GlaxoSmithKline Pakistan Limited

GlaxoSmithKline Pakistan Limited (PSX: GLAXO) was set up through a merger of three companies, SmithKline and French of Pakistan Limited, Beecham Pakistan (Private) Limited and Glaxo Wellcome (Pakistan) Limited.

The company has two business divisions of pharmaceuticals that includes prescription drugs and vaccines, and consumer healthcare division that includes OTC medicines, oral care and nutritional care.

Shareholding pattern

As at December 31, 2020, more than 82 percent of the shares are held by the associated companies, undertakings and related parties. This category solely includes S.R.One International B.V. Close to 6 percent shares are held by the local general public and roughly 3 percent shares held by each of the following- banks, DFIs, NBFIs, insurance companies and modarabas and mutual funds. The remaining about 2 percent shares is with the rest of the shareholder categories.

Historical operational performance

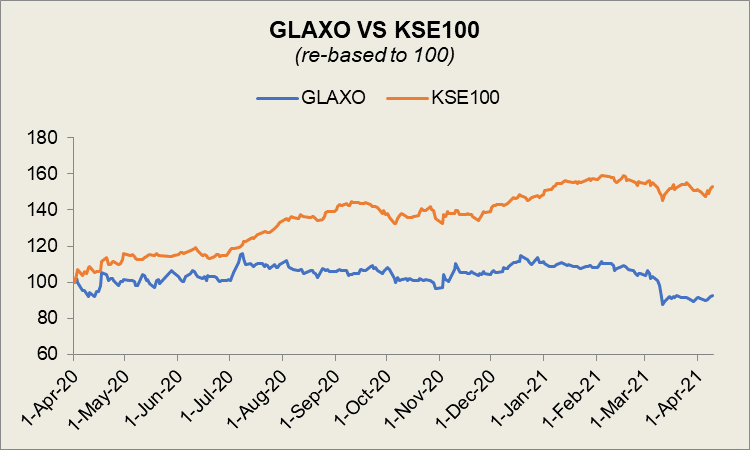

GlaxoSmithKline has largely seen a growing topline over the years with the exception of once in CY14 when it contracted by over 9 percent, and more recently in CY20, when it contracted by 4 percent. Profit margins have mostly remained stable after CY15.

During CY17, revenue saw one of the highest increases since CY10, at nearly 19 percent, crossing Rs 32 billion in value terms. The major growth drivers for the company were antibiotics, dermatology, analgesics and gastro-intestinal segments. In addition, the company also received considerable orders from the Punjab government “on account of the primary and secondary healthcare tender”. On the other hand, cost of production increased only marginally, keeping gross margin more or less unchanged, at 26.5 percent. There was a slight increase in distribution expense that was attributed to investment on product promotion. With most other elements remaining similar year on year, net margin reduced slightly to 9 percent, compared to 10 percent in CY16.

Halfway through CY18, general elections were held in the country, that brought with it a degree of uncertainty. Despite this, GlaxoSmithKline saw revenue rising by nearly 4 percent during CY18, reaching Rs 34 billion in value terms. Major growth drivers were the antibiotics, dermatology and analgesics, while Rs 4 billion of the total sales were made to GSK Consumer Healthcare. During the year, the company also launched Augmentin tablets in Dessiflex Blister packaging- first time across GSK globally. Given the inflationary pressures, and currency devaluation, cost of production increased to over 75 percent of revenue. This brought down gross margin to almost 25 percent. However, bottomline was supported due to other income coming from promotional allowance. Thus, net margin was slightly improved at 9.6 percent.

In CY19, GLAXO saw another rise of more than 7 percent in its revenue. Antibiotics, dermatology and analgesics therapy segments were again the major contributors towards the topline. However, cost of production continued to incline, consuming 79 percent of revenue- the highest seen. This was attributed to rupee devaluation that led to an increase in prices of imported raw materials as well as locally purchased ones. The government allowed the pharmaceutical industry some price adjustment that kept the margins from reducing drastically. With operating expenses reducing, and other income rising further, net margin was relatively maintained at 8.3 percent. Other income was higher due to a promotional allowance of nearly Rs 2 billion from the parent company for investment in brands.

Revenue during CY20 contracted by 4 percent in the event of Covid-19 pandemic. Sales to GSK Consumer Healthcare decline to Rs 1.2 billion, as compared to that seen historically, at around Rs 4 billion. This was due to market authorization rights being transferred to GSK Consumer Healthcare. The core pharmaceutical business, however, witnessed a growth of 6 percent. Cost of production reduced only marginally to over 78 percent of revenue, keeping gross margin flat at 21 percent. With a lower distribution expense due to utilization of digital channels for connecting with healthcare professionals, along with rise in other income, net margin was higher at 9.6 percent for the period.

Quarterly results and future outlook

Revenue was 4 percent lower in 1QCY21 year on year. Despite this, the company managed to raise profit margins by lowering costs. Cost of production for the quarter was notably lower at over 75 percent, down from over 79 percent in 1QCY20. Administrative and distribution expenses also reduced most likely due to use of digital mediums and low attendance at offices; finance cost was at only Rs 2 million compared to Rs 49 million in the same period last year. Thus, net margin was significantly higher at 9.4 percent for the quarter, as opposed to 5.3 percent in 1QCY20.

With lockdowns also seen in other countries, there were supply chain disruptions in various industries. Given that GLAXO operates in the pharmaceutical segment, it was allowed to operate, yet it faced challenges on imports of raw materials. Moreover, the government’s attempts to ensure economic stability may improve growth outlook.

Comments

Comments are closed.