Pakistan’s power system generated a billion more units in May 2021 than May 2020. The demand is surely gradually picking up – having increased 6.5 percent year-on-year. Seen with the Covid dip witnessed in March and April of 2020 – the single digit increase is not to be read much into. From what the government tells, the industrial demand has increased in double digits, since the launch of support packages and abolishment of peak-tike rates.

The electricity generation mix today is visibly improved from three years ago, with higher contribution from hydel, coal, imported gas – and much reduced reliance on furnace oil. That said, furnace oil keeps making a comeback, at the first hint of increased load or reduced contribution from hydel sources. In May 2021, hydel power generation was lower by a billion units year-on-year. Needless to say, furnace oil came in to bridge that gap with 0.8 billion units on its own.

Furnace oil-based electricity generation has increased by 44 percent year-on-year or 1.5 billion units in 11MFY21. The overall share may only have risen from 3.2 percent in the same period last year to 4.5 percent for 11 months of FY21 – but it underscores serious problems in the generation chain. The fuel cost side of things alone means an additional burden of Rs22 billion from last year, higher by 51 percent, most of which owes to higher volume, and not price.

The system’s dependable capacity at 34,500 MW should be adequate enough to cater demand in all times – peak or otherwise. The very fact that just one unexpected interruption in one of the bigger hydel power plants can bring the generation capability gasping for breath – should be reason enough for introspection. This also underlines the longstanding issues of miscoordination between the authorities responsible to plan generation, procure power, and arrange for timely fuel supplies.

The regulator has time and again pointed at the lack of communication and the failure to arrange timely fuel supplies, which continues to lead to blatant violation of economic merit order of dispatch. Consider this that the first FO based power plant on merit order in May 2021 was sitting at number 49 – way below the big and more efficient power plants. But as always, merit order went for a walk.

Look deeper and you will start to know the extent of the problem. Pakistan’s much celebrated “world’s most efficient” RLNG power plants, under the National Power Parks Management Company (Baloki and Haveli Bahadur Shad) with a combined dependable capacity of no less than 2550 MW – have been generating less than 30 percent of the dependable capacity for the best part of last six months. Quaid-e-Azam Thermal Power with less than half the dependable capacity has been generating nearly as much as the NPPMCL in the same period.

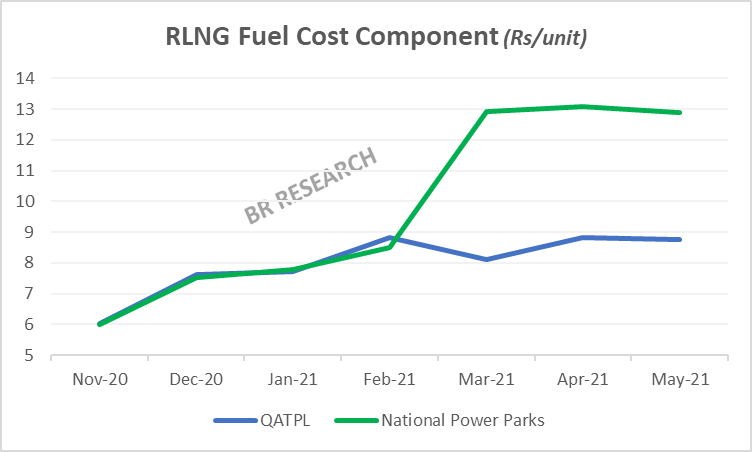

It gets more complicated as the efficient RLNG power plants have proven to be quite the fuel guzzlers for past few months. The actual Fuel Cost Component of Haveli Bahadur and Baloki RLNG plants has averaged Rs13/unit in the last three months – even higher than a number of FO based plants. Don’t forget these plants also have the transmission constraint as has been highlighted numerous times by Nepra. With fuel charges that high, the merit order then becomes a bigger problem.

The inability to run the plants because of ill-planned evacuation program in yesteryears, makes the problem uglier. The capacity component looks bigger as the plants fail to run at full throttle. It has been like this for quite some time. Meeting power demand and boasting it won’t be enough. Getting the system in order should also be prioritized. There are efficiencies to be had in following the order and aligning the transmission gaps. For now, massive subsidy has been allocated for the power sector to keep it afloat. But affordability should also be brought in by improvements within.

Comments

Comments are closed.