Crude oil production in the country has been higher in FY21 versus FY20 due to lesser lockdowns and restrictions which restricted overall throughput of the fields amid weaker demand. But demand uptick and revival of production from the exploration and production companies to their earlier levels have been the only factors behind higher oil production. Extravagant finds, discoveries or extraordinary recovery in reserves were not factors behind the growth in local crude oil production. Natural gas production on the other hand remained subdued further in FY21. Overall, news reports suggest that crude oil witnessed an increase of around 24 percent in FY21, while natural gas declined by 2 percent year-on-year.

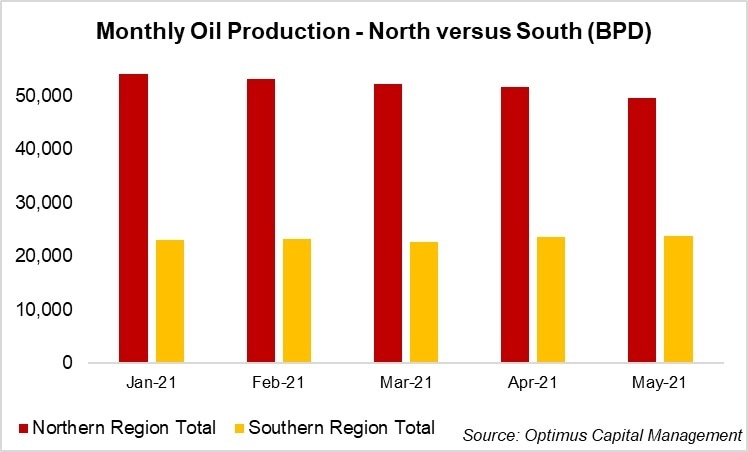

Monthly data available till May 2021 shows that crude oil monthly production has been on a month-on-month gradual decline – May-21 production flows were down by three percent. Crude oil production from the northern region that accounts for 70 percent on average witnessed 4 percent month-on-month decline while the southern region production was up by 1 percent in May-21. OGDCL that has the highest share in monthly production has seen its share increase from 47 percent in January to 50 percent in May, with a subsequent gradual month-on-month decline in the non-listed E&P player MOL’s production flows.

Natural gas monthly production in May-21 remained flattish month-on-month; however, it is expected that June-21 production volumes would be lower month-on-month due to gas shortage in the country, which will explain the overall decline. Decline in natural gas production is largely to do with falling production from key natural gas fields.

While production flows have been under pressure in recently years for both oil and gas, the recent surge in oil volumes as well as the surge in oil prices is likely to boost revenues for E&P companies in FY21. A sustainable recovery in oil prices is in sight, which will increase investment in the exploration activities and also increase company earnings. However, the downside of higher oil prices is the likely negative impact on circular debt of natural gas and hence the liquidity of the oil and gas exploration and production companies.

Comments

Comments are closed.