While not so soaring as many have been reporting, FDI to Pakistan has witnessed an improvement in September 2021, rising by 16 percent year-on-year to $263 million as per SBP official data. FDI from China has seen a decline and has been surpassed by FDI from USA. The improvement in inflows is much needed but the monthly tally for September 2021 is also only highest after October 2020 total in the midst of covid pandemic when overall global foreign investments were already low.

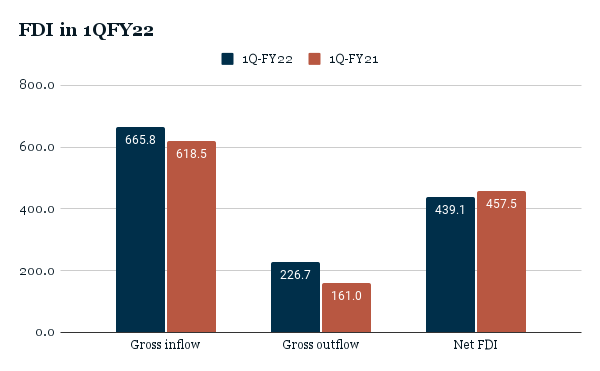

Cumulatively, net FDI in the first three months of FY22 (1QFY22) stood 4 percent year-on-year lower led by a 41 percent rise in outflows amid support of 8 percent year-on-year increase in inflows.

The gloom over FDI to Pakistan is far from over not only because of the continued pace of investment but also due to the decline in FDI from China - something that this space has warned about many times. With all eggs in the proverbial Chinese basket amid not a sizeable traction in investment flows from other countries, foreign direct investment is in a much precarious situation today; there is a dip and drying out of the consistent flows from China, and FDI from other countries are subject to volatility especially amid the currency depreciation and geo-political situation in the region. Moreover, the decline in FDI during 1QFY22 - which could have been better than the Covid-hit 1QFY21 - has also to do with the inflationary spell brought by surging commodity and petroleum prices.

The FDI challenge is much older with a key role played by the systemic factors. Not only has there been a decline in annual FDI flows, but FDI stocks are also decreasing over the last five years falling from $42 billion to $36 billion in five years till Dec-2020. Fault lines appeared overtime in country’s business climate, which includes issues in simplification of regulation and setting up as well as timely approvals along with the role BOI has played as the facilitator - all of which need immediate action

Comments

Comments are closed.