It is not quite 2008 yet, but it is the closest since. Inflation fears around the globe are inching up with ever increasing commodity prices. Energy prices in particular, have skyrocketed in the last few months. For more obvious reasons, most headlines are captured by oil. But it is natural gas, that has broken decade-old records, and is showing no signs of slowing down anytime soon.

European natural gas prices have hit the highest in 13 years. The inventories are at a 10-year low, and observers note there is just not enough gas out there to satiate the growing global demand in a fast-recovering scenario. Gas markets in the past had clear segmentations among geographies, but that now seems to be changing, becoming what is termed as a genuinely global market.

Beyond Europe, prices in Asia and the USA too have breached multiyear seasonal highs. Gas prices in the USA have doubled in less than a year, reaching a 7-year high. As China recovers faster than expected, it has overtaken Japan as world’s biggest LNG importer.

Weather extremities are occurring more often now and are clearly more than a rarity. It was extreme cold weather last winters that crippled the LNG market. Right now, it is heatwave in parts of the USA and Europe. Come winters, no one is ruling out another round of chilling temperatures. This time around, the extreme weather is happening during a recovering world economy, and higher oil prices, which could keep the bulls running.

The likes of Japan, Korea, and China have already started procuring shipments for the upcoming winters, given the learnings from the previous winter. Pressure on spot prices seems a relentless one that could last all the way till winters arrive. Pakistan is not a huge player in the spot market and will be trying its best to procure gas at best possible rates. Winter of 2020 must have taught Pakistan a lesson or two, and the Pakistan LNG Limited locking winter deals in the next month or two cannot be entirely ruled out.

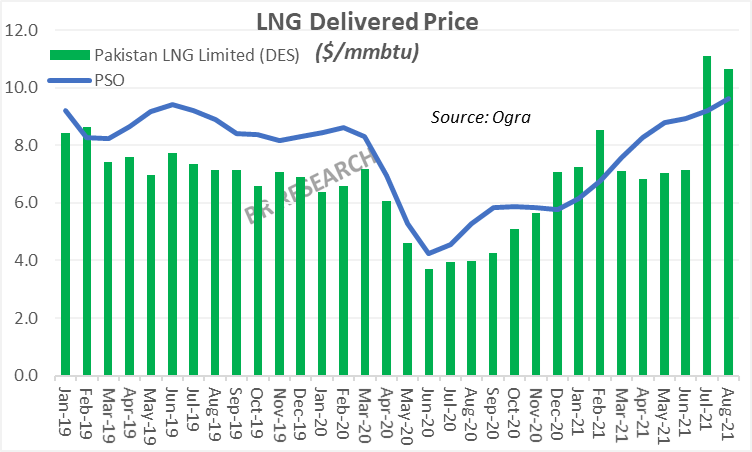

The now infamous dry-docking issue aside, Pakistan is all set to receive its priciest ever LNG in July 2021, as the spot arrangements for July have been booked at a DES price of $11.2/mmbtu. Combine it with $9.2/mmbtu from the long-term Qatar deal – the average price for July would still be over $10/mmbtu. At these rates, power production on LNG could be a costlier affair than some of the FO plants – and the peak demand months could see the highest FO use in the last three years.

Comments

Comments are closed.