Security Papers Limited (PSX: SEPL) was set up as a private company in 1965. Two years later, in 1967, it was converted into a public limited company. The company’s products include Banknote paper and other security documents such as Prize Bonds, Defense Savings Certificates, Non-Judicial Stamp Papers, passport papers, cheque book, certificates for educational boards and degrees or universities.

Shareholding pattern

As at June 30, 2021, over 60 percent of shares are held by the associated companies, undertakings, and related parties. Within this category, the majority of shares are owned by Pakistan Security Printing Corporation (Pvt.) Limited. Roughly 10 percent shares are held in each of the following: local general public and insurance companies. Another 9 percent are held in banks, DFIs, NBFIs, while the remaining about 10 percent shares are with the rest of the shareholder categories.

Historical operational performance

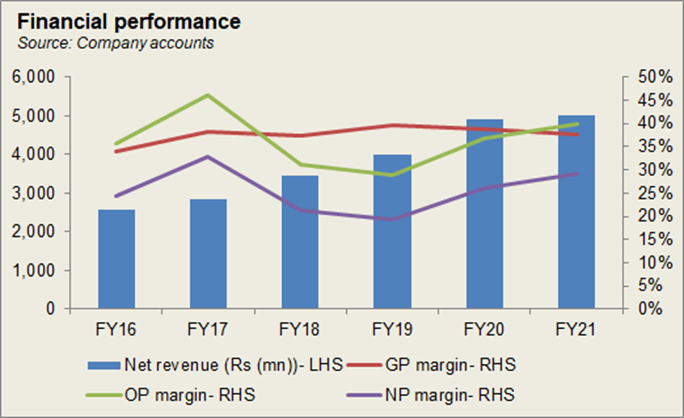

Since FY13, the company has mostly seen a growing topline, with the exception of FY15 when it contracted by over 4 percent. Profit margins grew and reached a peak in FY17, after which they began to decline, before picking up again in FY20.

In FY17, Security Papers registered a 10 percent growth in its topline. The company saw the highest sales volumes thus far, registering a growth of 7.5 percent; banknote paper, in particular, performed very well. In addition, the company was also able to negotiate a higher selling price with one of its big customers, Pakistan Security Printing Corporation (Pvt.) Limited. On the other hand, production of saleable bank paper and other paper was recorded at an all-time high of 2,822 tons while production cost went down, to 61.7 percent of revenue, allowing gross margin to improve to over 38 percent. Bottomline was further supported by an additional Rs 521 million brought in through other income. This was sourced from the gain on redemption of mutual funds and dividend income on mutual funds. Thus, the net margin was posted at 33 percent for the year.

Security Papers saw the highest growth in revenue thus far in FY18, at nearly 22 percent. This is reflected in the highest volume of banknote paper sold to its biggest customer Pakistan Security Printing Corporation (Pvt.) Limited. The selling price for the products also increased that contributed to better revenue; the latter crossed Rs 3 billion in value terms. Demand during the year was also higher. But with the rise in costs, as input prices increased, gross margin reduced to over 37 percent. Operating and net margin fell further as other income reduced that was unusually high in the previous year due to a one-time event of mutual fund redemption, which was nil in the current period. Therefore, the net margin was recorded at 21.3 percent for the year.

Revenue continued to climb during FY19, as it posted a growth rate of 15.4 percent, crossing Rs 4 billion in value terms. Sales volumes were higher by 12.8 percent, while banknote paper alone registered an almost 20 percent rise due to a high demand coming from Pakistan Security Printing Corporation (Pvt.) Limited. As a share in revenue, therefore, production cost was lower at 60 percent, allowing gross margin to improve to 39.6 percent. But this did not trickle down to operating and net margin due to an escalation in other expenses that made nearly 9 percent of revenue. This was due to an unrealized loss remeasurement on mutual funds. Therefore, the net margin was recorded at 19.3 percent - lower than the previous year.

Despite the general economic slowdown seen in the first half of FY20 and the effects of Covid-19 in the second half when most businesses suffered losses and/or lower profits, Security Paper witnessed the highest growth in revenue at 22.5 percent. Total sales volumes increased by 16.3 percent, while each segment individually also saw an increase in volumes due to high demand. Production increased marginally to 61.3 percent, keeping gross margin more or less flat at nearly 39 percent. Other income increased considerably again, due to mark-up on Pakistan Investment Bonds and Treasury Bills, while other expenses normalized. Thus, the net margin rose to 26 percent of the year. Although this was not the highest achieved, in value terms, net profit reached an all-time high as it crossed Rs 1 billion.

Recent results and future outlook

Revenue growth in FY21, at 2 percent, was relatively subdued compared to the double-digit growth seen in the last five years consecutively; it crossed Rs 5 billion in sales. Banknote paper posted an 11 percent growth in sales volumes but the remaining segments such as passport paper, educational degrees, and certificates, etc. experienced a decline in volumes due to the effects of Covid-19 and travel restrictions. There was also a slight increase in production cost that brought the gross margin down to 37.6 percent. With most other factors remaining similar except for other income that provided significant support to the bottomline, the net margin grew to over 29 percent, with net profit posted at another high of Rs 1.4 billion. Other income was high due to gain on remeasurement of mutual funds.

The company has undertaken BMR activities continuously to improve production capacity and widen its product range. With the resumption of travel and other activities, the company can continue to maintain its growth momentum.

Comments

Comments are closed.