Pak Elektron Limited (PSX: PAEL) was set up in 1956 “through a technical collaboration with AEG” under the Companies Act 1913 (now, Companies Act 2017). Later in 1978 the Saigol group acquired PAEL, and a decade later was made public.

The company manufactures and sells electrical capital goods and domestic appliances. It has two main operating divisions- power division and appliances division.

Shareholding pattern

As at December 31, 2019, the directors, CEO, their spouses and minor children hold over 29 percent of revenue. Of this, Mr. M. Naseem Saigol, the chairman of Pak Elektron Limited, holds 25.4 percent shares. The local general public holds almost 47 percent shares; some 6.6 percent shares are held in insurance companies followed by 6 percent in foreign companies; another almost 5 percent shares in banks, DFIs and NBFIs. The remaining about 6 percent shares is distributed with the rest of the shareholder categories.

Historical operational performance

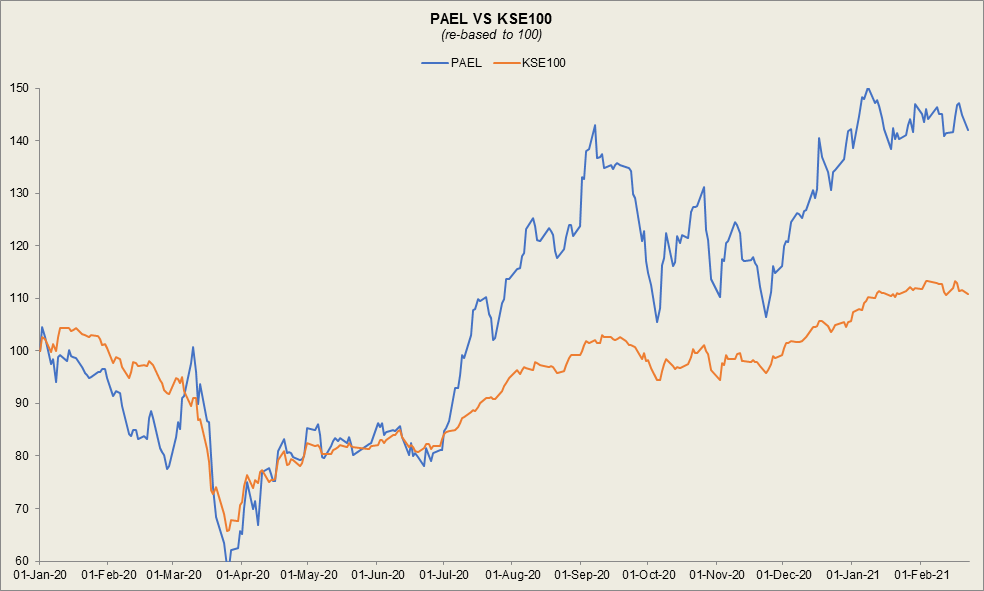

Pak Elektron has witnessed a fluctuating topline for the last eight years, while profit margins have been on a gradual decline before improving in CY19.

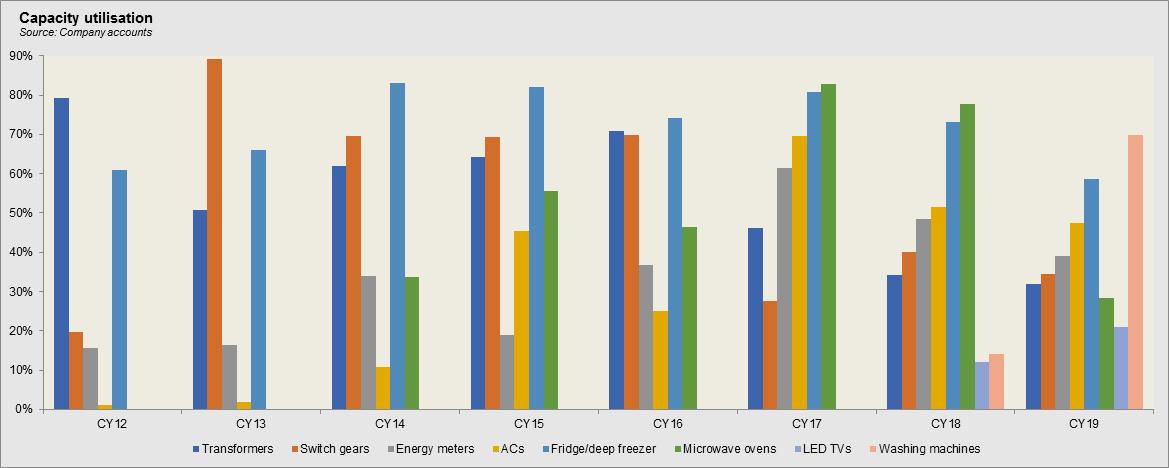

In CY17, the company saw the highest growth in its topline at over 27 percent driven by a 42 percent growth in the appliances division while revenue from the power division remained nearly flat year on year. The latter was due to slow ordering from WAPDA and discos. About 67 percent growth in appliances division came from refrigerator; the company launched various variants in the division that were accepted well in the market. Despite achieving the highest ever sales at Rs 26 billion, the higher cost of production consuming nearly 85 percent of revenue, did not allow profitability to improve. The higher distribution costs, at 3 percent of revenue, due to advertisement campaigns for the wide range of products, also lowered the profit margins. Thus, net margin was recorded at a little over 5 percent, compared to 9.5 percent seen in CY16.

Revenue contracted by a little over 10 percent during CY18; revenue from the appliances division remained nearly flat, while revenue from the power division reduced by almost 20 percent. Moreover, cost of production went up to over 88 percent of revenue that hurt profit margins. In addition, the inflationary pressure in the economy during CY18 had an adverse effect on the disposable incomes which translated into curtailed spending on appliances. Also, the general elections held in the mid of CY18 also meant a slowdown in the power segment. Therefore, demand by electric power distribution companies for electric equipment was slow. With currency depreciation and higher interest rates also translated into a higher finance expense. Thus, net margin contracted to 2.25 percent while in value terms, bottomline was almost three times lower, at Rs 528 million.

Contraction in revenue during CY19 was slightly lower at almost 5 percent, than compared to that seen previous year. The appliance division saw a mild improvement in its business volume by Rs 511 million, while revenue from this division saw a marginal incline. Sales from the power division were lower by 16 percent. Despite this, the company set up a power transformer facility to be completed by next year, as it saw future growth momentum in the power division. Cost of production, on the other hand, was lower than last year, as its share in revenue. Therefore, gross margin improved to almost 15 percent. However, net margin fell to less than 1 percent as a result of higher distribution expense as well as finance expense that made up 4 percent and nearly 7 percent of revenue, respectively. Distribution expense was higher due to freight and forwarding and warranty period services, while finance expense was higher due to greater short-term borrowings.

Quarterly results and future outlook

During the 9MCY20, revenue was higher by almost 29 percent year on year, of which a majority of the revenue was earned during the third quarter of CY20. During the period, the company also completed its power transformer manufacturing facility and it started commercial production. Among the three quarters of CY20, the lowest cost of production was seen in the third quarter which meant it also saw the highest profit margins. The first quarter had lowest topline due to the pandemic related countrywide lock down; it also saw the highest finance expense, that reached over Rs 1.8 billion cumulatively in 9MCY20. So, while gross margins were higher during 9MCY20 year on year, the distribution and finance expense led the company to post a loss of Rs 173 million for the period, as compared to a net profit of Rs 301 million seen in 9MCY19.

Due to the construction sector been given an incentive package, the company foresees an increase in consumable income as a result with construction activity gaining momentum. This would have a positive effect on demand of company’s home appliances. Moreover, CPEC related developments would lead to demand for electrical equipment by the private industries sector in addition to a growing electricity demand.

Comments

Comments are closed.