Early signs of current account slippages are becoming visible. The deficit stood at $632 million in May 21, and the amount is likely to be higher in June. In 11MFY21, the current account surplus is standing at $153 million as compared to a deficit of $4.3 billion (1.8% of GDP) in the same period last year. The full year FY21 is likely to show a marginal deficit – this is one of the better years in terms of balance of payment especially considering that the economy grew at 4 percent in it.

The party seems to be over now. COVID has given a cushion to Pakistan in terms of higher remittances and other inflows, and lower commodities prices to contain imports – all of this is largely due to less travel. For details read “Demystifying the current account surplus”, published on 20th Nov 2020. Now in the vaccinated world, travel is opening and economic activities around the globe are picking up. This along with domestic pick up in economic activities will push the imports further up. Then the growth in remittances may die down as well.

In May 21, goods imports are recorded at $4.9 billion (PBS: $5.3bn) – the number is close to the country’s highest monthly average imports during first half of 2018. In 11MFY21, the imports are up by 17 percent to $47.3 billion (PBS: $50.0bn) – highest number was $50.5 billion in 11MFY18. Imports are already high despite having low commodity prices in the first half of FY21 – excluding petroleum group, imports are up by 24 percent in 11FY21.

There are some elements in imports which were not significant in yesteryears. This is attributed to higher staple agriculture commodity imports and due to shift of some elements of informal imports into formal – more of that to happen next year with a new smuggling law.

The incremental imports in 11FY21 as compared to same period last year stood at $1.3 billion for wheat, sugar, and cotton. The question is whether these are one-offs or going to be a regular feature. Well, no one can tell that as demand and supply data of these (especially wheat) is patchy and there could have been a case of inward smuggling in the past – as international prices used to be lower than Pakistan. In the last two years, after PKR steep depreciation, the case is reversed, and outward smuggling is probably the case now.

There are many other items where imports were happening through informal channels- or the values were under-reported. Now these are coming at original (or close to actual) values. Two noticeable items are mobile phones, and rubber tyres and tubes. Mobile phone official imports are up by $854 million to $1.79 billion in 11MFY21 as DIRBS is now fully implanted. In tyres, the import was happening by having tyres within tyres – that is being curtailed. The number is up by three times to $278 million in 11MFY21. Adding the two items, incremental imports are at $1.1 billion. Cumulative incremental impact of higher agri staple commodities and other two items is at $2.4 billion in 11MFY21.

There could be other items as well where better import numbers recording is taking place. The point is that reported imports might be close to highest ever number, but actual imports increase would have been less. Now with higher commodity prices, imports would touch new highs of $5.5-6 billion in coming months. That would challenge the balance of payment.

Not to mention that goods exports are picking up too. Albeit at a slower pace and quantum of exports pick up is much less. Goods exports are up by 10 percent in 11MFY21 to $23.1 billion. Barring textile, all the other major groups export growth is below average. Textile exports are up by 10 percent – within it, higher growth is in value added sectors. The major increase is in miscellaneous items which are up by 51 percent to $1.8 billion – that is showing that new avenues of exports are opening.

In May21, exports performance is worse than April 21 – down by 7 percent to $2.1 billion. The decline in PBS numbers (based on shipment) is higher. Its down by 25 percent to $1.7 billion. The lower exports in May (on shipment basis) are due to extended Eid holidays. That would have some impact on the SBP numbers too in coming months. Anyhow exports momentum is better, new investment is coming and next year the overall exports may grow further. This year exports on payment basis (SBP data) in all likely hood to cross $25.5 bn – highest ever, and next year the number would be even higher.

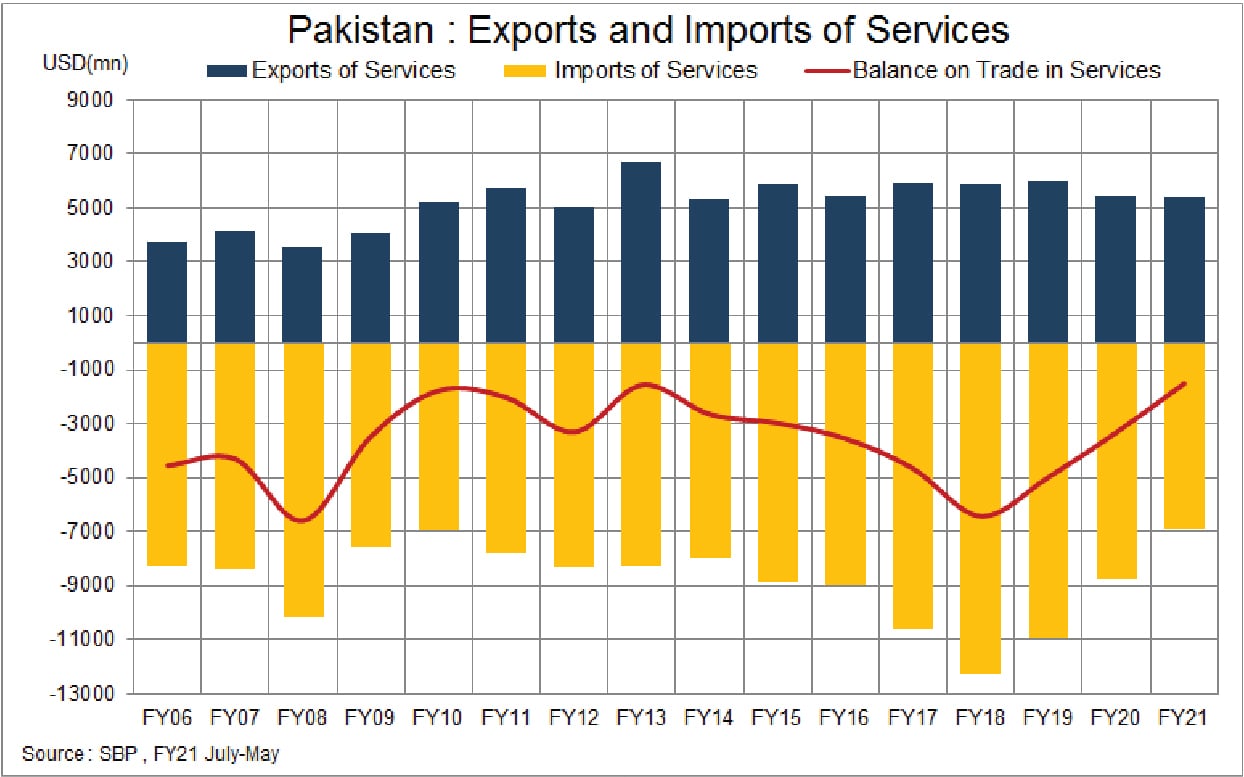

Nonetheless, trade deficit on goods is worsening and may worsen further. Its up by 26 percent to $24.1 billion in 11MFY21. The encouraging improvement is in services trade deficit which is reduced to half. It is standing at $1.5 billion in 11MFY21. Pick-up of exports in services is by 6 percent to $5.4 billion. IT exports are up by 47 percent to $1.9 billion in 11MFY21. This could be due to a combination of new business coming in and moving exports to formal channels as informal channels are squeezed owing to reduced travel.

The real gain is in the curtailment of imports of services – down by 15 percent to $6.9 billion. In this case virtually all the decline is linked to less travel. Passenger air transport services trade balance has improved by $541 million. Personal travel trade services balance is improved by $453 million – within it, religious travel – hajj and umrah, savings are at $355 million. All these gains will vanish once (and if) the travel is back to normalcy.

The overall trade balance in goods and services is worsened by 16 percent to $25.6 billion. There are some improvements in primary income balance – mainly in primary income debit – lowered by 8 percent to $4.8 billion. The primary income deficit is lessened by 10 percent to $4.3 billion. Overall balance on goods, services and primary income are worsened by 10 percent or $3.0 billion to $29.9 billion.

The real gain in current account is due to secondary income account balance – home remittances and other current transfer. The balance is improved by $7.4 billion or 33 percent to $30.1 billion. The growth is in home remittances – up by $29 percent or $6.1 billion, and other current transfers (donation, charity etc.) – up by 78 percent or $1.5 billion.

The impact of less travel is reflecting in both - the money used to be sent as cash during flights by friends, family, khapia and all is now coming through formal banking channels. There is low demand on cash currency in open market with less travel and exchange companies are net sellers in the interbank market. Then, the impact of actual (or close to) recording of imports (as discussed for smart phones and tyres) is mirror imaging in remittances. The smuggled goods payments used to net off outside Pakistan with inward remittances. That is not happening and both imports and remittances are growing. Nonetheless, remittances growth is higher as cash movement in flights is almost completely done away with.

The growth in remittances seems to be limited next year. Many fear that the toll may fall with the opening of travel. However, imports will pick up, as discussed above. That is why current account is likely to slip. It is important to find out sources of financing current account in capital and financial accounts. Otherwise, the growth in SBP reserves by $3.9 billion in eleven months of this fiscal will wash out in six months or so.

Comments

Comments are closed.