Kohinoor Textile Mills Limited

Kohinoor Textile Mills Limited (PSX: KTLM) was set up under the Companies Act, 1913 (now, Companies Act, 2017). It is a public limited company that manufactures yarn and cloth, processes and stitches the cloth. It also caters to the global market. Its major export destination is the USA.

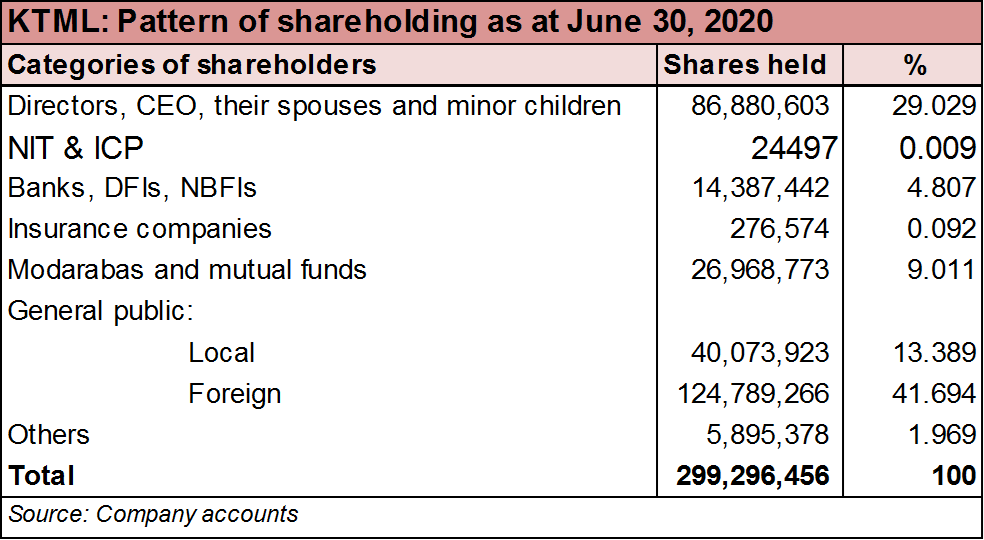

Shareholding pattern

As at June 30, 2020, the directors, CEO, their spouses and minor children collectively hold a major part of the shares, at around 29 percent. Of this, 14.5 percent shares are with the CEO, Mr. Taufique Sayeed Saigol, followed by Mrs. Shehla Tariq Saigol, spouse of the Chairman, Mr. Tarid Sayeed Saigol. Close to 42 percent shares are with the foreign general public; 13.4 percent with local general public and 9 percent held in modarabas and mutual funds. The remaining, about 7 percent shares is with the rest of the shareholder categories.

Historical operational performance

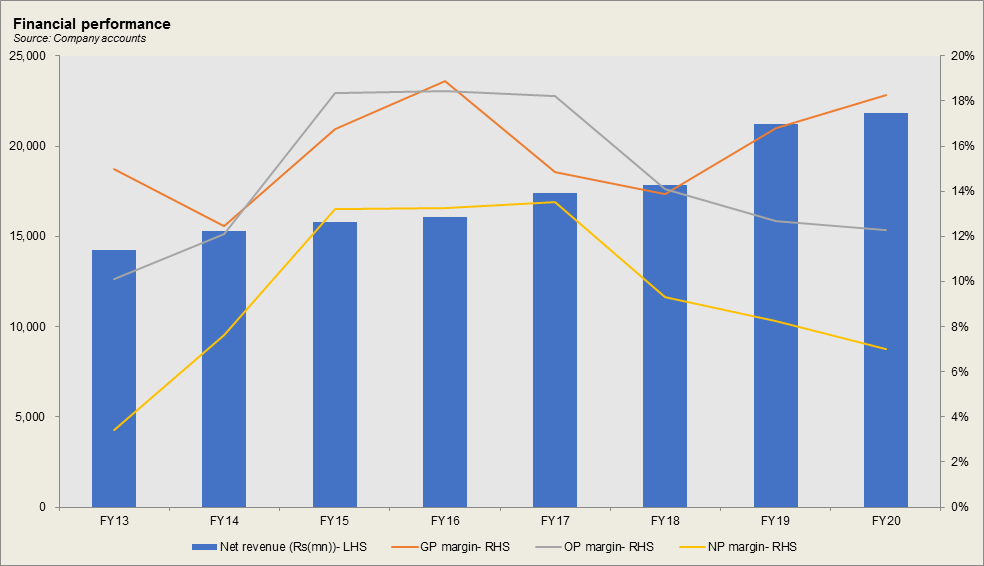

Kohinoor Textile Mills has seen a rising topline at varying growth rates, except for in FY12, while profit margins have been on a gradual decline since FY17 onwards; albeit gross margin has followed an upward trend after FY18.

During FY17, Kohinoor Textiles topline increased by a little over 8 percent. Both local sales and export sales contribute significantly towards the total revenue pie. In FY17, local sales exceeded export sales that had declined year on year in value terms, by 6.3 percent. Cost of production on the other hand, went up to consume 85 percent of revenue, as compared to 81 percent in FY16. Most of this incline was associated with raw materials expense and fuel and power expense. This led gross margin to decline close to 15 percent, however, the bottomline improved year on year, with net margin also higher marginally, due to a higher than usual support coming from other income- over Rs 1.7 billion. This was primarily generated through dividend income from Maple Leaf Cement Factory Limited.

Revenue continued to increase through FY18, although at a lower rate of 2.5 percent. Where export sales continued to contract, the decline was made up for by increase in net local sales, that grew up to over Rs 11 billion. Cost of production grew slightly to 86 percent of revenue, keeping gross margin relatively flat; however, the fall in other income that made up nearly 10 percent of revenue, caused operating margin to fall. Coupled with increases in overall expenses including the finance cost, net margin fell to a little over 9 percent. Again, the primary source of other income was Rs 1 billion in dividend income from Maple Leaf Cement Factory Limited.

At nearly 19 percent, the company saw one if its highest growth rates in its revenue, rather it was the highest recorded in the last five years. A lot of this incline came from the spinning division as the company made timely purchase of raw materials that kept costs in check. Moreover, in response to the government’s efforts to document the economy, the company claimed to have altered its product mix to produce counts that can be taken up by registered buyers. In addition, cost of production reduced to a little over 83 percent that helped to improve gross margins. However, net margin fell to 8 percent owing to a decline in other income due to a drastic fall in dividend income along with a collective rise in share of expenses in revenue.

Topline growth in FY20 stood close to 3 percent. Unlike, previous years where local sales were increasing, in FY20, local sales registered an 11.6 percent decline, while export sales picked up by 32 percent; in value terms though, local sales exceeded exports. Within the segments, while spinning division still brought in a major part of revenue, increases were seen in weaving and home textile divisions. Coupled with a lower cost of production, gross margins improved, however, operating and net margin were lower year on year due to significant contraction in other income in addition to finance expenses making almost 4 percent of revenue- highest share in revenue seen since FY15.

Quarterly results and future outlook

The first quarter of FY21 saw impressive recovery as it was higher year on year by 31 percent despite the event of Covid-19. Instead export markets opened up with encouraged demand that raised sales volumes. Although second quarter saw lower sales quarter on quarter, it had improved from the same period last year. A lot of this improvement was associated with the spinning division.

However, the processing and cut & sew division witnessed lower profitability owing to the increase in costs; this in turn was due to the outbreak of the Covid-19 pandemic that adversely affected costs. Comparing 1HFY21 year on year, while gross margins were higher, net margin was at 7.2 percent in 1HFY21 compared to 8.6 percent in 1HFY20. While most other factors were similar as their shares in revenue, it was the considerably lower other income that drove down profitability for the period.

While topline has continued to increase, although at a lower rate and cost of production has also remained relatively in tune, hovering below 85 percent, in addition to timely procurement of raw materials, it is the fluctuation in other income that would cause uncertainty in the future profitability.

Comments

Comments are closed.