Mughal and Iron and Steel Industries Limited (PSX: MUGHAL) was set up in 2010 as a public limited company under the repealed Companies Ordinance, 1984. The company manufactures and sells mild steel products.

Shareholding pattern

As at June 30, 2020, nearly 69 percent shares are held by the directors, CEO, their spouses and minor children. Of this, over 13 percent shares are owned by Mr. Muhammad Mubeen Tariq Mughal, one of the directors on board, followed by nearly 11 percent held by each of the following: Mr. Fahad Javaid, another director on board, and Mr. Khurram Javaid, the CEO of the company. Some 10 percent shares were with the local general public, and 6 percent held by the associated companies, undertakings and related parties. The remaining roughly 15 percent shares were the rest of the shareholder categories.

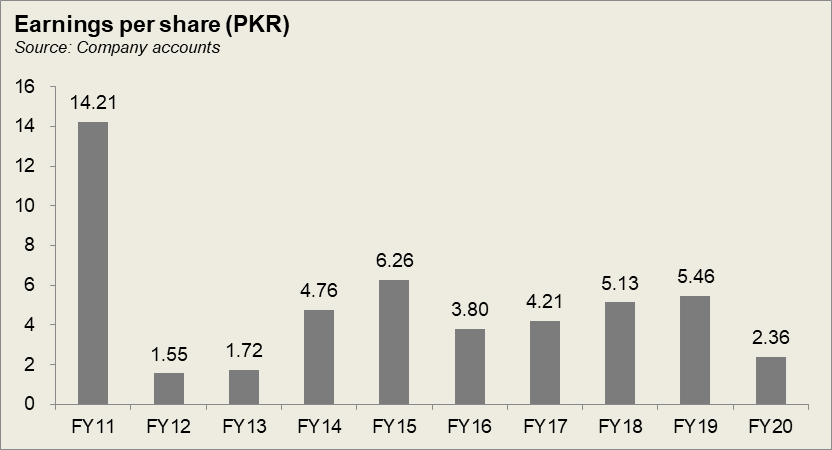

Historical operational performance

Mughal Iron and Steel Industries Limited has mostly seen a growing topline with the exception of FY17 and more recently in FY20. Profit margins, on the other hand, increased until FY14, remained mostly stable until FY18 when they reached a peak, before gradually declining until FY20.

After rising consecutively for five years, the company’s topline fell marginally by less than 1 percent during FY17. This was due to one time billet sale order being executed and completed last year. The decrease in sale of billet was nearly made up by increase in sales of steel re-bars. The loss in sales could not be made up for entirely due to decrease in sale price in the first half of the year. Cost of production increased very marginally, keeping gross margin close to 10 percent for the year. However, net margin rose slightly from 4.7 percent in FY16 to 5.3 percent in FY17. This was due to a decline in finance expense and taxation. The decline in finance expense was due to “elimination of notional interest on sponsor shareholders’ loan and decrease in exchange loss on deferred letters of credits.

In FY18, the company achieved several milestones; it improved grid station load from 19.99MW to 79.99MW, improvement in gas load from 2.80 MMCFD to 6.30 MMCFD, along with commissioning of six further gas engines for the purpose of in-house electricity. This was expected to not only help to solve energy shortage but also eliminate raw material issues since the expansion plan included installation of induction furnaces. It was also expected to bring down the reliance on outsourced, expensive billet. All this was reflected in the growth in revenue at 18 percent, crossing Rs 22 billion in value terms. Cost of production also went down to 87 percent of revenue. Together these two factors helped to raise net margin 5.8 percent. Improvement in net margin was minimal due to rise in finance expense owing to increase in working capital requirements.

Revenue growth in FY19, at nearly 39 percent, was the highest in the last four years, with topline nearing Rs 31 billion in value terms; this was the highest seen. The rise in revenue was attributed to increase in both, sales volumes as well as sales price. Cost of production, on the other hand, rose to nearly 90 percent of revenue due to the inflationary pressures in the economy combined with currency devaluation. This raised the input costs, thereby decreasing gross margin to 10 percent. With a further rise in finance expense owing to high interest rates, net margin reduced to 4.4 percent.

In FY20, revenue fell by 11.4 percent. This was largely attributed to the Covid-19 pandemic and the resultant lockdown that meant that operations were halted for more than a month. In addition, the company had to postpone its re-bar re-rolling mill expansion since foreign engineers could not travel to Pakistan due to the travel ban. With the decline in revenue, combined with high input costs, cost of production rose to over 90 percent of revenue. The burden of increase in costs could not be transferred entirely to the end user; therefore, gross margin reduced to 9.6 percent. The decline in profitability was worsened due to finance expense that continued to rise because of high interest rates in addition to exchange loss due to currency devaluation. Thus, net margin fell to 2 percent, the lowest seen since FY12.

Quarterly results and future outlook

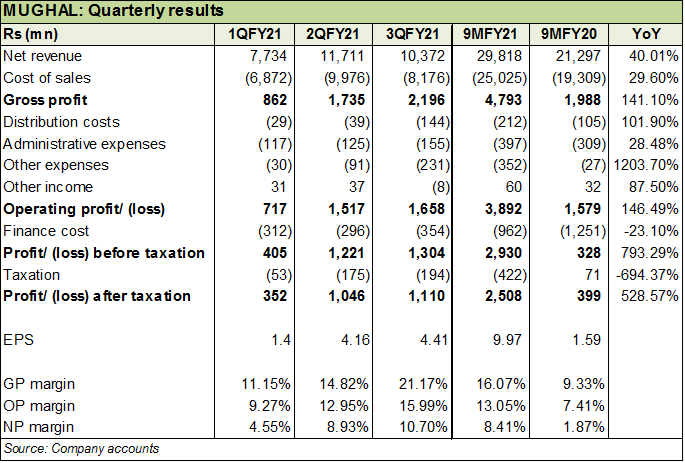

The first quarter of FY21 saw revenue higher by nearly 16 percent year on year. this was attributed to increase in sales volume of re-rolled products in addition to higher exports of copper ingots. Prices for re-rolled products, however declined that brought down gross margins year on year. But net margin was supported by decline in finance expense owing to lower markup rates.

The second quarter saw revenue increasing by over 58 percent, due to increase in both, prices and volumes. This, combined with an overall decrease in expenses resulted in better profitability for the period year on year. The third quarter also saw higher revenue year on year, with topline of nine months of FY21 cumulatively being 40 percent higher year on year. Thus, net margin at 8.4 percent for 9MFY21 was significantly higher than that in 9MFY20.

Lower interest rates have had a positive impact on the company’s profitability. There is, however, still some uncertainty regarding the effectiveness of vaccination drives, and the third wave of Covid-19 pandemic. overall, the company foresees growing demand for steel given the government’s focus on development projects and the housing needs of the country.

Comments

Comments are closed.