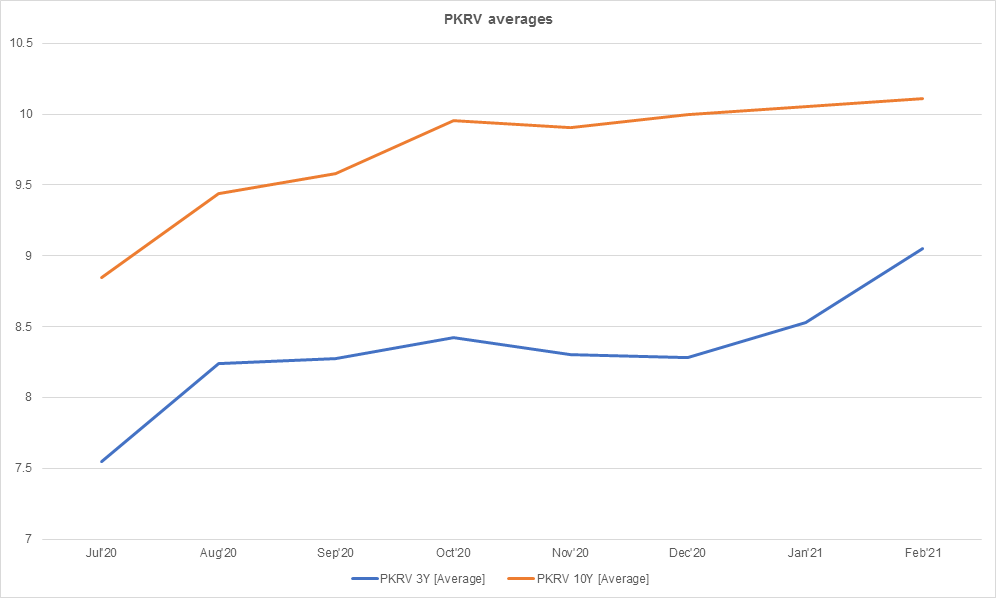

The market is getting greedy and the government may be feeding this greed. There is no stopping the rates from moving up. After the reduction of policy rate to 7 percent in Jul-20, the 3-Year paper cutoff was reduced to 7.37 percent and 10-year at 8.99 percent. Fast forward in Mar-21, at the same policy rate along with forward guidance, the 3-year paper cut-off yield was at 9.41 percent and 10-Year at 10.29 percent – rates have increased by 1.3 to 2.04 percent since then.

Let’s reiterate– this is a net injection market and government is lacking options to finance its deficit; therefore, banks are in the driving seat. With IMF coming back, government has to respect its targets more and as a result, market is getting further a leverage to squeeze the government.

Right after July (with economic recovery) banks’ minds were changed – in Aug-20’s auction, the participation was at much higher rates. Government adopted a policy to fix the 5Y and 10Y rates by accepting virtually nothing at those rates. But conceded on 3Y paper where government had accepted Rs41 billion at 8.2 percent – the yield was up by 91 bps.

In the next auction in Sep-20, the market was not even interested in 3Y paper at the previous cut-off. Government just accepted Rs1.7 billion offered at 8.2 percent in 3Y and a few millions in 5Y and 10Y to keep rates intact. The story continued till Dec-20.

Government kept on fetching some amount in 15Y and 20Y papers to show some acceptance. The market watching the government behavior, started participating less. It was a dull market. The government started conceding to the market in January. By showing its new acceptance rates – at 8.5 percent for 3Y, 9.53 percent for 5Y and 9.99 percent for 10Y, and rejected 15Y and 20Y bids.

This was in anticipation that the market will show higher participation in upcoming auctions. Market did participate good chunks in 5Y and 10Y papers in Feb-21, but at its own desired rates. Government did accept some at even marginally higher rates – the market offered Rs148 billion in 5Y and government accepted Rs19 billion at 9.59 percent and Rs24 billion (participation Rs87bn) at 10.05 percent.

In March, market offered higher than target amounts at even higher rates (as was the case in previous auctions), government took more heart out to accept Rs77 billion in total against the auction target of Rs100 billion at 9.41 percent for 3Y, 9.9 percent for 5Y and 10.29 percent for 10 year – up by 0.24 to 0.42 percent from previous auction.

The question is where does the buck stop? What rate is enough for the market? What strategy should the government adopt to bring banks back? It is hard to say. Earlier, government did make a mistake by rejecting all the bids. Now market is asking too much. Government needs to revisit its policy of rejection. And look for alternate avenues for borrowing.

Nonetheless, SBP wanted an upward sloping yield curve. However, the steep slope now might not be to the central bank’s liking. Don’t expect any change in monetary policy in March. 50-100 bps increase thereafter is very much priced in. It is expected the cat and mouse game will start again from next month’s auction.

Comments

Comments are closed.