Service Industries Limited

Service Industries Limited (PSX: SRVI) was set up under the Companies Act, 1913 (now Companies Act, 2017) in 1957 as a private limited company. It was converted into a public limited company two years later, in 1959.

Service Industries Limited purchases, manufactures, and sells a range of products such as footwear, tyres and tubes, and technical rubber products. The company’s sales are not limited to the domestic market, but it is also present in the international market. Although the European market is a primary export destination, it is also expanding its export markets to the US, Australia and the Middle East.

Shareholding pattern

As at December 31, 2020, close to 45 percent shares of the company are held by the directors, CEO, their spouses and minor children. Of this, over 19 percent shares are owned by Mr. Hassan Javed, an executive director, and 10 percent by each of the following: the CEO, Mr. Arif Saeed, and Mr. Omar Saeed, an executive director. About 14 percent shares are with the NIT & ICP, followed by 25 percent with the local general public. The remaining about 16 percent shares is with the rest of the shareholder categories.

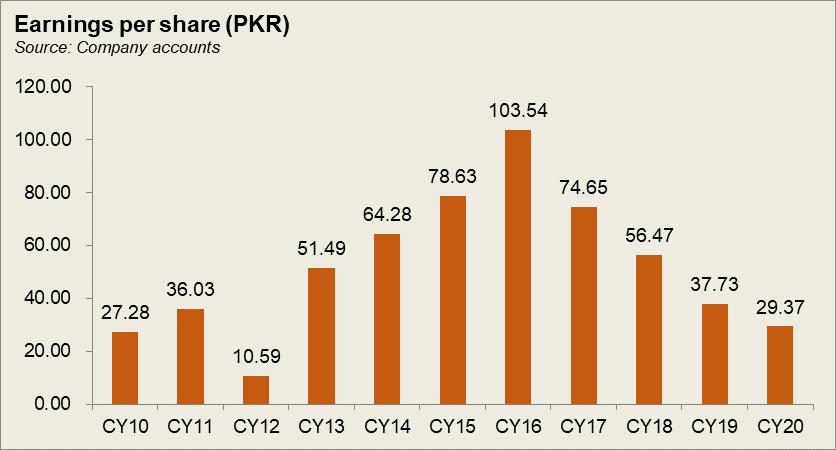

Historical operational performance

Service Industries Limited has consecutively seen a growing topline over the years, with revenue contracting only recently in CY20. Gross margin and operating margin have been increasing gradually after CY17, whereas net margin has been on a gradual decline.

In CY17, the company saw relatively higher growth in revenue year on year, at 10 percent. Both export sales and local sales registered an increase. However, this benefit was offset by the costlier imported raw materials due to currency devaluation- particularly in the tyre business. Cost of production went up from 80 percent in CY16 to nearly 83 percent in CY17. Therefore, gross margin also reduced from nearly 20 percent to 17 percent. Some revenue was also brought in through other income; majority of this was sourced through special custom rebate. However, this was not sufficient to support the bottomline. Thus, net margin reduced to 4.3 percent for the year.

Growth in revenue was at over 15 percent in CY18. Footwear exports grew by 45 percent “through quantity and value”, while domestic footwear sales declined; tyre division saw a 21 percent growth in revenue- it was also a major contributor to the total revenue pie. Cost of production remained undeterred at around 82 percent of revenue, allowing gross margin to incline only marginally to almost 18 percent. The increase in revenue also reflected in the bottomline, that improved to over Rs 1 billion; net margin was recorded at a slightly higher 4.4 percent during the year.

In CY19, topline grew by nearly 9 percent. Most of this growth was seen in local sales, while export sales fell by 13 percent. Within the footwear division export sales reduced, while the tyres division saw both local and export sales rising; local sales of tyres contributed majority of the revenue. On the other hand, cost of production reduced slightly to over 81 percent of revenue, taking gross margin to nearly 19 percent. However, the escalation in finance expense due to higher interest rates brought down net margin to 3.4 percent.

After rising consecutively for almost a decade, revenue contracted for the first time in CY20, by 6.5 percent. This was largely attributed to the Covid-19 pandemic and the resultant lock down; as a result, the operations of the company were shut down. Globally, trade was also adversely impacted. This is mostly reflected in the 69 percent decrease in export sales of footwear. The sales of tyres were not impacted because of the nature of the product. On the other hand, the company was able to reduce cost of production as a share in revenue to nearly 80 percent raising gross margin to 20 percent. But the same could not be seen in net margin that decreased to 2.8 percent. This is due to finance expense that continued to increase.

Quarterly results and future outlook

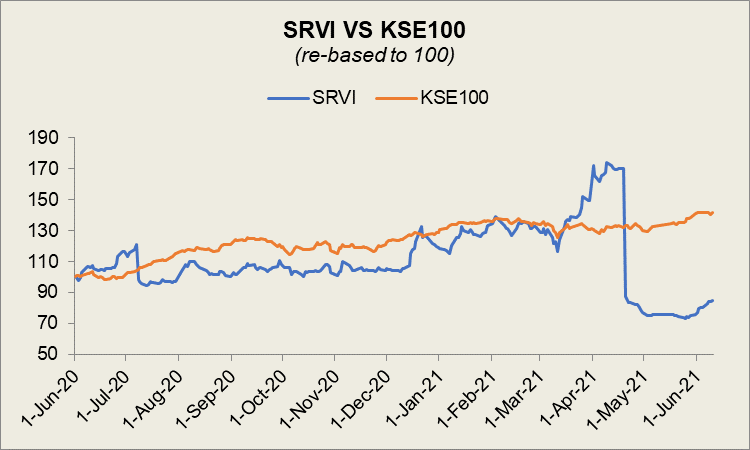

The first quarter of CY21 saw revenue rising by 50 percent year on year. This is primarily driven by the tyre division, that witnessed a 59 percent growth in its topline. Note that tyre division is also the major contributor to the total revenue pie. However, the high cost of production during the period decreased the gross margin, at 17.6 percent, compared to nearly 24 percent seen in same period last year. Despite this, net margin, at 2.27 percent, was higher for 1QCY21 relative to 0.3 percent in 1QCY20. This was due to the lower finance expense and taxation. In the event of Covid-19 pandemic, the State Bank of Pakistan (SBP) reduced the interest rates to support the economy.

Comments

Comments are closed.