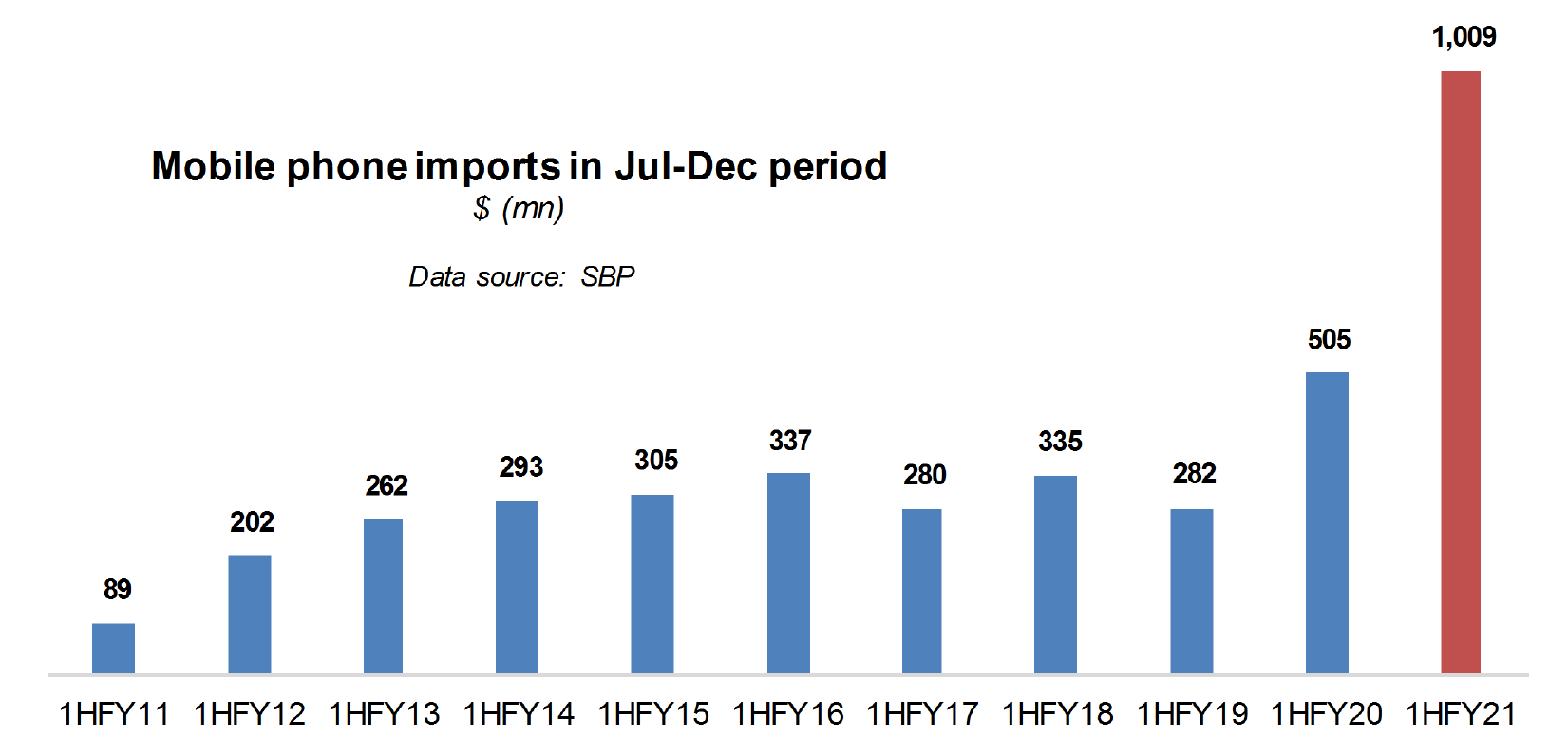

As per the latest SBP data, the mobile handset imports surged to $1.1 billion in Jul-Dec 2020 period. This figure is exactly double the forex spent on importing these devices in the same period of the previous year. (The shipment-based PBS data also show elevated device imports at $939 million in 1HFY21, up 52% YoY). These devices account for nearly half of yearly growth in Pakistan’s overall 1HFY21 imports.

More interestingly, some would say ominously, this tally in the first half of FY21 is almost equal to what Pakistan had imported in the entire FY20 ($1.1 billion). In short, Pakistan is set on a course to spend an additional billion dollars on mobile phone imports in the current fiscal, if this pace continued. Should this be concerning, while acknowledging that strangulating these imports can hurt ICT uptake?

Recall, the mobile phone imports had almost doubled in FY20 as well, as per SBP data. Similar trend is seen happening in FY21. On one hand, the rising imports on this count are a reflection of the curbing of the grey market of handsets. This is helped mostly by PTA’s Device Identification Registration & Blocking System (DIRBS) that has reined in the smuggling trade in devices.

On the other hand, rising imports, despite growth in domestically-assembled handsets, suggests that the latter cater to low end of the market, proving unable to cause a reasonable dent in handset imports for some time to come. The local market is estimated at 40 million mobile phones per year. While low-end phones lead in terms of sales volume, the medium and high-end phones account for bulk of sales value.

The concerned authorities need to ensure that incentives under the Mobile Device Manufacturing Policy are implemented in earnest. Besides, efforts need to be made to attract a globally-renowned smartphone manufacturer to set up a plant in Pakistan. The best bet at this stage is to convince one of the leading Chinese smartphone makers to take a leap of faith and help Pakistan develop the device ecosystem.

In the meantime, what if the import bill kept rising? While it remains to be seen whether FY21 will repeat the tale of FY20 in doubling imports, administrative measures such as imposition of new import duties or enhancement of existing taxes & duties can curb demand in the short term. But it may backfire as penalizing these imports may encourage smuggling and hurt ICT development. It’s a tough spot to be in.

Comments

Comments are closed.