Kamyab Pakistan Programme (KPP) is an ambitious plan to promote financial inclusion by providing interest free and subsidized loans to low-income families for business, agriculture, and housing needs. The aim is to provide loans to seven million families over 5-7 years. This will double the volume of existing micro loans where currently there are around 7.6 million active borrowers catered to by microfinance banks and non-banks.

The deserving families will be selected on the proxy means test (PMT) scoring of the Ehsaas Programme. 30.5 million out 38 million families in Pakistan have a PMT score of 44 or below (Monthly income of Rs37,373 or below). In the first phase, the target market is those families falling on the PMT score of 26 or below. The data for below 26 is authenticated and cleaned up. Rest of families’ data will be in usable form by September.

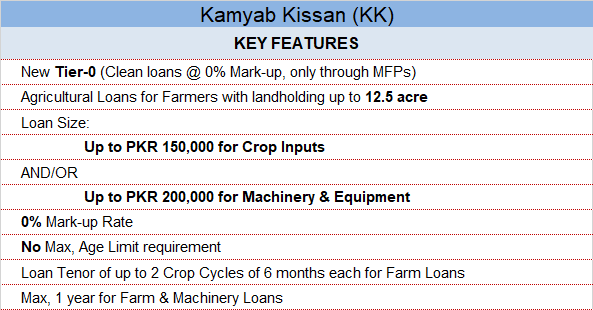

KPP wants to have a cumulative loan disbursement of Rs3.7 trillion (over Rs2tn outstanding loans) across seven million families. Of this, Rs1.2 trillion will be disbursed under Kamayab Jawan (KJ) to 3.5 million new borrowers, Rs700 billion are targeted for Kamayab Kissan (KK) for 2.4 million farmers having land of 12.5 acre or less. The remaining Rs1.8 trillion are for low-cost housing mortgages – this is already operational, but the response is lackluster.

The disbursement in the first year is targeted at Rs315 billion which will reach Rs1.6 trillion in the third year. By elections, Rs800-1,000 billions could be disbursed. The government will provide subsidy on each loan of around 5-8 percent at prevailing market rates. Then there is another 8 percent operational charge to be paid in subsidy to micro finance institutions (MFIs). On top of it, the government is covering 10 percent portfolio loss of micro lenders, and 100 percent coverage of wholesale lenders (commercial banks).

It is a big and bold commitment that FM and his team is assuming. The idea is to have a bigger economic multiplier for these loans. Since the program is reaching out to marginalized and excluded families, and the loans are for income generation and asset creation, the architects of the scheme are hoping for an economic multiplier of 6. That’s big, bold and beautiful, if it pans out as envisioned.

No doubt such loans have higher economic impact. These are to be rolled out by the private sector with the end risk shared by lender (micro finance institution) and government whereas banks, the wholesaler in this case, have no skin in the game. But banks are liquidity provider, they are working on their own conditions.

The model is simple. Banks will churn out the loans to microfinance providers at K+0.5 percent and that interest is to be provided by SBP and create a debt entry for the government. Banks risk assessment is about selecting the microfinance institution (MFI) and provide financing to it. If the MFI(s) defaults on its loans, government will fully cover bank losses. For the bank, this loan is as secure as T-Bills. And at the same time, it is counted as banks loaning to SMEs, agri and housing with low tax rates (at instances) and fulfilling SBP targets for banks with no impact on capital adequacy ratio. Bank get the sweetest deal, at no costs. But that’s nothing new. That is how commercial banking works in Pakistan.

The real game begins at the MFI stage. MFIs have the expertise and experience in managing micro portfolios. They will extend loans to end consumers – micro entrepreneurs, small farmers, and low-cost home buyers. Currently they are targeting these segments. Their cumulative loan book size is of Rs340 billion with 7.6 million active borrowers. The average loan size is around Rs25,022.

The government wants these institutions to extend loans to new borrowers (not existing) based on PMT scorecard. Government wants them to extend bigger loan sizes as compared to what size they are used to. Under Kamyab Jawan (KJ), they want to extend loan size up to Rs500,000 at 0-3 percent. These would be enterprise loans in both urban and rural set ups. The tenor will be upto three years with repayment in equal installments. For Kamyab Kissan (KK), the loan size limit is Rs150,000 per crop for two crops in a year, and Rs200,000 limit for machinery and equipment. There will be zero markup and loan cycle limit would be six months for a crop and one year for machinery loans.

These loan sizes could be bigger than what MFIs have an expertise on which needs to be developed. Moreover, MFIs existing borrowers cannot borrow under KPP. The existing borrower is paying around 30 percent interest, and the newbies get it at zero. The existing borrowers are clearly at a disadvantage and would like to move to the government once its paying loan cycle will complete. Once old borrowers get government free loans, the overall pie of borrowers’ growth would be limited. This is very likely to happen as distortion in pricing tends to have such an impact.

The other challenge these MFIs will face is jeopardization of their existing successful models. Some models are commercially run, and others are supported by donors – private, public, and multilateral. They operate in silos and have their own turfs to play in. What the government is doing has an unintended consequence of transiting all into one model – donor funding-based model to operate on zero rates – Akhuwat is doing one with great success.

Since KPP volumes are so big to start with, there is a great fear that this would cannibalize existing market if KPP roll-out is as per plan. For instance, KPP’s plan in the first year is to roll out Rs315 billion – almost the size of the existing market that have an organic growth of two decades. There are serious questions on the capacity of MFIs to support such a leap.

Since MFIs have skin in the game, they might have cautious start. The government will cover 10 percent of their portfolio loss while 90 percent is their own risk. The recovery rate on existing is expectational – some cases as high as 99 percent. Government is betting on it. The better recovery is because of their cautious approach and repeated games. If someone defaults, they would not get loan again from the same institution. That is a big deterrent. But these borrowers are selected by MFIs and based on certain informal credit scoring models. The institutional framework is working. Disruption could be risky.

Government may push MFIs to loan out more to new customers of higher ticker size. It will pay MFIs 8 percent operational charge subsidy. Right now, these MFIs charge higher. They would have to compromise on their processes – this will add to the risk. Some may go aggressively, and some may not.

Government wants to give loan free to a community that is used to pay 30 percent. This is a big distortion. According to a Pakistan Microfinance Network (PMN) study, return on micro entrepreneur ranges from 70-220 percent and the borrower is making money while paying at 30 percent. The problem the industry has is of liquidity as its cost of borrowing is high (or cost of deposits is high for micro finance banks), and banks are reluctant to lend. The best part of KPP is to get liquidity for MFIs at zero cost from banks (as banks interest is to be paid by the government). The next step is providing loan at zero percent for new borrowers in segment (especially KJ) where there is established and working market. That model needs to be reevaluated.

These risks need to be looked at to make the programme more robust and sustainable. Not to mention, if the programme is to be continued for five -seven years, this may change the landscape of micro lending in Pakistan. All what is required is to start slowly and to learn from doing and to adapt the new model close to existing to have synergies.

Having said that, the first step is in the right direction. The focus is to work on PMT score of below 26. The loan size would be small, and that market is not really covered by MFIs as they provide loan to usually 30 plus score. The next step should be taken with care and much more deliberation.

Comments

Comments are closed.