Oil and Gas Development Company Limited

Oil and Gas Development Company Limited (PSX: OGDC) is the largest player in the E&P sector in the country. It has the largest portfolio of net hydrocarbon reserves in Pakistan, which includes 44 percent of oil and 37 percent of gas as of June 2020. The company contributed to 29 percent of Pakistan’s total natural gas production, and 46 percent of its oil production in FY20.

Shareholding Pattern

Government of Pakistan is the largest shareholder in OGDC. Its disinvested part of its shareholding in the company back in 2003. Initially 2.5 percent of the equity with an additional green-shoe option offered to the public. Then in December 2006, the government divested a further 10 percent of its holding in the company. The breakup of the latest shareholding is given in the illustration.

OGDC recent performance

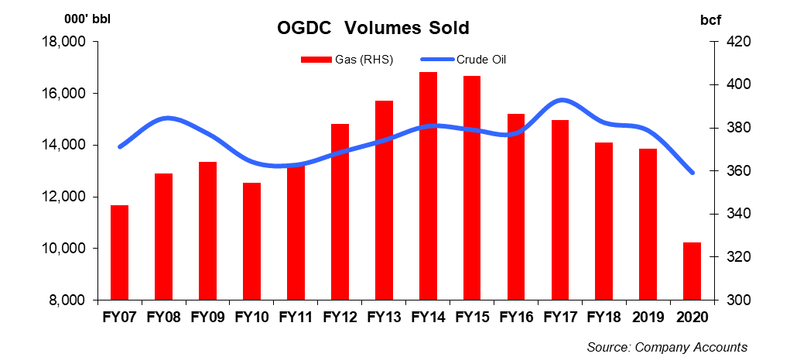

Being the leading oil and gas E&P company, OGDC stay ahead with its & exploration and drilling activities despite the natural decline in the reserves, discoveries, and hence crude oil and gas production. A look at the OGDC’s last three-year performance shows that while the company has been aggressive in its drilling activities as well as in acquiring seismic data, production of hydrocarbons has been on a downward trend. gas production particularly has been falling due to natural depletion in the mature fields.

However, when compared to FY13, the annual report for FY18 gives some indicators of improvement such as higher 2D and 3D seismic survey acquired; continued and sustainable drilling activity where the average number of exploratory/appraisal and development wells have remained constant; better crude oil, LPG and sulphur quantities sold over the years etc. But when looking at the financials, sales revenue and earnings show a decline not only due to weaker production stats but also lower oil prices that resulted in lower realised prices of oil and natural gas.

However, year-on-year performance of the E&P company was better due modest recovery in the price of crude oil. Plus, higher LPG production complemented by favourable exchange rate and planned capital spending contributed positively to the financial growth in FY18. Also, OGDC made 4 new oil and gas discoveries.

Here again, net earnings were affected due to increase in operating expenses, depreciation on account of capitalisation of assets and amortization of development and production assets on account of capitalisation of new wells and change in reserves estimates and higher cost of dry and abandoned wells owing to 11 wells declared dry and abandoned in FY18 against 4 wells in FY17 negatively affected the financial results.

FY19 was a profitable year for OGDC where net earnings increased by 50 percent year-on-year. This resulted from an increase in sales revenue by 57 percent year-on-year in FY19 due to increase in average net realised prices of crude oil and natural gas as well as flattish growth in the hydrocarbon production; crude oil production increase by 1.1 percent year-on-year, while natural gas production increased by 0.8 percent year-on-year. 16 wells were spud, comprising of 9 exploratory/appraisal and 7 development wells. OGDC’s exploratory efforts yielded 3new oil and gas discoveries.

FY20 was smeared by the beginning of COVID-19 pandemic. It was also a slow year for the oil and gas exploration and production sector where crashing oil prices along with COVID-19 had key impact on the sector’s financial performance. OGDC saw its bottomline being impacted as FY20 earnings slipped by 15 percent year-on-year, where most of the decline came from 2HFY20.

The squeeze in earnings started from the top as OGDC’s revenues decreased by 6 percent year-on-year in FY20. The decline was both due to falling crude oil prices and production levels. Realized prices of crude oil witnessed a drop of around 20 percent to $46.76 per barrels whereas LPG realized prices also fell by 11 percent year-on-year to Rs63,997 per ton in FY20. Realized gas prices however, increased by 16.5 percent to Rs.393.32 per mcf. Production numbers were also subdued as COVID-19 left many fields like Nashpa, Mela and KAPDTAY in partial shutdown mode. Oil and gas production thus witnessed decline of around 12 percent each in FY20, while LPG production fell by 11 percent.

Despite decline in revenues, the company incurred higher in operating expenses, which affected gross profits. Furthermore, increase in all expenses including exploration, general administration, and finance cost and lower other income and no exchange gains affected the net margins. Growth in exploration expenses was due significant cost of dry and abandoned wells during the year as well as increased spudding.

OGDC in 1QFY21 and beyond

It was hoped that the worst was over in terms of COIVD-19 once the lockdown restrictions were removed. There are two ways to look at OGDC’s financial performance for 1QFY21: compared to 1QFY19, earnings and revenues slipped; but sequentially, the quarter portrays improvement.

Overall, the company’s earnings for 1QFY21 were seen slipping by 14 percent year-on-year, starting with a 10 percent year-on-year decline in the topline. OGDCL’s revenues for the quarter were affected by decline in volumes for gas and oil versus those in similar period last year. During the period, the demand and price of crude oil remained suppressed as the coronavirus pandemic is far from over globally. Average realized prices of crude oil during the quarter were down by over 26 percent. The quarter recorded a 5.8 percent 3.6 and percent decline in average daily oil and gas production respectively, on a year-on-year basis. Production of oil and gas was affected by natural decline in key field as well as annual turnaround and non-revival/partial revival of wells post COVID restrictions. Natural gas production was also down due to lower offtake from the power sector.

Higher operating expenses further dragged gross margins. However, lower exploration charges as well as higher other income offered some support to the falling earnings.

COVID-19 has made sequential analysis more meaningful as countries have gone and come out of lockdowns and related restrictions. Though the E&P’s earnings declined year-on-year in 1QFY21, OGDC’s financial performance for 1QFY21 versus 4QFY20 saw significant rebound in earnings as well as sales – (43%and 28% QoQ), which means that the coming quarters are likely to be better than at least the last quarter of FY20 that really bogged down the company’s performance in FY20.

Comments

Comments are closed.