Colony Textile Mills Limited

Colony Textile Mills Limited (PSX: CTM) was set up in 2011 under the repealed Companies Ordinance, 1984 (now Companies Act 2017). The company manufactures and sells yarn, fabric, and garments. It also trades in real estate.

Shareholding pattern

As at June 30, 2020, close to 49 percent shares are held by the directors, CEO, their spouses and minor children. Of this, close to 42 percent shares are held by Mr. Fareed Mughis Sheikh, the CEO of the company. Another almost 49 percent shares are held by the general public, while the remaining roughly 2 percent shares are with the rest of the shareholder categories.

Historical operational performance

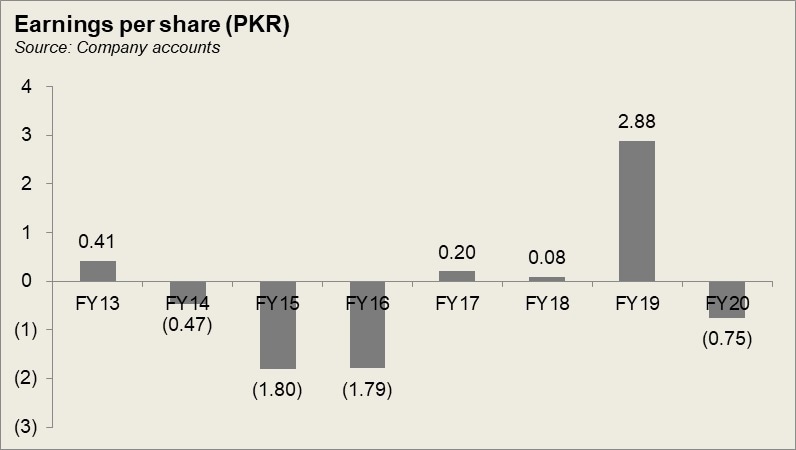

Colony Textile Mills has seen a fluctuating topline since FY14, while profit margins have also followed a similar trend.

After declining for two consecutive years, topline in FY17 grew by over 15 percent. While export sales declined by nearly 33 percent, local sales registered a 26 percent growth. With Pakistan textile products being uncompetitive in the global market due to stiff competition from regional competitors, the industry players found better margins in the local industry as is reflected in the growth of local sales, as opposed to export sales. On the other hand, cost of production, although continued to consume a major chunk of revenue, fell to 92.6 percent of revenue. This allowed gross margin to improve to 7.4 percent. Profitability was further supported by other income that was generated through “gain on remeasurement of investments”. Thus, net margin also improved to 0.7 percent, compared to the loss of Rs 889 million in the previous year.

In FY18, Colony Textile Mills saw one of the highest growths in revenue at 22.5 percent, crossing Rs 16 billion. Both, export sales and local sales witnessed an incline, by 46 percent and 19.6 percent, respectively. On the other hand, cost of production decreased only marginally, therefore gross margin remained roughly flat at 7.6 percent. Operating margin, on the other hand, reduced to nearly 6 percent due to a decline in other income that was unusually high in the previous year. Combined with this was a higher tax expense, margins were further trimmed. Thus, net margin was recorded at less than 1 percent in FY18.

In FY19, the company saw the highest revenue growth at over 39 percent. Sales surpassed Rs 23 billion. Although both export sales and local sales increased, most of the growth in revenue was contributed by local sales that saw a 37.8 percent incline; export sales grew by over 12 percent. Cost of production remained undeterred at around 92 percent; therefore, gross margin was also fairly stable at around 7.5 percent. Most other factors remained similar year on year, but other income grew substantially to contribute more than Rs 2 billion towards the bottomline. This was generated through “gain on restructuring from banking companies/financial institutions”. Although there were significant increases in other expenses and taxation, they were offset by other income. As a result, net margin was recorded at its highest of 6.2 percent.

After growing consecutively for three years, revenue contracted in FY20 by over 23 percent. Export sales grew by 9.9 percent while local sales fell by 24.4 percent. Note that most of the company’s revenue is generated through local sales. At the start of the year, the company revoked the zero-rated status for the textile industry that led to resistance by the local players. As a result, production had to be reduced. When the situation eased, the pandemic broke out in the country that led to a lock down causing business activities to come to an abrupt halt. With the decline in revenue, costs made nearly 95 percent of revenue; other income also reverted to its previous levels, while finance expense was at its all time high due to high borrowing rates. Thus, the company incurred a loss of Rs 375 million for the year.

Quarterly results and future outlook

The first quarter of FY21 saw revenue higher by almost 51 percent year on year. This is due to resumption of activities after the lock down eased in the country. Moreover, with lock down still in place in other countries, some of the global demand was diverted towards Pakistan that helped in growth in sales. Cost of production, although beyond 90 percent, was substantially lower than that seen in same period last year, therefore, profitability was better in 1QFY21 at 1 percent, compared to the loss incurred in 1QFY20.

The second quarter of FY21 was also higher year on year by 5 percent. along with cost of production being lower in 2QFY21, bottomline was also considerably supported by other income, thus net margin was better in 2QFY21 at nearly 6 percent, compared to 4 percent in 2QFY20.

Third quarter of FY21 too, saw a higher topline year on year, by 25 percent. However, cost of production was marginally higher at nearly 91 percent; operating expenses across the board also exceeded that seen in 3QFY20 in value terms. Therefore, net margin was lower in 3QFY21 at 1.8 percent. Cumulatively, though, the company fared better in 9MFY21.

Although the company has seen profitability until 9MFY21, the challenge of local cotton production still remains a challenge for the entire industry. With lower local production, the industry is forced to rely on imports, that exposes it to an exchange rate risk and brings greater volatility into the equation.

Comments

Comments are closed.