There are some early signs of hot money returning. Nothing too hot though. It is just a little higher sum of money coming in the last week – still nowhere close to pre-Covid days. The global yields are up, and money is pouring back in emerging markets. Lately, yields in government papers are moving up, attracting marginal interest of hot money investors.

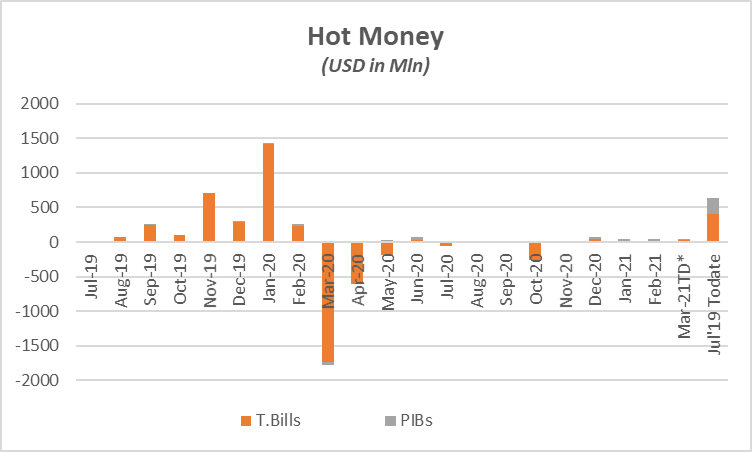

The hot money – portfolio investment by hedge funds and the likes – first started coming in government T-bills back in July 2019. It sped up in Nov 2019 and crossed $3 billion by Feb 20. Then Covid hit. The money left at higher speed than it came in. By Oct 2020, only $400 million was left in T-bills and PIBs.

The flows started returning in December – but only by a trickle, as the total amount was paltry at $78 million. However, a fresh element was an equal interest in PIBs and T-bills. Another $83 million poured in Jan-Feb ($60mn in PIBs). Meanwhile, the bond yields started moving up slowly. The interest from local market was slow. Still, the contribution from foreign funds was around 10 percent of PIB auctions in Jan-Feb.

But March has started on an interesting note. Another $43 million came in a week’s time. That is probably the highest weekly inflow since Feb 2020. It is too early to say how much more would come in the days to come. The global liquidity is already witnessing pre-Covid highs in a to-be vaccinated world.

The hot money evaporation between March-May 20 was due to the global panic leading to a liquidity flight out of emerging markets. It did not indicate anything particularly unique to Pakistani economy. It was giving good returns and exit was not as bloody as in several other economies. The balance of payment situation of Pakistan has significantly improved during Covid days, as the economy has run a current account surplus for six consecutive months.

Bond yields started moving up from Dec 2019, and the timing has coincided with hot money returning. The market is ready to take risk at current rates. This kind of money usually comes in flocks. Still, the early birds are in the vicinity. Only time will tell whether bigger flows will arrive. Once the IMF program returns from its hibernation, the show may rebegin

Comments

Comments are closed.