Honda pedals forward

After demonstrating sobering trends in profitability for two years—with particularly subdued outcomes during MY20 which was a period largely prior to the covid-19 outbreak--Honda Atlas Cars (PSX: HCAR) is gearing back into neutral. Evidently, the company has come out of the pandemic fairly unscathed and it was the muted economy that affected its balance sheet performance more, long before the pandemic even hit. In MY21, the dividend payout of 36 percent is signalling confidence in the company’s future.

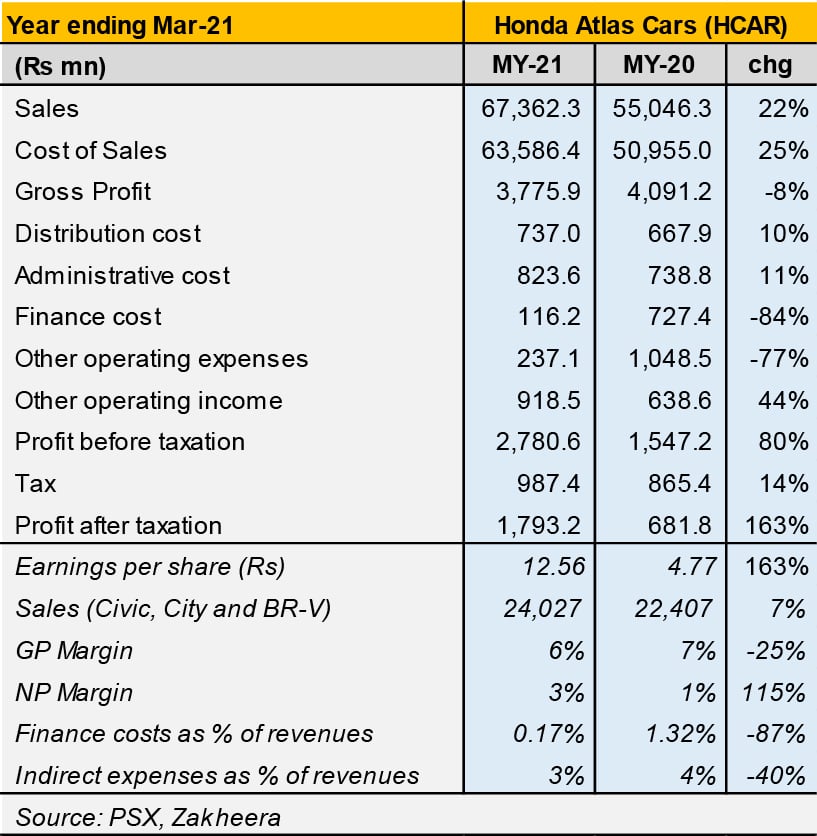

The company recorded a 7 percent growth in volumetric sales yielding a solid 22 percent surge in the top-line demonstrating an estimated 14 percent increase in revenue per unit sold in the outgoing year (note: this is an estimate since the units sold number only includes locally assembled vehicles). Higher sales coupled with higher comparative prices have boded well for the company. In addition, the much lower borrowing costs for auto finance seekers on account of the favourable kibor has provided adequate motivation to Honda loyalists to purchase these cars before the Central Bank raises policy rates.

Gross margins however show a decline despite an appreciating rupee. To be sure, the exchange rate has played a pivotal role in automobile prices in the country—in fact, over the past two years, a depreciating rupee had caused several frequent price hikes by domestic assemblers that ultimately pushed demand to the brink. However, an improved rupee position has merely hit pause on the price increases with no reversal in sight for end-consumers. Such was expected.

Having said that, the company is witnessing a higher cost of production per unit sold—up 16 percent, greater than the revenue growth by comparison resulting in reduced margins. This is likely due to higher shipping costs, a phenomenon that has emerged due to the pandemic causing container shortages and supply snags in the global market. Raw material prices for domestic use have also witnessed an upward inflationary trend.

The company has kept an overall lid on overheads (see table), though distribution expenses did balloon in the last quarter by 355 percent year on year. Finance costs as a share of revenue are almost negligible, shrinking further due to reduced borrowing costs. The real sweetener for auto players is the “other income” component—in MY21, 33 percent of the Honda’s before-tax profit came from other income which was higher at 41 percent last year (owing to higher policy rates) but which ultimately brought the company immense welfare. To illustrate, operating profit of the company during MY21 despite an improved top-line dropped 18 percent year on year.

The market is being inundated with new models and new assemblers, vying for many more to come as the government prepares a fresh auto-development policy with a focus on electric vehicles. The trouble for Honda and Toyota, in fact, has not arrived yet as they are currently not facing too much competition. Thus far, Kia is the only major contender that is hailing volumes. Many new Chinese players have entered in several segments that could potentially grab market share but they are still flirting with hesitant consumers by giving steep price cuts while figuring out how to run their plants most efficiently. Once market confidence establishes in these models, these players might give traditional market holders something to worry about. Until that time, Honda will continue on its recovery path, despite selling more expensive cars.

Comments

Comments are closed.