authored by Mr. Faisal Rashid, Senior Consultant on Public Financial Management at Oxford Policy Management, and peer reviewed by Dr. Anjum Nasim, Senior Research Fellow at the Institute of Development and Economic Alternatives (IDEAS).

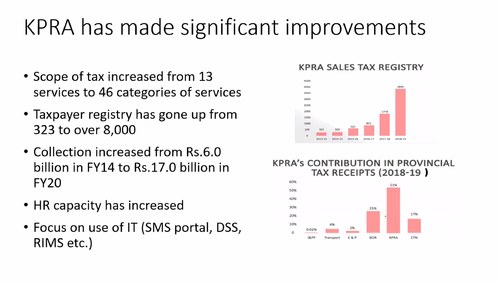

According to Mr. Faisal Rashid, KPRA has made significant progress by increasing the scope of taxes from 13 services to 46 categories of services. He also added that collection of SST increased from PKR 6 billion in FY14 to PKR 17 billion in FY20.

Mr. Faisal Rashid also suggested that innovative use of IT through Data Integration and Data Scraping, RIMS, E-IMS, E-courts, E-Strive and SMS portals has helped in broadening the tax base, improving real time connectivity with businesses and enabled better performance management of staff.

Mr. Hassan Daud, CEO Board of Investment and Trade, KP also commented that "KPRA is now working on building its capacity by bringing novelty in the overall framework through new technologies and ideas."

In addition to this, Dr. Ijaz Nabi, Chairperson CDPR and Country Director, IGC Pakistan, suggested that it is important to use this opportunity to identify additional services that need to be taxed, and find better ways of generating more revenue through property taxes. This could be done by enhancing the legal environment of tax enforcement through relevant training schemes.

The Guest of Honor, Mr. Taimur Jhagra, Finance Minister, GoKP, endorsed these suggestions presented in the webinar and outlined the next policy steps to be taken by the KP Government.

He concluded the discussion by explaining how KPRA reform has been a top priority for the government and highlighted some successes of recent reforms, such as increase in tax revenue by 65% in the last year. He expressed hope that they would be able to reach at least 20 billion this year despite COVID-19 challenges.

Comments

Comments are closed.