The power regulator has allowed Rs0.9 per unit on account of first and second quarterly tariff adjustment for FY21. The petition was placed in March 2021, and this is by far the quickest quarterly tariff adjustment call made by Nepra – and for all good reasons. Now that the quarterly tariff adjustment mechanism is largely formula based and automated, the allowance is a much smoother process and deviates little from what is asked for.

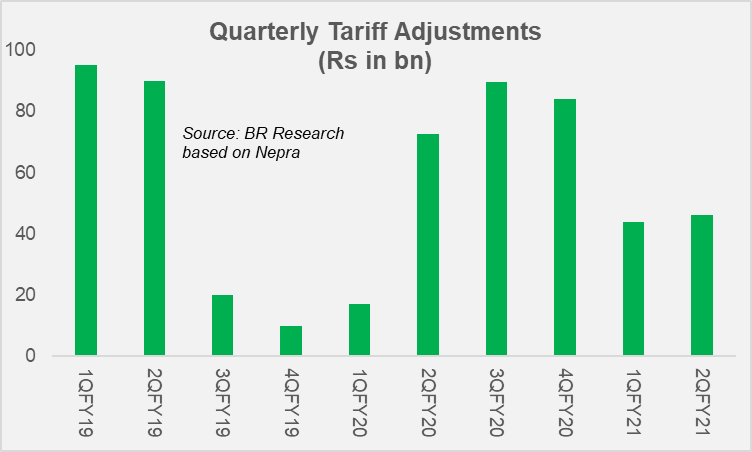

The latest quarterly adjustment of Rs90 billion will be collected over 12 months from the date of notification. The previous quarterly adjustment of Rs0.83 per unit is also in the mix, which sends the total adjustment to be collected for the bulk of next 12 months at Rs1.7 per unit. The 2QFY20 and 3QFY20 adjustments which totaled Rs1.6 per unit, had lapsed in October 2020. The revised base tariff led to an increase of Rs1.95 per unit – and the consumer end tariff would remain considerably higher year-on-year.

Needless to say, the bulk of adjustment comes from the capacity charges, which account for more than 80 percent of the quarterly adjustment. There is a sliver lining in that, as future quarterly adjustments would likely be on the lower side, as they would fall in the period after base tariff revision. A lot will depend on how (and if) the government intends to notify the changes, which under the new mechanism should not take long. But seeing how the government has resisted going for the second round of base tariff revision, a long delay in adjustment notification cannot be entirely ruled out.

The fact that the second round of base tariff revision has been delayed indefinitely, it could lead to more stern rounds of quarterly adjustments. Capacity payments are only going to get higher from hereon and the government would do well to chalk out a plan on how to fund the gap in the upcoming budget. With inflation still on the higher side, more room will have to be made to stem the flow of circular debt. The hint needs to be taken by the tax authorities to pull up their socks and look for alternate avenues, that could offer more fiscal space.

Comments

Comments are closed.