OGDCL keeps it flowing

Waning foreign direct investment has not been the only concern for the hydrocarbon exploration and production sector; local investors have also been weary because of the decline in domestic production of hydrocarbons and smaller discoveries - of both crude and natural gas - amid falling reserves. And this could very well be a disincentive for foreign investors.

The largest E&P player in the country - Oil and Gas Development Company Limited (PSX: OGDCL) has also seen its production volumes decline over the last few years. There has been a continuous year-on-year decline in crude oil and natural gas production which was more pronounced in FY20. The trend of falling average gas production continued in FY21 where it was lower by 2.6 percent year-on-year. However, some recovery was witnessed by OGDCL in its crude oil production which climbed by 2.3 percent year-on-year.

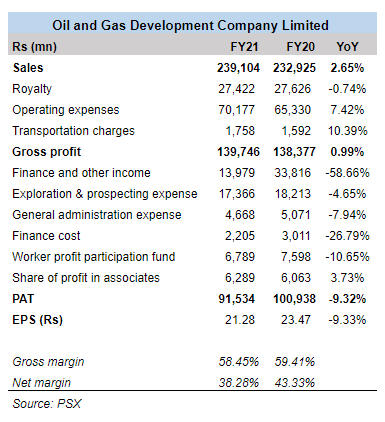

Along with the increase in crude oil and LPG production volumes, average realised prices for natural gas were up by 8 percent year-on-year, acting as the driving factors for revenue growth. However, decline in gas production flows along with flat crude oil realised prices offset the gains, and OGDCL’s topline grew marginally by 2.65 percent in FY21.

Growth in OGDCL’s bottomline was recorded at 9.3 percent year-on-year, which was supported by a 5 percent year-on-year decline in E&P player’s key expense head: the exploration and prospecting expenditure, which was due to fewer number of dry wells in FY21 versus FY20. OGDCL spud 10 exploratory/appraisal, 8 development and 2 re-entry/side track wells making 20 wells altogether; and it added 12 wells to the production system in FY21, which added to the production flows.

However, OGDCL’s profitability during the year was affected by reduction in other income due to exchange loss and decline in interest income, and higher operating expenses primarily due to higher amortization, development and repair cost.

Comments

Comments are closed.