Century Paper and Board Mills Limited

Century Paper and Board Mills Limited (PSX: CEPB) was established in 1984 as a public limited company under the repealed Companies Ordinance, 1984. It began commercial production in 1990. The company, which is part of the Lakson Group of Companies, manufactures and markets paper, board, and related products.

Shareholding pattern

As at June 30, 2021, close to 69 percent of the shares are owned by the associated companies, undertakings, and related parties. The majority of the shares within this category are held by SIZA (Private) Limited and SIZA Services (Private) Limited. Over 13 percent are held by the general public, followed by almost 6 percent held in modarabas and mutual funds. The directors, CEO, their spouses, and minor children own less than 1 percent share in the company, while the remaining roughly 12 percent shares are owned by the rest of the shareholder categories.

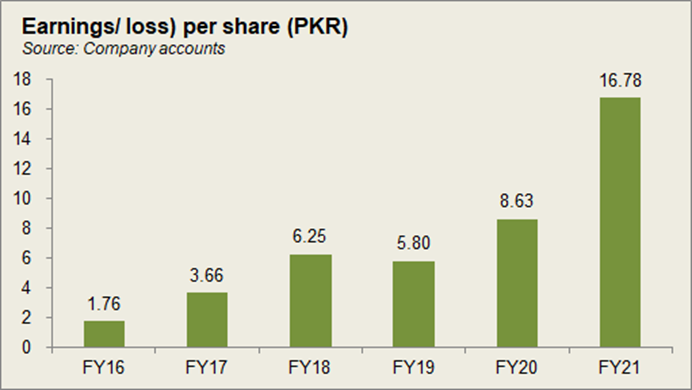

Historical operational performance

Since FY10, Century Paper and Board has seen a consecutively growing topline, with the exception of FY15, when it contracted by 10 percent. Profit margins grew until FY13, declined until FY15, before rising again until FY21.

Revenue in FY17 grew by 15 percent year on year, crossing Rs 15 billion in value terms. A volumetric gain in sales was also 15 percent. This was attributed to an increase in domestic market share in the total revenue. Production was also higher, at 214,468 metric tons, which allowed for capacity utilization to improve. On the other hand, production cost reduced to over 88 percent of revenue, compared to over 90 percent seen in the last year. As a result, the gross margin was recorded at a higher 11.6 percent. With most other factors remaining more or less unchanged as a share in revenue, and with some support coming from other income, net margin also grew to 3.9 percent. The other income was almost double in value terms due to a settlement agreement in favor of the company for an 18 MW Coal Based Co-Generation Power Plant between Century Paper and Board and Runh Power Corporation Limited.

The company witnessed the highest growth rates seen in the last seven years, in revenue during FY18, at over 23 percent. Sales volumes were higher by 5 percent, yet it translated into a 23 percent increase in net sales due to an increase in price; the burden of higher input costs was passed on to the consumer. Production cost fell further to nearly 87 percent of revenue, raising gross margin to over 13 percent. Operating costs overall saw a marginal decrease in share in revenue, therefore, the effect also passed on to the bottomline, with net margin recorded at over 5 percent for the year.

Revenue growth momentum continued through FY19, as the topline registered a 17.3 percent incline, crossing Rs 22 billion in value terms. Sales volumes were also higher, although only marginally by 1 percent, at 216,771 metric tons. Production cost, which had been reducing consecutively for the past three years, increased in FY19, to 88 percent of revenue due to a rise in input prices, fuel items, and currency depreciation; therefore, gross margin reduced to almost 12 percent. Net margin further shrunk to almost 4 percent, due to an escalation in finance expenses. This was brought about by a rise in interest rates that was a result of a tightening monetary policy, in addition to long-term financing obtained to undertake capital expenditure.

Revenue growth in FY20 was relatively subdued as it fell to single digits, at over 9 percent. The economy had started to stabilize somewhat after the government’s economic measures. But the second half of the year was adversely impacted by the Covid-19 pandemic that led businesses to shut down production. Most of the impact was concentrated in the last year of FY20; sales volumes during the year were lower by half a percent. In FY20, the company also exported moderate volumes to Afghanistan and the Middle East. Production cost, on the other hand, was down to 83.8 percent of revenue, allowing gross margin to improve considerably to 16 percent. While net margin also improved, to 6.2 percent, the increase was limited due to a rise in finance expense and taxation. Finance expenses were higher due to high-interest rates that only decreased in the last quarter of FY20.

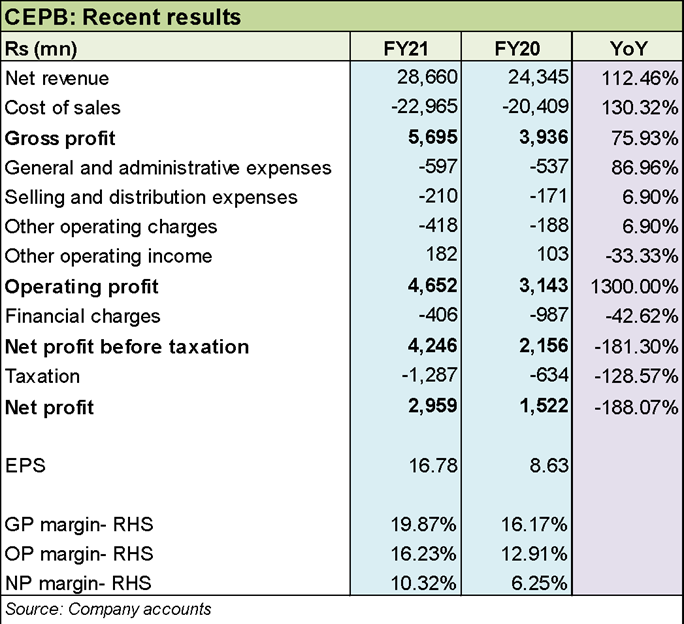

Recent results and future outlook

In FY21, although the market size of paper and paperboard reduced, consumption of the same continued to grow. But it was still lower than that seen in FY19. Demand for packaging board and corrugated boxes increased as online shopping was preferred during Covid-19. Sales volumes registered an 8 percent growth, which translated into a 17.7 percent growth in revenue. Production cost fell to an all-time low of 80 percent, which allowed gross margin to reach a peak of almost 20 percent. Other income also brought in additional support to the bottomline of Rs 182 million. Despite the higher taxation, the company posted a net margin of 10.3 percent- the highest seen whereas net profit was recorded at nearly Rs 3 billion.

The company expects the trend of online shopping to continue, hence the demand for shipping cartons and packaging boards will remain. However, the lost demand for printing paper is not expected to recover. Given the trend of rising input prices, the company plans to continue to undertake BMR activities that would aid in increasing volumes and reducing costs in order to maintain profit margins.

Comments

Comments are closed.